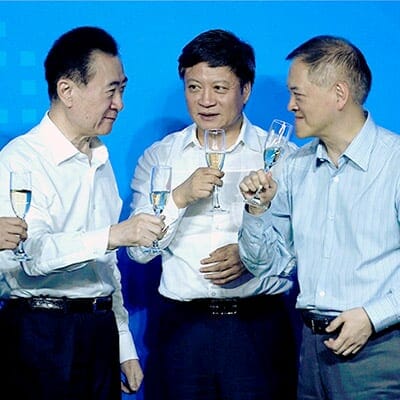

From left to right, Wanda’s Wang Jianlin, Sunac’s Sun Hongbin, and R&F’s Li Sze-Lim

China’s biggest-ever property deal has taken another twist, with Guangzhou’s R&F Properties suddenly stepping in to acquire 77 hotels from Dalian Wanda Group for RMB 19.9 billion ($2.9 billion).

The acquisition is the latest twist on a sale of Wanda’s hospitality and theme park assets, which also stars developer Sunac, with special guest appearances from some of China’s best-known financial regulators.

Sunac China Holdings had agreed last week to buy 76 of the 77 hotels, together with Wanda’s 13 cultural tourism projects, for a total price of RMB 63.2 billion ($9.3 billion). The Tianjin-based developer will now be purchasing only the tourism projects from Wanda.

Sunac Now Buying Less for More

Under the new agreement, announced in Beijing on Wednesday, Sunac will acquire a 91 percent stake in the tourism properties for RMB 43.8 billion ($6.5 billion) and will take on RMB 45.4 billion ($6.7 billion) of loans attached to the assets. The company has already made a down payment of RMB 15 billion ($2.2 billion) towards the purchase.

In addition to the reduction in the scope of Sunac’s acquisition, Wanda also revealed that it will no longer be lending to Sunac to finance the deal, after previously agreeing to extend a RMB 29.6 billion ($4.35 billion) loan to help Sunac buy the assets.

Under the terms of the restructured transaction, China’s third-richest man Wang Jianlin will be selling the assets through his main property business, Wanda Commercial Properties. The news closely follows reports that Chinese regulators have ordered scrutiny of Sunac’s credit risk and are clamping down on funding for Wanda’s overseas entertainment projects.

Everyone’s a Win-Win-Winner After Last-Minute Scramble

The parties to the revised transaction apparently scrambled to reach a final agreement until minutes before last week’s announcement was made at a high-profile signing ceremony. That unveiling was delayed for an hour, while according to Chinese media, the R&F logo was taken off a backdrop at the venue, only to be put back on later.

One Chinese journalist reported hearing a glass break, while others claimed they saw people storming out of a room in anger, according to an account in The New York Times. Wanda chairman Wang Jianlin blamed the delay on a printer problem and denied there were quarrels.

Wang described the reconfigured sale as a “win-win-win” for the property trio, but Wanda may come out as the biggest winner among the three parties.

Wanda will receive RMB 60 billion in cash, double the amount it would have pocketed under the original deal, as it will not need to extend loans to any of the buyers, according to an analyst cited by The South China Morning Post. The announcement posted on Wanda’s corporate website noted that “Wanda can significantly decrease the liabilities and recover tremendous cash flow via this transfer.”

Sunac Steps Back from Debt Abyss

Sofitel Wanda Ningbo is one of the 77 hotels R&F has just agreed to buy

Sunac is now paying an additional RMB 200 per square metre for the cultural tourism properties, which span a total area of 48 million square metres and typically include theme parks as well as retail, hotel and residential facilities. R&F, in the meantime, is acquiring the hotel portfolio at a discount of 40 percent over what Sunac had originally agreed to pay for it just last week.

According to the announcement, the sale will “significantly increase Sunac’s consolidated revenues and profits, and will help Sunac to rank among the top two real estate companies within 2 years. For Sunac, it is worth acquiring the cultural tourism projects by paying higher prices, without acquiring the hotel properties.”

With a bit of help from government minders, Sun Hongbin’s Sunac may have realised it had bitten off more than it could chew by taking on the horde of properties, a sale that was poised to make Sunac the country’s most indebted developer.

On Tuesday, Chinese media reported that the China Banking Regulatory Commission (CBRC) had instructed commercial banks to review their credit exposure to Sunac. China Construction Bank reportedly froze the sale of a Sunac financial product and cancelled a trust loan of RMB 1.5 billion ($222.1 million) to the property firm.

Hotels a Better Fit for R&F than Sunac

In contrast with rival homebuilder Sunac, R&F has experience in the hospitality business, having opened 24 hotels worldwide under international brands such as Hyatt and Marriott. The top 20 mainland developer headed by Li Sze-Lim says the deal will make R&F the world’s largest five-star hotel owner by adding 77 high-quality hospitality assets at low cost to its existing portfolio.

This past January, R&F said it was investing $3 billion over the next five years to build luxury hotels in Cambodia in partnership with the country’s Royal Group.

Try not to confuse the terms ‘operator’ and ‘owner’ when writing about hotels.

Thanks Robert — glad to have you on our crowd-sourced proofreading team.