Wang Jianlin is betting on service sectors like the movie business to provide a new engine of growth for Wanda

China’s biggest commercial property developer has made headlines around the world as it builds up a sprawling retail empire and snaps up overseas assets from cinema chains to sports firms. Questions were raised, however, about the sustainability of this aggressive growth drive earlier this year when Dalian Wanda Group released disastrous revenue figures for 2016.

Wanda’s announcement of its revenues for the first half of 2017, if taken at face value, suggest that the company headed by mega-billionaire Wang Jianlin has found its footing again, with diversification into non-property sectors providing a new source of growth.

Wanda Is Doing Just Fine, According to Wanda

In a statement on its corporate website, the Beijing-based group said its revenue for the first half of 2017 grew 12.4 percent year-on-year to RMB 134.9 billion ($19.8 billion), 16.2 percent above target. That growth figure jumps to 17.9 percent year-on-year if Wanda Tourism, the group’s travel business, is excluded on the grounds that the unit was acquired by online travel agency Ly.com earlier this year.

Whether or not the higher figure is used, Wanda’s revenue growth represents a significant comeback from its dismal 2016 results. Wanda’s overall sales plunged by 13.9 percent last year, with revenues from the company’s commercial property division dropping by 25 percent, according to Wanda.

The statement on H1 revenue is unusual in that unlisted companies typically do not disclose financial information, and Wanda did not specify whether the results had been audited or whether it was referring to contract or operating revenue. Wanda also did not disclose profit figures.

Wanda Still Relies on Property Sales

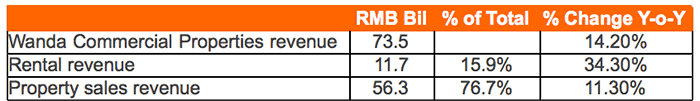

Although Wanda is celebrating what it describes as a “strong growth trajectory across all business sectors” in H1, the published figures suggest that its development business still relies primarily on sales of property for its revenues, with only 11.7 percent of its property revenues coming from commercial rents.

Source: Dalian Wanda Group

Overall, the company’s property business accounted for 42.1 percent of the group’s total revenue in the first half of 2017 – shrinking from 45 percent at the end of 2016 – with services making up 57.9 percent of the total, according to Wanda’s financials.

The Wanda Commercial Properties division saw overall revenue growth of 14.2 percent year-on-year, reaching RMB 73. 5 billion in the first half, after the company opened five new wholly owned malls, alongside another nine “asset-light” Wanda Plazas that it opened in concert with outside investors during the period.

Unlike traditional commercial developers, Wanda continues to make the majority of its real estate revenue from property sales, as the company’s projects often include a significant residential component, and space within its malls has traditionally been available for purchase on a strata-title basis.

Wanda opened three new shopping malls in one week in June, including the Fuzhou Wanda Plaza

Property sales revenue for Wanda reached RMB 56.3 billion during the period, accounting for nearly 77 percent of real estate revenue for the company. Although rental revenue from its commercial properties, grew 34.3 percent year-on-year to RMB 11.69 billion, this revenue accounted for under 16 percent of its real estate business.

Wanda’s real estate growth comes as the company continues to rapidly expand its real estate portfolio. In terms of area the group opened 912,000 square metres of new projects in the first six months of the year, with the total real estate owned by the commercial properties division said to have expanded to 33.8 million square metres, up 4.8 percent from the end of 2016.

In addition to its fourteen new malls, the company opened four new hotels during the first half of the year, adding to its portfolio of over 100 hospitality properties. The company says that it has another 28 projects currently under development, including 26 Wanda Plazas and 2 Wanda City mall projects. All of the Wanda Plazas are said to be asset-light projects.

Biggest Jump in Newest Businesses

Wanda also claims a revenue increase of 31 percent for its Cultural Industry Group business, after adjusting for the sale of Wanda Tourism, and a 46.8 percent increase for its Financial Group.

Although Wanda delisted its commercial property business from the Hong Kong stock exchange last September, the group has other listed units including Shenzhen-listed Wanda Film Holdings, which reported operating income growth of 16 percent year-on-year in the first half. The film unit, which owns the majority of US-based AMC Entertainment, operates 14,347 cinema screens globally, according to Wanda’s website.

Leave a Reply