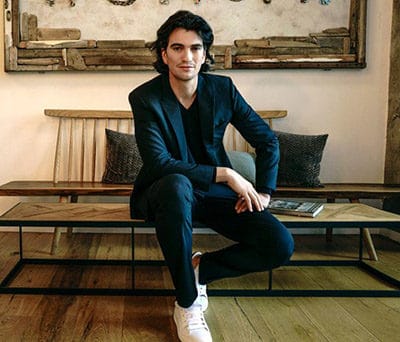

WeWork’s Adam Neumann hopes to fluff up his cash cushion with $4 bil in fresh debt

Seven months after filing for an initial public offering, WeWork is planning to raise as much as $4 billion in debt to refill its corporate coffers, according to news accounts citing sources familiar with the shared office provider’s discussions.

The planned offering would aim to raise $3 billion to $4 billion, according to a report in the Wall Street Journal, with the debt facility potentially growing to as much as $10 billion in coming years, and would be in addition to whatever funds the loss-making company could raise through its stock debut.

The debt issue, which could be on the way within the coming months, according to an account by Reuters, would be in addition to whatever funds WeWork might raise through a stock offering, the potential timing and financial details of which have not yet been made public.

The debt financing round is seen as a way to boost confidence in the money-losing $47 billion start-up after shares of fellow unicorns Uber and Lyft have fallen below their IPO prices this year.

Replenishing the Capital Supply

WeWork, which rebranded as the We Company earlier this year, has been discussing its debt deal with bankers including David Solomon, the chief executive of Goldman Sachs and JP Morgan Chase boss Jamie Dimon, according to the Wall Street Journal story, with the two banks said to be managing the offering.

JP Morgan Chase boss Jamie Dimon will handle the debt sale, but hasn’t swapped his private office for a sofa

The debt offering could help alleviate concerns about WeWork’s burn rate after the company lost $1.9 billion in 2018 – nearly double its 2017 shortfall. The Softbank-backed shared office provider has been racing to expand globally, while sitting on cash stock pile of $6 billion in cash as of the first quarter of this year, according to a company representative.

An extra $4 billion in dry powder could reassure investors who may have grown concerned when WeWork’s primary backer, Softbank, was unable to follow through on a previously planned $16 billion investment in the New York-based startup last year.

While WeWork has adjusted its expansion flight path toward partnerships with landlords to cut capital expenditures, without the fresh source of funding, the company would run out of cash by around the end of 2021 if it maintained its 2018 burn rate.

According to financials cited in an earlier Wall Street Journal story, WeWork, which typically signs long term office leases with landlords to then sublet rooms and desks to tenants on a short term basis, had around $34 billion in lease obligations at the end of 2018 – nearly double the rental liabilities it had at the end of the previous year.

Eyes on the IPO Prize

WeWork’s debt plan indicates that the company may be conscious of the fate of its Softbank stablemate Uber which, two months after its May IPO, is still trading at more than 3 percent below its debut price.

During this year WeWork has been taking steps to ensure its financial fitness in the run-up to the market premiere including entering talks to buy out its India partner for up to $1 billion and setting up an independent investment fund to resolve potential conflicts of interest raised by CEO Adam Neumann’s investments in properties which he later leased to his own company.

In Asia, while WeWork has a pair of new Kowloon East facilities slated to open in Hong Kong within the coming months, it has also tempered its expansion in the region’s most expensive city by reportedly walking away from a number of potential new lease deals during 2019.

Leave a Reply