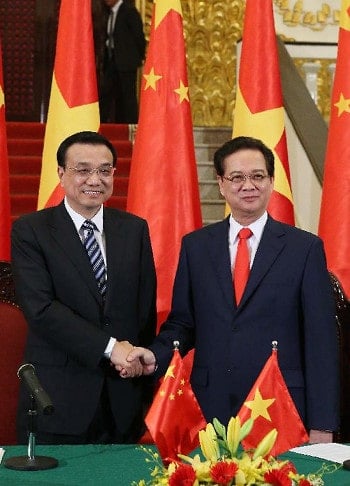

Chinese Premier Li Keqiang (L) and his Vietnamese counterpart Nguyen Tan Dung at a meeting last year to improve bilateral ties

The surge of Chinese investment into the world’s asset markets has met with mixed reactions in many countries, but it may be looked upon most suspiciously in neighboring Vietnam.

Recently released statistics show that China’s wave of outbound investment has rolled south across the border into Vietnam, where the country’s Foreign Investment Agency says Chinese FDI rose to $2.3 billion in 2013, up from $345 million in 2012.

The China outbound trend has also hit the US of course, where a report by the Rhodium group shows Chinese acquisitions of US assets doubled last year compared to 2012, reaching US$14 billion. Globally, international investments by Chinese companies grew by 11 percent in 2013, climbing to US$85 billion according to figures from the American Enterprise Institute-Heritage Foundation China Global Investment Tracker.

The 100 percent increase in Chinese investment that America has experienced, however, pales compared to the more than 600 percent jump in Chinese projects in neighboring Vietnam, and the trend appears to have some Vietnamese worried.

Vietnam State Media Skeptical of Chinese Motives

While Japan remains the biggest foreign investor in Vietnam and China is not yet in the top 10, the nature of Chinese investment, and the ongoing friction between the two countries is already leading to negative reports in Vietnam’s government-controlled media.

Last week, state-run news site Vietnam Net Bridge criticised Chinese investment as “erodent” and implied that Chinese interest in its neighbor to the south has been targeting some specific “goals” which may stretch beyond the commercial.

The website drew attention to Chinese companies’ taste for deals related to infrastructure, mining, and real estate, and also suggested that Chinese firms target industry sectors where they can win projects through “dubious and tortuous bids.”

The report went so far as to say that Chinese commercial deals in Vietnam could threaten the nation’s security. The byline-less article concluded with the rather ominous line, “A market economy must perform under its rules. However, it must also be managed by the framework set to protect the national sovereignty.”

Chinese Companies Should Win Deals in Vietnam

Regardless of suspicions on the part of the government or other players in Vietnam, there are some good reasons why Chinese investment should be moving south across the border.

With average real estate values down 30 percent in Vietnam from the peak in 2007 according to a recent study by CBRE, cash-rich Chinese companies looking for high returns may find Vietnam’s property market attractive, and they are also more likely than other foreign developers to understand the housing tastes and requirements of the locals.

In infrastructure, China’s expertise in building roads, bridges and other major development projects should give it an edge as Vietnam tries to catch up with China’s more developed transport network, especially given the lower price point that Chinese companies are often able to offer.

Chinese firms are also more likely than investors from other nations to understand the processes and peculiarities of Vietnam’s state-run but privatising economy, and Vietnam’s foreign investment laws are largely based on similar statutes in place in Vietnam.

Political Animosity May Trump Commercial Imperatives

However, while Vietnam and China share a border, and have tremendous linguistic and cultural similarities, the two east Asian nations also share a history of suspicion, and at times open conflict, that makes China’s enthusiasm for Vietnamese real estate, resources and industry a touchy subject with its less prosperous neighbor.

Vietnam (along with the Philippines, Indonesia and other nations) continues to struggle with China’s aggressive claims over islands in the South China Sea (known in Vietnam as the Eastern Sea) and the potentially rich oil reserves in the area.

Also, for many Vietnamese, the memories of China’s 1979 invasion of northern Vietnam and the ensuing border war still linger. Going back further, there are centuries of conflict between the two nations with Vietnam remaining sensitive of its one-time status as a Chinese vassal state, and the 1000 years of tribute paid to Chinese emperors.

What this means for Chinese firms is that while they have the cash needed to help build Vietnam’s economy, and the experience and expertise of many of their firms may be well-suited to the current needs of its neighbor to the south, Chinese cross-border deals into Vietnam may be slow to develop and plagued by ongoing suspicions.

Note: The author spent eight years managing companies in Vietnam during the 1990s.

Leave a Reply