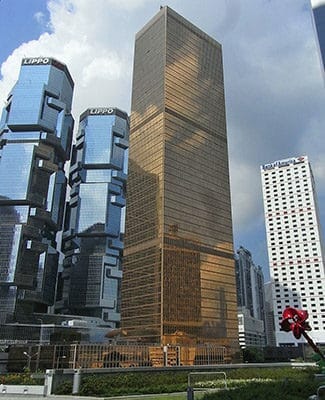

The curtain wall isn’t actually gold plated, but the Far East Finance Centre still looks like money

The practice of divvying up office space for sale into floors or even units – the “strata sales” market – is well-established in Hong Kong, with prominent property brokerages having teams devoted to the practice.

But until recently, strata sales did not define class-A office space, the trophy towers in which blue-chip institutional tenants demand premier service, a single accountable landlord, and the possibility of readily expanding or shrinking space over time.

But sky high asset values and office rentals for the city’s skyscrapers have already turned The Center, a $5.2 billion office tower on Central’s Queen’s Road into a strata-title property, and the once B-grade buying practice is rapidly spreading to other top-end towers.

Rising Asset Values Drive Piecemeal Deals

The short story why: “It is pretty simple. The per-square-foot or unit prices are making whole-building purchases unaffordable,” said William Liu, Senior Director for Capital Markets and Investment Services at Colliers International in Hong Kong. “The lump sums to buy an entire building get too large for all but a few buyers.”

During 2018 Hong Kong property news has become cluttered with stories of new record prices per-square-foot, such an announcement announcement this week by a subsidiary of the Winland Group, that it had acquired a 2,789-square-foot unit in the Far East Finance Centre on 16 Harcourt Road in Admiralty for HK$165 million. Winland’s Mexan Limited unit purchased the 47th floor office from a pair of British Virgin Islands-registered firms that had purchased the office space last year for HK$101 million.

The news sales price works out to HK$59,353 per square foot, making the sea view unit the third most expensive office space in Hong Kong after another unit in the Far East Finance Centre sold for HK$61,000 per square foot in April, and a unit in 9 Queen’s Road Central sold for HK$60,000 per square foot during the same month.

Also this week, an unspecified buyer paid HK$55,000 per square foot for a floor with views of Victoria Harbor, in the Bank of America Tower in Central, according to the Hong Kong Economic Times.

Office districts such as Central and Admiralty, until recently the preserve of en bloc deals for whole buildings, are being redefined by strata-sales.

Buy, Then Stratify

William Liu of Colliers sees a bright future for strata deals in Hong Kong

Even when entire Hong Kong towers are bought, strata sales may lurk in the background.

Just last week Reuters reported that Chen Chang Wei’s Heng Group is planning floor-by-floor strata-sales to help finance its recent $HK15 billion ($1.95 billion) buy of Cityplaza Three and Cityplaza Four in Quarry Bay, after the mainland investor bought the pair of office towers from Swire Properties last month.

The Hengilong strata-sales strategy follows on the heels of strata-sales at the 73-storey The Center skyscraper, which sold for HK$40.2 billion last year, the highest price ever for an office building.

Strata sales are resulting in record prices, report brokerages.

“The investment market for offices continued to reach new heights after whole floors in the high zone at Far East Finance Centre and 9 Queen’s Road Centre were sold for HK$660.0 million (HK$61,111 per square foot) and HK$514.2 million (HK$60,000 per square foot), respectively, breaking the HK$60,000 level for the first time,” international property consultancy JLL said in a May report.

Strata-buyers are a diverse lot, said Colliers’ Liu. “That’s the beauty of it. You have PRC (mainland China) buyers, but also end-users who have been facing relentless rent increases, and want stability.” High net worth individuals and even some name-brand corporate entities fill out the ranks of strata-buyers, said Liu.

So far, certain US-based blue-chips, such as Apple or Google, and major law and accounting firms do not appear interested in the strata-market, confirmed Liu.

But many strata-owners are also entering the market, to sell and cash-out now-valuable properties so as to re-locate to less-expensive decentralized premises, observed Liu.

“As a result, I expect to see growing strata-sales markets in Hong Kong for a long time,” said Liu.

Leave a Reply