Greenland Group’s Zhang Yuliang is selling $220 million in new shares after its HK-listed stock went up by 167 percent

Some of China’s biggest property developers have launched more than $1.76 billion in share offerings in the past week as the country’s real estate firms take advantage of the current stock rally.

The share sales by Hong Kong-listed China Resources Land, Yuzhou Properties, CIFI Holdings and Greenland Group allow the mainland home builders to lower their debt levels, and refill coffers for future project acquisitions in China and abroad.

Despite a year-long downturn in China’s real estate markets land prices on the mainland remain high and the new cash generated by these listed giants could provide them with a financial edge over smaller rivals who remain dependent on domestic loan financing.

150 Percent Surge in Share Values Driving Offers

The biggest of the share issues was by China Resources Land, which sold $1.3 billion worth of new shares last week, only to be followed just two days later by Yuzhou Properties, which announced on Thursday that it planned to raise $102 million by selling 360 million shares.

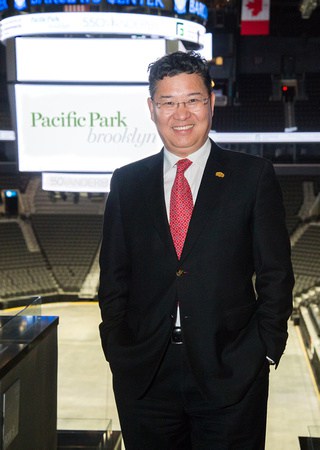

On Friday analysts saw a term sheet for a $220 million share sale by Greenland Group’s Hong Kong-listed subsidiary, and on Monday CIFI Holdings halted sales of its shares on the Hong Kong Exchange, and a story in Reuters cited a term sheet for a $140 million share sale by the developer.

The share sales by these four developers follow just over a month after top ten real estate firm Guangzhou-based Country Garden Holdings sold $813 million in new shares to Ping An Insurance, and appear to be in reaction to significant increases in share prices driven by the current stock rally. Since the first of this year, China Resources Land rose by as much as 28 percent, Yuzhou gained by 25 percent before the announcement, and Greenland Group has risen 167 percent during the same period.

And the action in May and June follows a trend that has been going on since January, after 2014’s banner year for Chinese stocks. The Shanghai stock exchange’s property index has surged 150 percent over the past 12 months, and so far this year the Hang Seng China Enterprises Index has risen 21 percent.

Developers (and other companies) have been quick to cash in. So far in 2015, Chinese developers have sold a total of $19.2 billion in new shares, and Chinese companies from other sectors are also cashing in on the stock rally. Investment conglomerate Fosun announced a $1 billion share sale one week ago, and Taiping Insurance raised $1.7 billion this month.

Land Prices Still High and So Are Debt Levels

The share sales come at an opportune time for the listed developers, as the country’s prolonged real estate slide has hurt revenues while continuing high land prices created new cost pressures.

China Resources Land has been among the developers forced to pay record rates for new land. In January this year the subsidiary of China Resources led a consortium that paid RMB 8.63 billion ($1.39 billion) to acquire a site in Beijing’s central Fengtai district. The sale set a new record for the nation’s capital and was 22 percent over the opening price of RMB 7.07 billion for the 155,675.9 square metre site.

At an April auction in Beijing, another state-owned developer persevered through 140 rounds of bidding to pay RMB 5.64 billion ($909 million) for a site approved to accommodate a 60,500 square metre residential project, working out to an accommodation cost of RMB 43,000 per square metre.

These record high rates for land are being paid despite a continuing decline in home prices. The latest data from China’s National Bureau of Statistics, which was released today, show that in April home prices fell on a year-on-year basis for the eighth straight month.

In April, China Vanke, the nation’s second-largest developer by sales blamed the squeeze between land prices and home sales for a 57 percent drop in its profits in 2014.

Non-Listed Developers Face Financing Challenges

As a result of deals like this, many companies have stretched their balance sheets to the limit; China Resources Land saw its debt levels rise 33 percent by the end of December 2014. Across the industry loans to developers from China’s banks rose by 24 percent in the first quarter of 2015, reaching nearly $1 billion.

Vanke CEO Yu Liang might be thinking about all the companies that won’t be around anymore

This surge in credit does not mean, however, that all developers are getting more access to debt financing. As one veteran China developer explained to Mingtiandi, “Easier credit doesn’t mean it’s easier for everybody. The state-owned developers get the first chance – at fractionally above benchmark rates. Next in line are the favored private developers, and then everybody else gets what’s left over at benchmark rates plus 15 percent.”

This financing favoritism means smaller developers, which also typically lack listed entities are facing a much tougher task in trying to acquire the new land sites necessary to keep their businesses running. With property firms in general among the most indebted in China, many are being forced to enter into consortiums with other developers to gain access to land, but in the process are losing control over project management and finances.

Many others are simply missing out on sites in the country’s largest markets – the areas where China’s housing market shows the most promise of recovery.

Small Developers Will Struggle to Maintain Pipelines

The combination of new opportunities for equity financing for China’s listed giants, combined with restricted access to debt financing for smaller developers is likely to hasten the consolidation of the country’s property industry. The most likely scenario is that smaller developers are starved of the pipeline of new projects necessary to sustain home sales, and quietly disappear.

“Any M&A will most likely consist of acquiring assets, not companies,” Robert Fong, of Bloomberg Intelligence told Mingtiandi. The Hong Kong-based analyst added that, “The industry consolidation will likely take the form of weaker companies withering on the vine, while stronger ones grow organically.”

This trend has already been underway for some time, but is likely to be accelerated by the developer share price surge.

In May last year Vanke CEO Yu Liang predicted in an interview that China’s real estate sector would consolidate from 85,000 firms at the time to only 10,000 within 15 years.

With some of China’s biggest developers taking in $1.6 billion in capital this month, while smaller private companies scramble for loans to afford rising land costs, this consolidation could happen even faster than the veteran property executive predicted.

Leave a Reply