After seeing the company’s profits drop by 65% in the most recent quarter, Beijing-based real estate developer SOHO China has announced that it plans to shift its approach from selling commercial real estate to individual investors to leasing out its own buildings to tenants.

The change in strategy follows a 5.3 percent drop in SOHO’s share price after the company’s disappointing profit numbers were announced on Friday. Shares of Soho China closed at HK$5.40 per share on Friday, August 17th — making this the worst day for the company’s stock since December 19th.

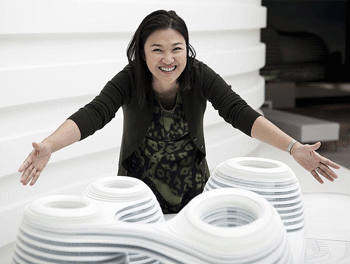

Explaining the shift in approach in an interview with Bloomberg TV, SOHO CEO Zhang Xin said, “For build and hold, there will not be many surprises because you’re holding the buildings for lease. The leasing market is more stable than the sales market. When we do build and sell, the capital market doesn’t always understand.”

Until this new strategy was announced, SOHO had been known most recently for its strata-sales approach to developing commercial office and retail space. The firm’s primary mode of operation had been to build properties and then sell of floors or smaller spaces to individual investors. This practice, which is popular among China’s domestic developers, contrasts with the build-own and lease-out approach taken by most Western real estate developers.

In the interview, Zhang indicated that SOHO hopes to have nearly RMB 4 billion in rental income annually within three years. During the first half of 2012, Soho China took in RMB 76 million yuan in rental income in the first half. This compares with the RMB 1.15 billion that the company made from selling properties.

The company did not address how it would attempt to replace the quick cashflow it had been receiving from selling its assets as it shifts to leasing out its properties.

Beijing’s average prime-office rent rose 4.6 percent in the second quarter from three months earlier, with an average yield of 7.4 percent, while in Shanghai it gained 2.1 percent in the period, with a yield of 6.1 percent, according to property broker Knight Frank LLP. Hong Kong, the world’s costliest place to rent office space, has an average yield of 3.3 percent, the broker said.

Leave a Reply