The Cargo Consolidation Complex is fully leased to PCCW

Nuveen announced the addition of four assets to its Asia Pacific core investment strategy today with the acquisition of a data centre in Hong Kong’s New Territories and a set of three multi-family properties in Japan’s second largest city.

The completed acquisitions across two of the industry’s hottest sectors were made on behalf of Nuveen’s $2 billion Asia Pacific Cities Fund, with the US investment firm highlighting its Hong Kong acquisition as its first in the city, and as an opportunity to leverage growing demand for data infrastructure while diversifying its portfolio.

“Hong Kong is a critical financial and technology hub and one of the most mature data centre markets in Asia with rich network connectivity, robust infrastructure and healthy market fundamentals, making this an important strategic investment for the Asia Pacific Cities Fund,” said Louise Kavanagh, chief investment officer and head of Asia Pacific for Nuveen’s real estate division. “We will continue to diversify its portfolio geographically and into sectors which match its investment objectives.”

A report published by Cushman & Wakefield earlier this year ranked Hong Kong as the sixth most attractive location globally for operating data centres, thanks to a robust development pipeline, excellent networks and the availability of all major cloud services, with Nuveen fitting into a growing number of regional and global institutions pursuing digital infrastructure opportunities in the city.

Kwai Chung Asset in Demand

Nuveen’s Hong Kong digital prize is the Cargo Consolidation Complex, according to market sources who spoke with Mingtiandi, with the fund manager having paid a reported HK$2.88 billion ($371.7 million) to purchase the property near the Kwai Tsing container terminal from local investor Loh Shou-nin.

The Cargo Consolidation Complex has an enviable trading history

The 270,000 square foot data centre is currently fully-leased to local telecom leader PCCW, with all but the ground and first floors under contract through 2035, should the tenant decide to exercise options included in the lease. CBRE brokers Greg Penn and Tony Ng are understood to have represented the vendor in the disposal.

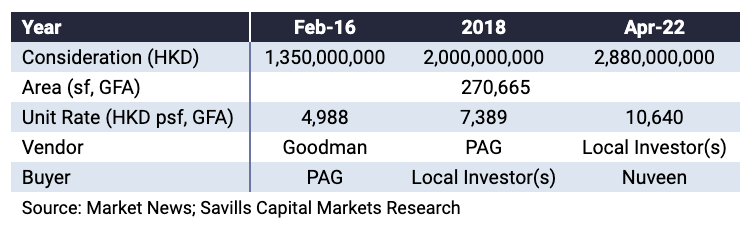

The sale illustrates the rising demand for data centre assets in the city, with Lou having acquired the property from PAG in 2018 for HK$2 billion, providing the investor with a more than 30 percent gain in less than four years. PAG had purchased the asset from Goodman for HK$1.35 billion in February 2016, according to data from property agency Savills, after the Australian developer had already converted the property for data centre use.

That kind of return has not escaped the attention of some of Nuveen’s competitors, with ESR last November having acquired the Brilliant Cold Storage Tower 2 in Kwai Chung – less than one kilometre from the Cargo Consolidation Complex – for $230.8 million. The Hong Kong-listed fund manager says it will convert the cold storage facility into a 40MW data centre.

In September last year Blackstone paid $36 million to purchase Yip’s Chemical Building at 13 Yip Cheong Street in Hong Kong’s Fanling area, with that asset located within a few blocks of data centre projects by Singapore’s Mapletree and Sun Hung Kai Properties SUNeVision.

Osaka on the Rise

With Nuveen’s Asia Pacific Cities Fund focusing on core assets for what it terms “future-proof cities” the firm’s other acquisition announced today also nodded to a fast-rising alternative sector by adding 342 multi-family units to the vehicle’s portfolio.

Nuveen’s Louise Kavanagh

Pointing to an overall occupancy rate of from 96 to 98 percent across Osaka’s multi-family market, Nuveen described the purchase as “an attractive investment opportunity in Japan as a resilient and defensive asset class.”

“The Japan market is seeing an upward trend in rental residential properties which our fund is able to take advantage of,” Kavanagh said. “Osaka’s economy, while less diversified than Tokyo’s, is manufacturing-based, a sector which has benefitted from increased global demand as well as the move to bring supply chains onshore following the Tohoku earthquake.”

While not providing specifics on the properties or the scale of the investment, the fund manager expressed confidence that, given the assets’ location advantages, including proximity to the city centre and access to rail stations, the properties would be able to attract and retain professional tenants and provide stable income streams.

In 2020 Nuveen had invested $140 million purchasing 10 multi-family assets in Tokyo and Osaka, with those acquisitions from fund manager PAG also on behalf of its Asia Pacific Cities fund.

House Party

In visiting the Osaka properties in preparation for the acquisition, Kavanagh and her team may have run into a few familiar faces from competing investment managers, as global institutions increasingly put multi-family acquisitions near the top of their target lists.

With Japan being the top location in Asia Pacific for the sector, in late March Goldman Sachs Asset Management said that it had established a joint venture which would be investing $300 million to acquire rental apartment properties in the country this year, and would be budgeting $500 million annually for such opportunities thereafter.

Providing a clearer picture of investor activity in the sector is the late March announcement by UK’s M&G Real Estate that it had acquired 1,575 apartments across Tokyo, Osaka and Nagoya for JPY 49.2 billion ($424 million), with Mingtiandi having identified the seller as Blackstone.

Also during March, Canada’s Manulife Investment Management said that it had agreed to form a JPY 19.8 billion joint venture with Japan’s Kenedix to acquire multi-family assets in Greater Tokyo, Osaka and Nagoya.

In addition to the acquisitions announced today, Nuveen in December closed on its $472 million purchase of a half-stake in One George Street – a 23-storey office building in Singapore – on behalf of its Asia Pacific Cities fund.

Note: This story has been updated to show that M&G Real Estate acquired their Japanese portfolio last month for JPY 49.2 billion. An earlier version stated the amount as JPY 109.3 billion. Mingtiandi regrets the error.

Leave a Reply