Kushner has been pursuing financing to redevelop 666 Fifth Avenue since 2015

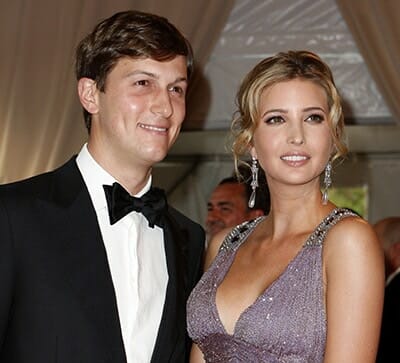

China’s Anbang Insurance Group plans to arrange $4 billion in construction loans and invest $400 million in equity for a Manhattan office tower at 666 Fifth Avenue owned by Kushner Companies, which was until this year headed by Jared Kushner, son-in-law of President Donald Trump, according to a report today in Bloomberg.

Under the terms of the reported deal, Anbang, which is closely tied to family members of former senior officials in China, would buy out the Kushner familys’ partner in the midtown Manhattan project. The agreement would also see Anbang helping to provide financing for a long-proposed redevelopment, and eventually take a controlling stake in the 60-year-old building.

Anbang’s investment values 666 Fifth at $2.85 billion, and the Kushner Companies would maintain a 20 percent stake. Together Anbang and Kushner plan to refinance the $1.85 billion mortgage and raise $850 million in funding through the controversial EB-5 investor visa program to build condos. The project is also slated to receive $100 million in investment from other investors.

Anbang Helps Kushner Make a Great Exit

In the proposed transaction, the terms of which were reportedly circulated to other potential investors, Anbang would buy out the stake in the building currently held by Vornado Realty Trust. That REIT is already the owner of two properties linked to President Donald Trump – 1290 Sixth Avenue in Manhattan and 555 California Street in San Francisco – and would be receiving a 10-fold payout on its investment in the building’s office portion and doubling its investment in the retail space.

“This may be a strong purchase for Anbang, but it’s a great exit for Kushner. He was able to get a great price for the troubled office towers while retaining partial rights to the more lucrative retail investment [and] Kushner secured additional loan forgiveness. A huge win,” Brock Silvers, managing director at China-based real estate private equity firm Kaiyuan Capital told Mingtiandi. “The sale also solves thorny issues for the seller, who was already forced into several refinancings. Anbang appears to be paying for influence with Trump, and certainly believes it has secured such influence.”

Since January, when he took on a senior level advisory post in his father-in-law’s administration, Jared Kushner has reportedly sold his stake in 666 Fifth Avenue. The New York real estate scion still retains an interest in his family’s real estate firm, however, and the murky nature of his divestiture has raised questions regarding potential conflicts of interest.

Kushner Companies paid $1.8 billion for the one square block property in 2007, but the building has since struggled financially. The global financial crisis meant that the tower’s annual debt was once as high as $78 million, until an $80 million cash injection from Vornado allowed the tower’s liabilities to be refinanced. Assuming Anbang can arrange new financing for the project, it will be the largest ever single-property construction loan in New York.

Trump and Family Find Some Love for Immigrant Millionaires

Anbang Investment looks like a sweetheart deal for Kushner

This isn’t the first time Trump’s business and famiy connections have been caught up in controversy over the EB-5 investor visa program. The Trump Bay Street complex in New Jersey – a luxury rental run by Kushner – opened just weeks after Donald Trump’s election, and benefited from $50 million in EB-5 funding from mostly Chinese investors hoping to secure US residency.

“I do think the EB-5 portion of the financing may be problematic. Given Trump’s immigration views, it may be politically hard to sell visas to a large group of Kushner’s Chinese investors,” says Silvers. “Anbang’s ties to Trump may actually generate extra scrutiny.”

Anbang’s big-buy mentality belies the sweetheart deal the company seems to be giving for the 41-storey building. In addition to the $400 million cash injection and the promised construction loans, the mortgage for the mixed-use building will be cut by 80 percent.

“This is a huge, huge exit strategy for an office building,” Joshua Stein, a real estate attorney told Bloomberg. “It does sound like a home run of a transaction for Kushner and his group.”

Trump Seen Reaching Out to China

Coming as Trump prepares to host president next month Xi Jinping at his Mar-a-lago club in Florida, the concept of a Chinese government-linked company entering a business partnership with the family of the US president has caused some concern.

It was reported in January that Jared Kushner met directly with Anbang boss Wu Xiaohui after Trump’s election, but before the inauguration, although it is not clear if any specific transactions were discussed. Wu, who is married to a grand-daughter of former Chinese paramount leader Deng Xiaoping, first gained fame globally with the $1.95 billion purchase of New York’s Waldorf Astoria in 2015.

Leave a Reply