A JustCo co-working centre in Singapore

Asia Pacific leads the world in flexible office growth, as the conventional workspace defined by cubicles and corner offices increasingly falls out of favour. According to a recent survey, the number of flexible office locations in six Asia Pacific cities has grown by an average of over 20 percent in the past year, exceeding global growth of 18 percent.

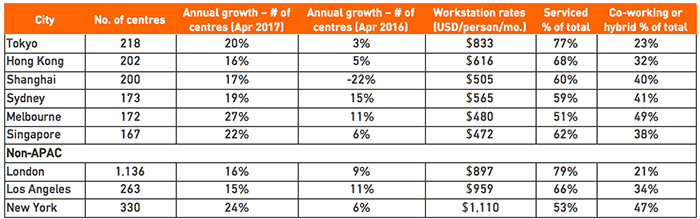

Tokyo, Hong Kong, Shanghai, Sydney, Melbourne and Singapore now have a total of 1,132 flexible office centres, which includes co-working and serviced offices, as well as hybrid centres combining both types, according to a recent report by The Instant Group, a London-based consulting firm.

More than 37 percent of those Asian centres are co-working or hybrid locations, highlighting a strong appetite in Asia for WeWork-style workspaces, which are starting to crowd out the more traditional serviced offices operated by brands such as Regus and Servcorp. Worldwide, that proportion is only 30 percent.

Hong Kong Supply Doubles in Two Years

Data collected by the Instant Group, which specialises in flexible workspaces worldwide, shows that growth has been especially strong in Hong Kong, where the number of flexible office locations rose by 17 percent during the year through April, and roughly doubled over a two-year period.

There are now 202 flexible workspaces in Hong Kong, the group’s figures indicate, compared to 330 in New York City and a remarkable 1,136 in London. Pricey office rents in Hong Kong and a growing technology, media, and telecom sector are driving sharpened interest in co-working and hybrid spaces.

“Hong Kong has challenges because it’s one of the most expensive places to get traditional office space,” said John Williams, head of marketing for The Instant Group in a conversation with Mingtiandi.

A flexible office workstation in Hong Kong costs an average of $616 per person per month. By contrast, the average traditional grade A office in Central costs more than $16 per square foot per month, according to property consultancy Cushman & Wakefield. Assuming conservatively that each employee occupies 70 square feet, that equates to an outlay of over $1,100 per worker per month.

Although Hong Kong has the second-highest number of flexible workplaces in Asia, other cities in the region are seeing faster year-on-year growth. Flexible workspaces increased by 22 percent in Singapore, 20 percent in Tokyo, and 17 percent in Shanghai in the year through April. Australia’s market is heating up even more rapidly, with Sydney growing by 19 percent and Melbourne by 27 percent.

Asia Is Getting Flexible

Jonathan Wright’s flexible office team at Colliers scored another leasing victory

“Right now, Asia is a little behind but is adopting quickly – particularly in more mature markets,” commented Jonathan Wright, who leads the regional practice group for flexible workspaces at Colliers International, in an email. “We very much expect well-funded operators to continue expanding.”

A March report from global real estate agency Colliers found growing market demand for flexible workspaces throughout Asia. The white paper attributed this growth to a number of factors, led by a boost in funding for startups, which favour flexible offices over more traditional Dilbert-style accommodation.

Other drivers include a pick-up in demand from multinational corporations – Colliers notes that transactions involving 15 or more desks have surged from 12 percent to 35 percent of the total in two years – lease accounting changes, technology that has simplified remote working, and employers catering to the desires of a rising millennial workforce.

Startups Lead, But Corporates Catching On

The Instant Group’s Williams also noted that many startups in Asia are following the trend seen in other markets, opting for flexible workspaces that allow them to grow at their own pace rather than committing to a hefty lease without a long-term plan. Flexible spaces make it easier to quickly hire new employees as a venture grows, or call it quits if a business doesn’t pan out.

Williams also says he has seen Asian markets latch on to the concept of a flexible working space that allows for creativity, collaboration and openness. “The flexible growth trend has really caught on,” he says of market leaders in the region. “They like collaboration, they want different environments to work in and they get caught up in the buzz of it. We’re predicting growth in the region.”

Major corporate users that have taken up flexible spaces in Asia range from tech firms Amazon and NetEase to banking and consulting players HSBC and PwC.

The Instant Group’s findings come amidst announcements of massive investments and fundraising efforts in the Asian co-working sector. Earlier this month, New York-based WeWork announced it was investing $500 million in growing its presence in southeast Asia and South Korea, shortly after unveiling a $500 million fundraising round for its expansion in China.

Rival co-working operator URWork, the $1.3 billion Beijing-based startup, recently raised RMB 1.2 billion ($178 million) to fuel its overseas expansion.

Leave a Reply