Stock market investors won’t be getting a piece of Cainiao’s shed action

Alibaba Group has scrapped plans for a Hong Kong initial public offering of its Cainiao logistics unit, with the Chinese e-commerce giant instead looking to buy the remaining Cainiao shares it does not own for $3.75 billion.

Alibaba holds a 63.7 percent stake in Cainiao and intends to acquire all outstanding shares from minority investors and employees with vested equity for $0.62 each, the NYSE-listed company co-founded by billionaire Jack Ma said Tuesday in a release.

After completion of the offer, which values Cainiao at more than $10.3 billion, Alibaba plans to position the unit to better realise “strategic synergies” with the company’s Taobao and Tmall sites and its international digital commerce group — which includes overseas platforms Lazada, Daraz and Trendyol — as well as support Cainiao in executing a long-term expansion of its global logistics network.

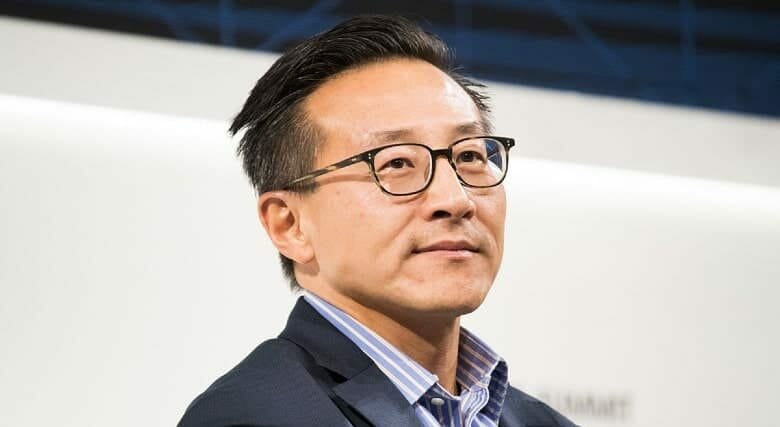

“Given the strategic importance of Cainiao to Alibaba and the significant long-term opportunity we see in building out a global logistics network, we believe this is an appropriate time to double down on Alibaba’s investment in Cainiao,” Alibaba co-founder and chairman Joe Tsai said in a posting on company news site Alizila.

Market Conditions Cited

Hangzhou-based Alibaba announced plans in May to pursue a Cainiao IPO as part of a group restructuring plan unveiled two months earlier, and the company filed documents for the offering with the Hong Kong stock exchange in September.

Chairman Joe Tsai says Alibaba has completed a comprehensive reorganisation

Financial details weren’t released, but Reuters reported in May that the IPO aimed to raise up to $2 billion. At the time, Alibaba reckoned that a separate listing would better reflect the intrinsic value of the subsidiary.

“However, given the market conditions, Cainiao’s IPO at this juncture would unlikely garner a valuation that reflects its strategic value to Alibaba’s business nor achieve the original purpose of unlocking value for Alibaba shareholders,” the company said Tuesday on Alizila.

Alibaba reported in February that Cainiao’s revenue in the December-ended quarter rose 24 percent year-on-year, driven primarily by cross-border fulfilment. Order volume for the unit’s premium five-day delivery service achieved triple-digit quarterly growth, according to the e-commerce giant.

Tsai said Alibaba has completed a comprehensive reorganisation to increase the competitiveness of its businesses while taking a more proactive capital management approach to return value to shareholders.

“We have made significant progress in exiting non-core investments and capital returns through dividends and share buybacks,” the chairman said. “This focus on capital efficiency and return to shareholders will continue without change.”

Eyes on JD, SF

Cainiao’s cancelled Hong Kong IPO comes after platforms from JD.com and SF Holdings filed their own applications to list in the Asian financial hub last year.

E-commerce giant JD.com in March filed for IPOs of its Jingdong Property, formerly known as JD Property Group, a developer and manager of logistics and business parks, and Jingdong Industrials, an asset-light provider of industrial supply chain technology and services and a partner of the JD Logistics fulfilment network.

SF Holdings in September tapped China International Capital Corporation and UBS as financial advisors on the courier giant’s planned IPO. The listing would be the second for SF, which already trades on the Shenzhen Stock Exchange, and could raise up to $3 billion, according to sources cited in a Reuters report.

The companies will be looking to light a spark under a Hong Kong market that saw 65 IPOs raise HK$45.8 billion ($5.9 billion) last year, down from 84 new listings and HK$99.6 billion in 2022. Among the exchange’s aborted IPOs was Dalian Wanda’s fourth attempt to list its mainland mall unit, with the exercise failing to meet a year-end deadline.

Leave a Reply