Yang Guoqiang’s Country Garden tops China’s developer ranks through November, with RMB 660 bil in sales

Mainland China’s top real estate developers have seen a bountiful year despite a downtrend in the past three months, with 26 developers reporting contracted sales exceeding RMB 100 billion ($15.5 billion) through the first 11 months of the year.

According to data released by CRIC, a research unit of mainland real estate agency E-house, the majority of the country’s 100 biggest developers have achieved double-digit growth since the beginning of this year, even as the central government has been trying to clamp down on property speculation by imposing tightened regulations on developers and brokers and cutting resettlement subsidiaries.

The regulations have been effective in curtailing sales growth, with most of the top developers seeing significant slowdowns in the most recent three months, although sales for the country’s largest players continue to expand at a pace faster than the industry-wide average.

The CRIC also predicted that more than 30 developers would become members of the RMB 100 billion sales club this year — almost double the 17 developers who reached that milestone in 2017.

Top Players See Faster Sales

In terms of sales growth through November, Hong Kong-listed Ronshine China achieved the most rapid rate of expansion among top mainland players. The Shanghai-based developer earlier this month said its aggregate contracted sales in the period amounted to RMB 108 billion — an increase of 162.8 percent over the same period last year. The surge in new contracts also brought Ronshine China into the RMB 100 billion sales club for the first time since it was founded in 2003.

Guangzhou-based R&F Properties also saw rapid sales growth, with contracted sales growing 55 percent to RMB 113.8 billion in the first 11 months of the year, compared to the same period last year.

Top Three Developers Reach RMB 500 Billion in Sales

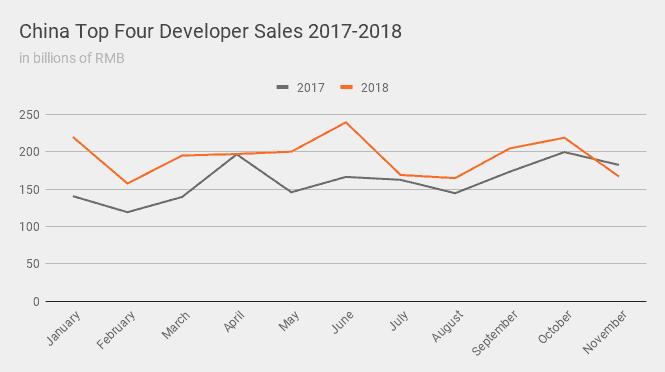

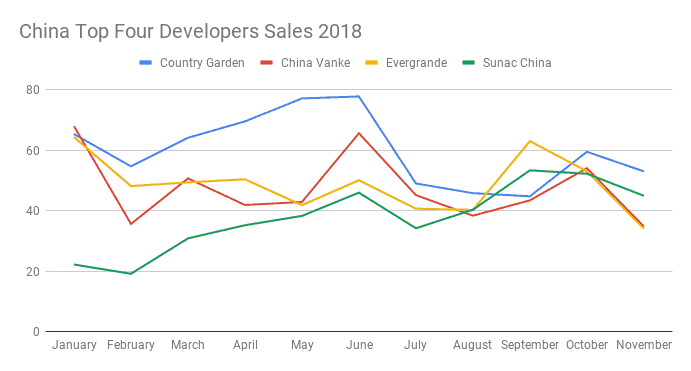

The top four real estate developers in China — Country Garden, China Vanke, China Evergrande, and Sunac China– saw their annual sales increase 17 percent year-on-year during the first 11 months of 2018.

Sales for the country’s top home-builders grew significantly more quickly than the industry average, with China’s National Bureau of Statistics reporting last month that, in terms of value, sales of residential buildings in China grew 15 percent during the 10 months of the year, with sales growing by just 2.8 percent in terms of floor space, according to the government statistics.

Country Garden continued to lead the RMB 500 billion league with China’s biggest selling developer of 2017 having signed contracts for RMB 664.5 billion in homes through the year’s first 11 months — an increase of 29.52 percent compared to 2017.

The Guangdong-based developer founded by ex-peasant Yang Guoqiang last year topped the home sales ranks with RMB 550 billion in contracts by the end of 2017.

China Vanke ranks second with contracted sales of RMB 543.95 billion through the end of November — an increase of 16 percent over the same period last year, while Evergrande had RMB 535.21 billion in sales in the 11 months, and Sunac China signed RMB 416.6 billion in new contracts.

Together, the 26 developers with at least RMB 100 billion in contracted sales so far this year have reported an average of RMB 172.5 billion in sales, an increase of 58.3 percent over the same period last year.

The number of developers reporting RMB 50 billion to RMB 100 billion in contracted sales has increased to 27, with average sales revenue of RMB 67.5 billion in the 11-month period, and the top 100 developers have seen total contracted sales of RMB 23.6 billion in the same period.

Big Sales, Big Debts

Although the top developers are experiencing record-breaking growth this year, they are also suffering from heavy debt burdens, driven in part by the central government’s deleveraging campaign.

In early November, two months after R&F Properties had a RMB 6 billion corporate bond plan terminated by the Shanghai Exchange, the heavily geared developer asked shareholders to approve the sale of up 805.6 million in new H shares, or 25 percent and 20 percent, respectively, of its existing and enlarged share base in a deal that could raise up to as much as HK$10.7 billion.

Evergrande which announced at its mid-year earnings conference earlier this year that it had reduced its debt ratio from 184 percent at the end of last year to 130 percent by June 30th, has issued another $2.6 billion in bonds in the last two months, with some of those notes paying coupons of up to 13.75 percent.

Leave a Reply