The costs of refitting buildings like the former Lord and Taylor store in NYC are weighing on We’s valuation

Executives at the We Company, the parent of shared office provider WeWork, are considering lowering the valuation for an upcoming initial public offering by around 50 percent, according to multiple news accounts citing sources familiar with the company’s plans.

The We Company is now expected to be asking investors to buy shares at a price that values the company at between $20 and $30 billion, with some sources cited in a Bloomberg account, saying that valuation is likely to land in the low end of that range. In its most recent private share transaction, primary backer Softbank had purchased shares in the We Company at a $47 billion valuation early this year.

The price cut on one of the year’s biggest IPOs has been accompanied by other moves by We to address investor concerns, as the loss-making shared office provider tries to raise at least $3 billion through an investor road show that some sources indicate could commence next week.

Losses Proving Hard to Sell

The change in valuation comes as the We company has been actively marketing its shares to potential investors, many of whom have raised questions about the firm’s finances and governance as it releases financial details in preparation for the IPO.

WeWork CEO Adam Neumann’s control of the company has raised questions

Analyst Kathleen Smith of Renaissance Capital in the US pointed out in an appearance on CNBC last week that the shared office provider has recorded the second-largest losses of any company to have sought a public listing, according to her firm’s analysis.

WeWork lost $1.67 billion for the 12 months through June 30 of this year, according to the company’s prospectus, with that shortfall approximately double the amount of red ink that it recorded during the preceding 12 month period.

With the We Company having filed the paperwork for its IPO last month, many details of the proposed listing remain unclear, with no fixed date having been set, and the company has yet to confirm which US exchange its shares would be listed on.

IPO Could Be Delayed Until Next Year

Among the facts that have emerged from the IPO preparations is a clearer view of Softbank’s position in the We Company, with the Japanese firm now holding 29 percent of the startup, even more than chief executive Adam Neumann.

The investment firm run by Japan’s Masayoshi Son has invested approximately $4 billion in the company formerly known as WeWork over the past year, although an attempt by Softbank, together with its Vision Fund, to spend $16 billion to take a controlling stake in WeWork last year foundered when Vision Fund backers balked at putting more money into what many saw as a high risk venture.

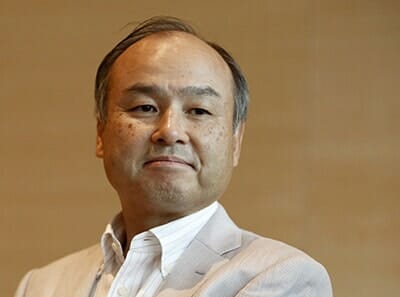

SoftBank CEO Masayoshi Son is being asked for more support

With the prospects for the IPO being called into question in recent days, Neumann flew to Tokyo last week to meet with Softbank’s Son and his team to discuss further investment in the We Company, according to an account in the Wall Street Journal.

The discussions included a proposal for Softbank to serve as an anchor investor in the We IPO, while the two sides also considered the potential for the Japanese firm to invest further sums now that would allow WeWork to delay its IPO until next year, according to the Journal report.

We Addresses Governance Concerns

In addition to scaling down its valuation and turning to Softbank for fresh cash, the We Company also made some changes this week which indicate that the office provider is sensitive to investor criticism as it readies its share sale.

After analysts questioned its all male board of directors, a revised S-1 filing with the Securities and Exchange Commission showed that the We Company has recruited Harvard Business School professor Frances Frei to join the board following the conclusion of the offering.

The same document also showed that the company is unwinding a controversial arrangement under which CEO Adam Neumann had sold the rights to the trademark for the We Company to the company he leads for $5.9 million, after first registering the trademark under a legal entity controlled by him personally.

The We Company IPO has also been criticised for its multi-class share structure, which ensures that Neumann, who currently owns 22 percent of the company, would retain control of the firm with his shares enjoying a voting rights of 20 times standard stock in the company. Agreements which deliver the rights to choose a new CEO to Neumann’s wife, in the event of the We Company co-founder’s death or incapacitation, have also raised questions about investor protection.

Earlier this year the We Company set up a separate asset management division, Ark, to purchase properties leased by the office provider in which Neumann had an interest, after analysts had highlighted the conflicts of interest involved.

Leave a Reply