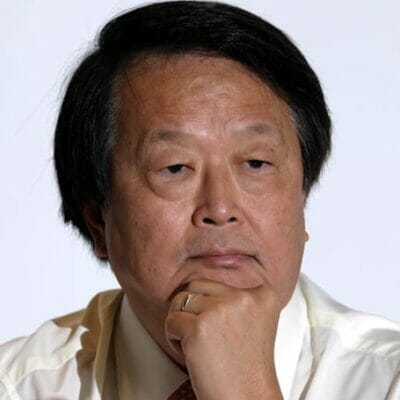

Perennial’s Kuok Khoon Hong is considering putting AXA Tower on the block, according to reports

A group of investors led by Perennial Real Estate Holdings are said to be considering the en bloc sale of AXA Tower, the sixth-tallest building in Singapore, for at least S$1.65 billion ($1.2 billion).

According to an account in The Straits Times, Perennial has received a number of inquiries about the building, which the Singapore-listed property firm attributed to “the improved Singapore office market environment and strong interest in the commercial office segment.”

Based on the building’s total net lettable area of 767,358 square feet, excluding strata floors that have been sold since last year, the target price translates to around S$2,150 ($1,582) per square foot following renovations that are slated to be completed in 2019.

Accounting for the S$140 million ($130 million) renovation cost that is fully debt-funded and will be transferred to the potential buyer, the value per floor comes to about S$2,333 ($1,717) per square foot.

Perennial-Led Group Could Sell Tower at $480M Markup

The building at 8 Shenton Way is owned by Perennial and HPRY Holdings, an investment vehicle wholly owned by Perennial chairman Kuok Khoon Hong, as well as other investors who did not wish to be identified. Perennial and HPRY hold stakes of 31.2 percent and 10.1 percent in the property, respectively, totalling 41.3 percent.

AXA Tower at 8 Shenton Way is Singapore’s sixth-tallest building

Completed in 1986, the 50-storey grade A tower that was once home to the Singaporean prime minister’s office currently houses anchor tenants AXA Insurance, aircraft sales and leasing firm BOC Aviation, and software maker Red Hat Asia Pacific. The distinctive cylindrical tower with a two-storey retail podium is located in the city-state’s downtown financial district, with frontages along Shenton Way, Anson Road and Maxwell Road, and is connected to the Tanjong Pagar MRT station.

The property has an unused plot ratio that could yield about 185,850 square feet of additional space upon renovation. A major upgrade is underway to expand the retail podium to about 60,000 square feet, build a new two-storey, 32,000 square foot annex block for medical suites, along with improvements to the existing offices and lifts.

The Perennial-led consortium bought the tower in 2015 for S$1.17 billion, translating to about S$1,735 per square foot. Last August, the owners put up two strata office floors (21st and 35th) for sale, at an indicative price of at least S$2,550 ($1,883) per square foot.

Singapore Market Recovery Drives Interest in Sale

A recent spate of office investment deals in Singapore makes this an opportune time for Perennial and its partners to think about putting their building on the block. Last month, CapitaLand said it was teaming up with Mitsubishi Estate and its own REIT affiliate, CapitaLand Commercial Trust (CCT) to build a landmark 51-storey skyscraper at Raffles Place costing S$1.82 billion ($1.32 billion).

In June, Hongkong Land announced it was partnering with Malaysia’s IOI Properties to build and manage a pair of office towers within the Marina Bay Financial Centre, paying S$940 million ($682 million) for its stake in the project. The previous month, CCT sold its stake in the 23-storey office building One George Street at Raffles Place to a subsidiary of Richard Li’s FWD Group for S$591.6 million ($424 million).

Nanjing-based developer Fullshare Holdings agreed in February to purchase the GSH Plaza office tower in Raffles Place for S$725.2 million ($512 million). In the same month, DBS Group sold the nearby PwC Building to Canada’s Manulife for S$747 million ($525.7 million).

Leave a Reply