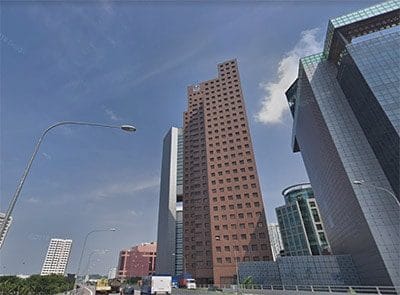

78 Shenton Way comprises a pair of office towers built at different times.

PGIM Real Estate is understood to have entered into an agreement with Alpha Investment Partners to buy 78 Shenton Way, a prime office property in Singapore from a fund managed by Alpha Investment Partners for around S$680 million ($494 million), according to an account by the Singapore-based Business Times.

The deal for the 362,000 square foot by net lettable area (33,630 square metre) property, which is expected to be finalised by the middle of this month, comes just over two and a half years after the fund managed by the private equity fund management division of Singapore’s Keppel Group took full possession of the property in a deal that valued the two-tower project at S$603 million.

The reported transaction, which follows planning applications by Alpha Investment Partners seeking to redevelop the property next to the Keppel Viaduct in Singapore’s downtown core, involves contingencies for revised pricing depending on which, if any of the requests to redevelop the pair of aging office towers receives approval from officials in Asia’s most planned city.

Asset Price May Depend on Development Approvals

A property investment affiliate of Prudential Financial, PGIM’s deal for 78 Shenton Way would secure for the private equity fund manager the pair of mis-matched grade A towers near the Tanjong Pagar MRT station at a price of around S$1,900 ($1,381) per square foot of net lettable area.

In addition to the headline price, PGIM Real Estate may have agreed to make a further payment to Alpha in the event that the planning authority approves, within a certain timeframe, redevelopment schemes proposed by Alpha that could result in enhancement of the site’s value, Business Times reported.

Alpha is said to have proposed a couple of mixed-development schemes for the property, which currently has a gross floor area of close to 494,400 square feet, with both concepts incorporating a residential component for the commercial project, which has another 66 years left on its current land lease. Securing approval for a project that includes a residential component would typically boost chances of getting a top-up of the leasehold site’s land use right for a fresh 99 years.

Former Lippo Centre Would Get New Owner

Alpha Investment Partners took full ownership of 78 Shenton Way after buying out partner Commerz Real’s half stake in the asset formerly known as the Lippo Centre for S$301.5 million in April 2016.

Eric Adler became the first chairman of PGIM Real Estate in June of this year

78 Shenton Way’s older Tower One is a 34-storey granite-clad building with a net lettable area of 284, 622 square feet. Completed in 1988, it has unobstructed sea views beyond the Tanjong Pagar container terminal. Tower One’s occupancy is 95 percent, with a variety of tenants including IPP Financial Advisors and companies in the shipping and related business.

The 11-storey Tower 2, which was completed in 2009, is a glass-clad office block built to Grade A office specifications. Its 77,577 square foot net lettable area is fully let, with a majority chunk of the space leased to AIG till late-2019.

PGIM Real Estate, part of the $1 trillion asset management arm of NYSE-listed Prudential Financial, Inc., has been ramping up its activity in Asia during the last two years. The firm saw its volume of Asia Pacific transaction double in 2017 as it focused on “enhanced-return opportunities” in major markets like Japan, Singapore and Australia.

In June of this year the US-based firm announced that its CEO, Eric Adler, had been promoted to become the first chairman of the firm’s PGIM’s real estate, a move seen as tightening the relationships between the company’s PGIM Real Estate and PGIM Real Estate Finance divisions.

Leave a Reply