Econ Medicare Centre and Nursing Home in Johor Bahru (Image: Econ Healthcare)

US private equity major TPG has offered to acquire Singapore’s Econ Healthcare Asia in a deal valuing the SGX-listed nursing home operator at S$87.8 million ($65.5 million).

Funds managed by Texas-based TPG aim to buy Econ’s 265,910,891 issued shares for S$0.33 each, representing a 20 percent premium to the last traded price before the offer was announced late Friday, according to a filing with the Singapore Exchange. Econ shares settled Monday at S$0.34, up nearly 8 percent from Friday’s close.

TPG plans to delist and privatise Econ — which runs 10 medical centres and nursing homes in Singapore and Malaysia, plus two facilities in China with joint venture partners — in order to exercise greater control and management flexibility, streamline resources and form strategic partnerships with TPG’s existing healthcare portfolio assets.

Econ’s chairman and CEO, Ong Chu Poh, holds a 77.85 percent stake in the company and has given his commitment to the offer, which comes after TPG last year closed on its eighth Asia-focused private equity fund with $5.3 billion in committed capital.

“The offeror believes that the privatisation of the company will provide the business with the necessary flexibility to focus on long-term execution whilst helping it save costs and resources associated with maintaining its listed status,” Econ said in the filing.

Management Continuity

Founded by Ong in 1987, Econ has grown from a single nursing home in Singapore into one of the city-state’s largest elder care providers.

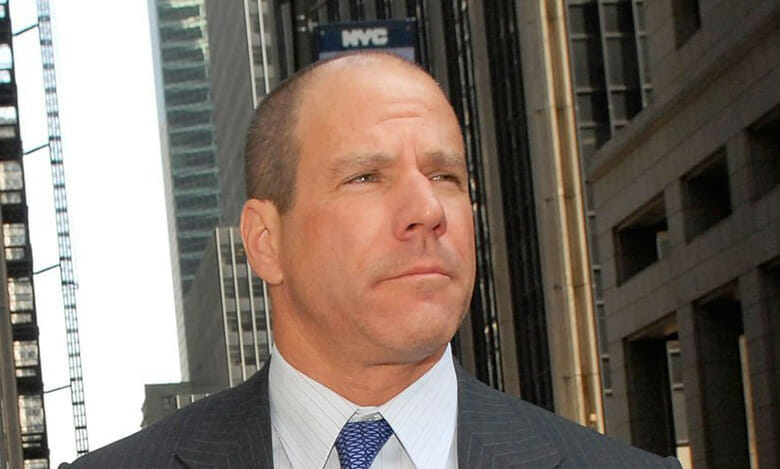

TPG chief executive Jon Winkelried (Getty Images)

TPG plans to retain Econ’s current management team to ensure continuity and minimise business interruption, according to the filing. The current intention is for Ong Hui Ming, Econ’s Singapore CEO and the daughter of Ong Chu Poh, to replace her father as group CEO.

While there are no plans to introduce major changes to the business, re-deploy fixed assets or cut staff, “the offeror retains and reserves the right and flexibility at any time to consider any options in relation to the company which may present themselves and which it may regard to be in the interest of the company,” Econ said.

TPG’s healthcare interests in the region include Indian hospital group Asia Healthcare Holdings, which the fund manager backs alongside Singapore sovereign giant GIC. The partners announced in December that GIC would invest an additional $150 million in AHH following an initial commitment of $170 million in 2022, with the Bengaluru-based group having invested a total of $300 million into hospitals focused on urology, oncology, fertility and other specialties.

Eyeing Asia Deals

TPG’s $5.3 billion Asia VIII fund, whose closing was announced last May, represents the firm’s largest-ever vehicle targeting the region.

The same month saw TPG disclose $2.5 billion in fundraising for a pair of Angelo Gordon co-branded vehicles, TPG AG Asia Realty V and TPG AG Japan Realty Value. TPG had acquired real-estate-focused Angelo Gordon in 2023 in a $2.7 billion deal.

TPG Angelo Gordon led one of Asia’s biggest hotel investments of 2024 with the JPY 106 billion ($691 million) purchase of the Grand Nikko Tokyo Daiba. The firm acquired the 882-key property from real estate giant Hulic under a joint venture with local player Kenedix.

Leave a Reply