The Center on Queen’s Road has been valued at $4.5 bil

Hong Kong’s richest man could make the city’s biggest property sale, thanks to the support of mainland investors hungry for properties in the Asian financial hub.

The Center office tower, the tallest building in the portfolio of Li Ka-shing’s Cheung Kong Property Holdings and the fifth-tallest in Hong Kong, is reportedly up for sale with several of China’s state-owned companies said to be preparing bids. The investor known in Hong Kong as Superman for his deal-making prowess could be selling the 73-story office building at 99 Queens Road in Central for a price in excess of HK$35 billion ($4.5 billion), making it the city’s richest property sale to date.

Knight Frank’s head of valuation and consultancy, Thomas Lam, told the South China Morning Post that state-owned Chinese companies are the most likely buyers for the building that provides Hong Kong homes for top corporates including Goldman Sachs and Singapore’s DBS bank, since the SOEs can afford the asking price and continue to purchase large-scale projects in Hong Kong.

Should Cheung Kong Properties succeed in selling the 130,000 square metre, circa 1998 tower, it will mark the eighth time in less than three years that a company controlled by Li has disposed of a major real estate asset in Greater China. Li has increasingly turned the focus of his $80 billion empire to opportunities in Europe and in emerging industries as Asian markets have slowed in recent years.

Low Yields Make CK Property a Willing Seller

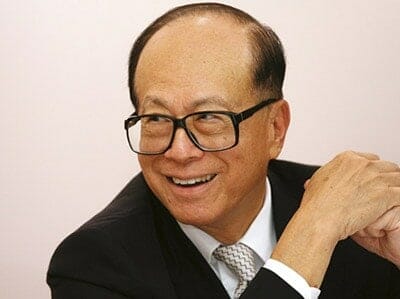

Li Ka-shing looks well pleased with the potential returns on this deal

According to Savills’ World Office Yield Spectrum report, grade A office yields in Hong Kong were 2.71 percent during the second quarter, making them the worst in the world in terms of office investment. Yields have similarly been shrinking in China due to the slowing economy and the rush of new credit flowing into the mainland economy that has led to a steady increase in the value of renminbi-denominated assets.

This has seen Li sell off a total of RMB 20 billion ($2.99 billion) of commercial properties in Shanghai, Beijing and Guangzhou since 2013. Li stated earlier this year that the only property in his portfolio not up for sale was the company’s headquarters, the Cheung Kong Center.

CK Property has not purchased land in China or Hong Kong during the first half of the year and CK Property’s deputy chairman, and son of Li Ka-shing, Victor Li said they have no intention to do so anytime soon while yields continue to be low.

Earlier this month, the elder Li announced that CK Property was looking beyond Hong Kong to diversify its portfolio. “As it is presently challenging to identify property investments with reasonable returns in the current cyclical stage of the property market, the Group will also pursue global investments to extend our reach to new business areas,” he said in a statement.

Mainland Investors Eager for Hong Kong Assets

And while lower yields may be a turn off for Hong Kong developers like CK Property, investors from China have been aggressively acquiring Hong Kong properties as the renminbi continues to decline in value against the US dollar and mainland banks free up more credit for acquisitions.

China-based investors set record after record for Hong Kong real estate purchases in the past ten months, with Evergrande Real Estate’s acquisition of the Mass Mutual Tower from Joseph Lau’s Chinese Estates for HK$12.5 billion ($1.61 billion) in November setting a record for the most expensive purchase of an office building in Hong Kong. The record looks likely to be broken by an eventual deal for The Center.

Hong Kong-based developer Wheelock and Company found its One Harbourgate complex in Kowloon to be highly coveted by Chinese developers. It sold the west tower and attached retail bloc to China Life Insurance for HK$5.86 billion ($755 million).

Cheung Kei Holdings, a property investment firm controlled by Shenzhen-based billionaire Chen Hongtian, purchased One Harbourgate’s east tower, a 15-story office building, for HK$4.5 billion ($580 million) in July.

Leave a Reply