The former Grand Park Orchard is now Pullman Singapore Orchard

Singapore’s High Court on Wednesday ruled that Park Hotel Management founder Allen Law had breached his fiduciary duty to the hospitality operator by transferring some of the firm’s assets to himself “at a gross undervalue”.

During the COVID pandemic, Park Hotel Management fell behind on lease payments for two Singapore hotels it operated, Grand Park Orchard and Park Hotel Clarke Quay. Law then embarked on a “restructuring” while knowing that the firm faced financial extinction with no hope of relief or rehabilitation, according to the judgment handed down by Justice Hri Kumar Nair.

Nair ruled that the so-called restructuring was a plan to move Park Hotel Management’s revenue-generating assets to Law, eliminate all liabilities owed to the firm by him and entities owned by him, and leave the company a shell carrying only substantial liabilities.

“This case was an egregious instance of a director who did the opposite of what the law demands,” Nair said in the judgment. “When his company was in financial peril, he transferred its viable assets and businesses (effectively) to himself at a gross undervalue and manipulated the books of the company to eliminate receivables owed by him and his entities, leaving the creditors with nothing.”

Bossini Heir

Law, son of Law Kar Po, chairman of Park Hotel Group and founder of clothing retailer Bossini, was sued by Park Hotel Management’s liquidators in 2022, with the plaintiffs alleging that the firm received no consideration for the substantial assets it divested. The assets included 12 hotel management agreements, including those for Grand Park Orchard and Park Hotel Clarke Quay.

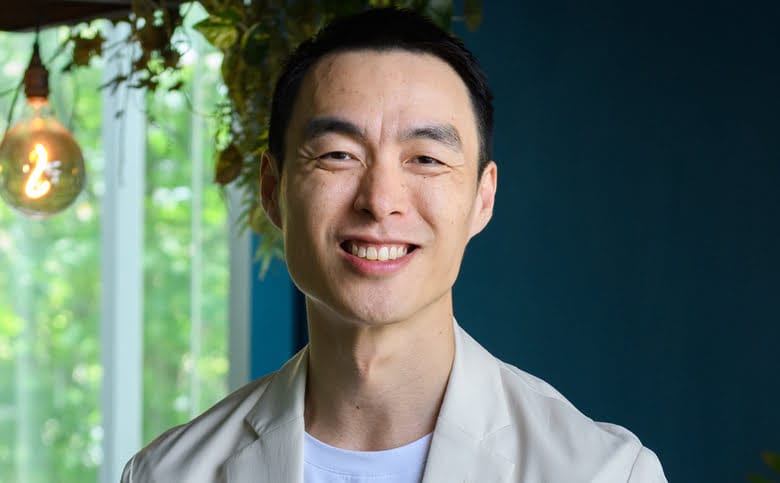

Park Hotel Management founder Allen Law (Image: Seveno Capital)

On Wednesday, the court held that Law had received more than S$10 million in cash payments from Park Hotel Management in 2021 and diverted S$22 million in receivables from the firm.

Nair directed the plaintiffs to file submissions within two weeks on the reliefs and costs they are seeking and for the defendants to respond within two weeks thereafter, with the time for appeal to begin after the judge issues a decision on reliefs and costs.

“This remains a legacy matter arising from the exceptional circumstances of COVID lockdowns in 2020 and their unprecedented impact on the hospitality sector,” a representative of the defendants said Wednesday. “The judgment is being reviewed and appropriate next steps are being considered.”

The former Grand Park Orchard now does business as Pullman Singapore Orchard, while Park Hotel Clarke Quay has been rebranded as The Robertson House by The Crest Collection and is managed by CapitaLand Investment’s Ascott lodging division.

Venture Capital Pivot

In April, Law announced the launch of Seveno Capital, a fund backing “early and growth-stage ventures with the holistic potential to extend the human health span”.

The entrepreneur committed $70 million over five years to Seveno as the principal investor, with the fund having made its inaugural bet on A Cabin Company, a wellness group building a global network of restorative spaces, starting in Japan.

A representative for Seveno told Mingtiandi on Thursday that the fund was not a party to the judgment issued by the court and that there was no statement available from Law.

Leave a Reply