Sunac chairman Sun Hongbin has a big smile as he imagines acquiring Kaisa’s 550,000 sqm of Shanghai projects at 40% off normal financing costs

The international creditors of troubled real estate developer Kaisa Holdings may need to wait at least five more years to get back what’s owed to them, and can expect to earn much less than what they signed up for.

This latest revelation about the troubled Chinese property firm came via a 56-page announcement to the Hong Kong stock exchange, which provides new details on just how much trouble the Shenzhen developer is in, and proposes reduced interest payments and longer repayment periods for holders of the company’s offshore bonds and loans.

In the announcement Kaisa reveals that sales remain frozen at 11 of the company’s projects in Shenzhen – substantially more than the four projects announced to the stock exchange previously, and also made it clear that if the company were to be forced to liquidate, it would only be able to repay 2.4 percent of its debt liabilities.

If the proposed deal is accepted by Kaisa’s offshore creditors, it would pave the way for Sunac Holdings, as well as Kaisa’s existing stockholders, to be able to bring to market one of China’s largest pipelines of residential and commercial real estate, at finance costs well below market rates.

Half the Interest If You Can Wait 5 More Years

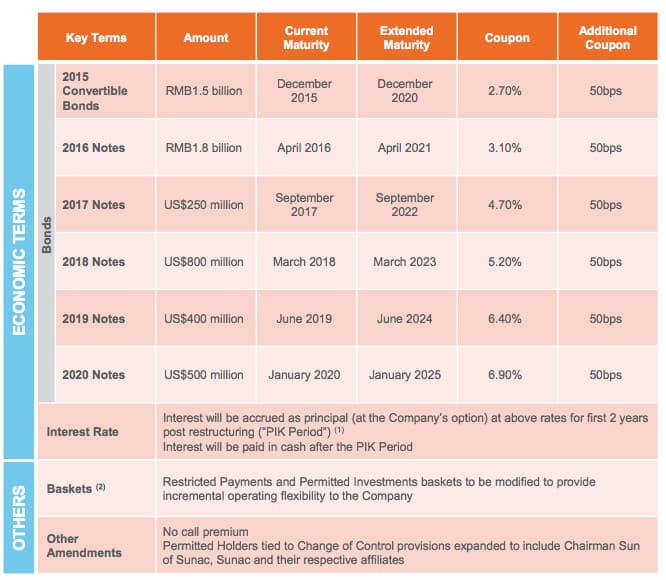

For investors in Kaisa’s RMB 17 billion ($2.7 billion) in offshore bonds and loans the key component of yesterday’s announcement is the proposed terms for repayment of these liabilities. The announcement follows an earlier proposal by the company for repaying its RMB 48 billion ($7.6 billion) in debts to domestic creditors.

The proposed terms for restructuring Kaisa’s offshore bond obligations

Kaisa’s laid out new terms for its six outstanding bonds which would stretch out the payment terms for each of them by five years, and lower the coupon rate by an average of more than 44 percent. In the case of its $250 million in senior notes due to mature in 2017, the company proposed to lower the coupon rate from 12.88 percent to just 4.7 percent.

In addition to the discounted coupon rates and longer horizons on the bonds, Kaisa also proposes to retain the option of making coupon payments in kind, rather than in cash, for the next two years. So bond holders who were expecting interest payments in hard currency might instead be receiving new notes or convertible bonds issued by the company.

Nearly RMB 30 Billion Due in Next 12 Months

Kaisa says that the dramatic restructuring of its obligations to its creditors is necessary due to both its high levels of debt and a range of revenue challenges – some of which were previously undisclosed by the company. Without these concessions, the developer indicates that the proposed acquisition of a controlling stake in Kaisa by rival Sunac can’t be consummated, and creditors would lose nearly everything in a liquidation.

While Kaisa had previously announced to the stock exchange that four of its projects in Shenzhen had been blocked from further sales by the government, yesterday’s announcement indicates that the authorities in the southern Chinese megacity had frozen sales at 11 of the developer’s projects.

Kaisa also revealed that commercial banks in China had suspended the issuing of mortgages for purchases of new homes in the company’s projects that have not had their sales blocked outright.

According to Kaisa, “Absent the release of the sale blockages and frozen assets in the near term,

the going concern value of the Company could be significantly impaired.” The statement disclosed that the company’s total cash balance fell from RMB10,913 million on 30 June 2014 to RMB1,897 million on 2 March 2015.

As part of the review of its finances, Kaisa said that it had retained Deloitte Touche Tohmatsu to analyse liquidation scenarios and found that in the event of a liquidation offshore creditors could expect to receive approximately 2.4 cents on the dollar for their bonds and other credit instruments.

Sunac Gets a 5 Year Solution to a 1 Year Problem

While the details provided by Kaisa’s management provide some scary insights into its acute cash shortage, there is still a tremendous amount of upside in this deal for Sunac, should creditors agree to the proposed haircut.

As long as its projects remain frozen, Kaisa will struggle to service its debt and remain a going concern. Should the Shenzhen government release the 11 frozen projects, however, the company’s cashflow could rapidly improve.

Presumably, such a change of course by the Shenzhen authorities is part of any acquisition by Sunac, which means that once the immediate cashflow crisis is alleviated, and with creditors having already agreed to a five year extension on debt terms, Sunac could enjoy the benefits of having acquired Kaisa’s large pipeline of projects in southern China at credit terms far below market rates.

Leave a Reply