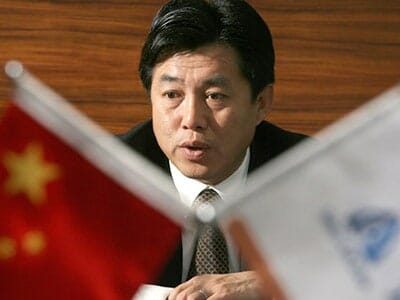

Sino-Ocean chairman Li Ming seems to have been taking a lot of calls lately

The battle for shares in China’s largest property developers surged to a new level late last week after Hong Kong real estate giant Wharf Holdings revealed on Thursday that it would be selling its 5.93 percent stake in Sino-Ocean Land to an unspecified buyer.

Wharf’s HK$2.2 billion ($284 million) sale, which it said would be completed early in the week of December 14th, comes just three days after Beijing-based Anbang Insurance bought up 20.5 percent of Sino-Ocean. That earlier transaction made Anbang the developer’s second-biggest shareholder after competitor China Life, which holds a 29 percent stake.

In the last two weeks Chinese insurers have rushed to buy up shares in the country’s largest property developers as the industry appears to be betting on the recovery of the mainland housing market in 2016.

Wharf Selling Its Shares for Current Market Price

Shares in Sino-Ocean were up 4.48 percent last week after Monday’s announcement that privately held Nan Fung, itself a major Hong Kong developer, had sold its 20.5 percent holding in Sino-Ocean to Anbang. That price hike did not deter the Wharf transaction, however, with the company saying that it would sell its 445 million shares to the unnamed buyer for HK$5 each – the stock’s closing price on Thursday.

Following the announcement, the Sino-Ocean’s shares slid by 2 percent to close at HK$4.48 per share on Friday.

Are Insurers Battling Over Sino-Ocean?

Wharf must be getting fond of Chinese insurers, after its sister company Wheelock sold a Kowloon office building to China Life last month for $755 mil

Should Anbang turn out to be the mystery buyer of Wharf’s stake in Sino-Ocean, the insurer would be upping its stake to 26.43 percent, still behind China Life, but within striking distance of gaining control over the developer.

During the past year Anbang has been among the most aggressive of the mainland’s insurers, acquiring a string of high profile assets, including New York’s Waldorf Astoria hotel. The company, which was founded and is still chaired by a grandson-in-law of former supreme Chinese leader Deng Xiaoping, has also in the last 14 months bought up US insurer Fidelity & Guaranty Life, Belgian insurer FIDEA, and Belgium’s Delta Lloyd Bank. The company recently abandoned a reported $1.6 billion bid for London’s Heron Tower office building.

However, there is also potential for other insurers to be bidding for shares in the developer. Wharf’s owners already have a relationship with China Life, after sister company Wheelock sold an office building in Kowloon to the mainland institution last month for $755 million.

The surge in trading of Chinese developer shares also includes conglomerate Shenzhen Jushenghua last week paying an estimated RMB 9.4 billion ($1.46 billion) to gain a controlling interest in China Vanke.

China’s real estate market has gradually been recovering for the last several months, and many analysts believe that the outlook for the country’s biggest developers is positive for next year as the government seems determined to revive the industry as a centre of investment.

Leave a Reply