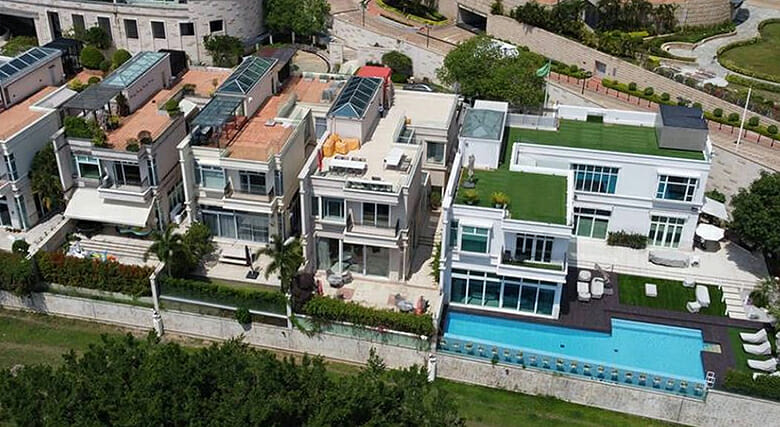

House 17 at the Residence Bel-Air is one of a row of super-luxury homes

A high-end home in Hong Kong’s Pok Fu Lam neighbourhood has been put on the market by receivers, with local media reports identifying its former owner as Mai Fan, vice-chairman and chief executive officer of Kaisa Group who had seen the estimated HK$260 million to HK$280 million ($35.6 million) villa seized by creditors in December, according to Land Registry records.

House 17 in the third phase of the Residence Bel-Air project, is being sold through a public tender which is set to close on 29 June, 2022. Should it change hands at the maximum valuation, which is equivalent to HK$70,832 per square foot of floor area, its new owners would be purchasing the luxury house at a 20 percent mark-down from Mai’s reported 2017 purchase price of HK$350 million.

The receivers, Cosimo Borrelli as well as Tai Shaw Hoong and Kent McParland from New York-based risk consulting firm Kroll, were appointed by Deutsche Bank AG on behalf of its Hong Kong branch, according to market sources who spoke with Mingtiandi.

Mai, who has served Kaisa since 2015, had his Hong Kong trophy home stripped away around the same time that his company defaulted on $400 million in offshore bonds in December of last year, with the Shenzhen builder now struggling to restructure some $11.8 billion in debt.

Getting Schooled in Pok Fu Lam

House 17, a four-bedroom bungalow in the third phase of the Residence Bel-Air project, covers a saleable area of 3,953 square feet (367 square metres) at 17 Bel-Air Rise in Hong Kong Island’s Telegraph Bay.

Kaisa’s Mai Fan may have bitten off more than he could chew

Future owners of the two-storey luxury property, which was completed in 2005 by Richard Li’s Pacific Century Premium Developments, will be able to enjoy seaside views, a rooftop deck, and a private garden in their new home.

Over the last five years, Phase 3 of Residence Bel-Air recorded just two transactions, with unit prices that ran from HK$54,414 to HK$58,058 per square foot, according to a press release from property firm CBRE, which has been appointed by receivers as the sole agent for the sale.

However, the project’s fifth phase witnessed a HK$64,000 per square foot sale during the most recent wave of the pandemic, CBRE said, adding that the supply of detached houses in the area is scarce.

Mainland investors like Mai had traditionally been a primary source of sales at Bel-Air in the past, said Alex Leung, senior director at surveying firm CHFT Advisory and Appraisal.

Developer Downfall

The Pok Fu Lam property previously owned by Kaisa’s Mai’s former home was put on the market about one month after Kaisa shares were suspended from trading on the Hong Kong exchange after the developer failed to publish its 2021 annual results by a 31 March deadline.

That suspension came after Kaisa saw its share price slide 75 percent over the last twelve months before the 1 April forced halt. During this year the company has reacted with a flurry of asset disposals and stake sales.

Last month, Kaisa Group entered a strategic cooperation agreement with state-owned China Merchants Shekou Industrial Zone Holdings and China Great Wall Asset Management on joint venture arrangements and asset acquisitions. Analysts predicted this could lead other distressed property developers to bring in state-owned enterprises or local governments for their restructuring, Reuters reported.

“Kaisa’s agreement with Merchants and Great Wall was an attempt to restructure its flailing finances, and as the first such major announcement by a developer during the current crisis, it caused Kaisa’s dollar bonds to jump,” said Brock Silvers, chief investment officer at Hong Kong-based Kaiyuan Capital. “The path toward a sectoral restructuring remains unclear, and in the interim, many large developers may continue to struggle with increasingly harried monetizations,” he added.

In January this year, credit rating giant Fitch withdrew Kaisa’s Long-Term Foreign-Currency Issuer Default Rating. This followed its downgrading of that rating from C to restricted default, after Kaisa’s failure to repay $400 million in senior notes due 7 December, 2021.

During that same month, Kaisa Group sold its 38th floor space in The Centre, an office tower in Central district, for HK$186.3 million to Shandong Hi-Speed Financial Group, according to a filing to the Hong Kong stock exchange.

Leave a Reply