Equity International, a private equity firm run by US investor Sam Zell and The Redwood Group, an Asia-focused real estate fund, announced this week a strategic partnership for expansion of Redwood’s logistics property platform.

According to an announcement from Redwood, the partnership with Equity International is intended to expand Redwood’s capital base for rapid, acquisition of logistics and industrial locations across key Asian markets, with a primary focus on China and Japan.

Redwood invests in logistics real estate projects in Asia, and most recently acquired a 24,000 sqm distribution centre in Beijing’s Tongzhou district during July of this year. The group currently maintains offices in Chengdu, Japan, Shanghai, Singapore, and South Korea.

During July of last year Redwood announced a first closing on its Redwood China Logistics Fund, after successfully raising Euros 95 million from Dutch pension fund manager PGGM. The Fund has an initial target of investing RMB 2.5 billion equity in distribution, logistics and light manufacturing real estate facilities in selected high growth markets in China.

Redwood’s founders, Charles de Portes and Stuart Gibson, are said to be among the pioneers in investment grade warehouse real estate in Asia, having developed the first build-to-suit distribution hub for DHL in the region in 1998, and the creation of the first private equity fund dedicated to Asian logistics real estate in 2002.

In China, Redwood is led by industry veteran Oliver Treneman, who previously served as COO with logistics developer Yupei when it was invested by Equity International.

Speaking of the new partnership, Equity International CEO Tom Heneghan said, “Redwood’s institutional reputation, experienced team and strong relationship network make them an ideal platform for EI in Asia.”

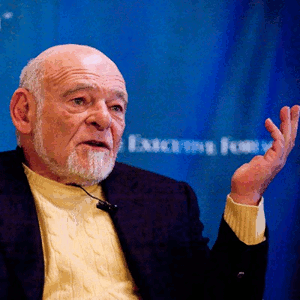

Equity International was founded in 1999 by American investor Sam Zell, who still serves as the firm’s chairman, and specializes in real estate investments outside of the US. The company has raised $2 billion and to date has invested in and alongside 24 portfolio companies across 15 countries.

Leave a Reply