Grand Ming says the sale of the iTech Towers will help cut debt (Image: DC Byte)

Grand Ming Group is seeking waivers from lenders after the Hong Kong developer breached financial covenants governing HK$4.8 billion ($610 million) in outstanding loans, in the latest distress signal for the city’s embattled builders.

The company led by chairman Chan Hung Ming has obtained waivers for HK$2.75 billion in borrowings tied to the default, which was triggered by a failure to meet thresholds for the ratio of consolidated EBITDA to consolidated interest expenses, the consolidated net gearing ratio and the current ratio, according to a Tuesday filing with the Hong Kong stock exchange.

The breach entitles the lenders to declare the outstanding principal amount, accrued interest and all other sums immediately due and payable, said Grand Ming, which last week reported an annual loss of HK$292.1 million, reversing a year-earlier profit of HK$298.5 million.

“The group is continuing to seek waivers from other lenders in respect of the breach,” Chan said in the filing. “As at the date of this announcement, the group has not received any demand from the lenders for immediate repayment of the loans under the loan facilities.”

Profit Warning and Asset Sales

Grand Ming’s disclosure comes just a few weeks after the mid-sized builder issued a profit warning to the HKEX, indicating that it expected to suffer a net loss of approximately HK$280 million to approximately HK$310 million for the year ended 31 March, after having achieved a net profit of approximately HK$298.5 million for the preceding 12 months.

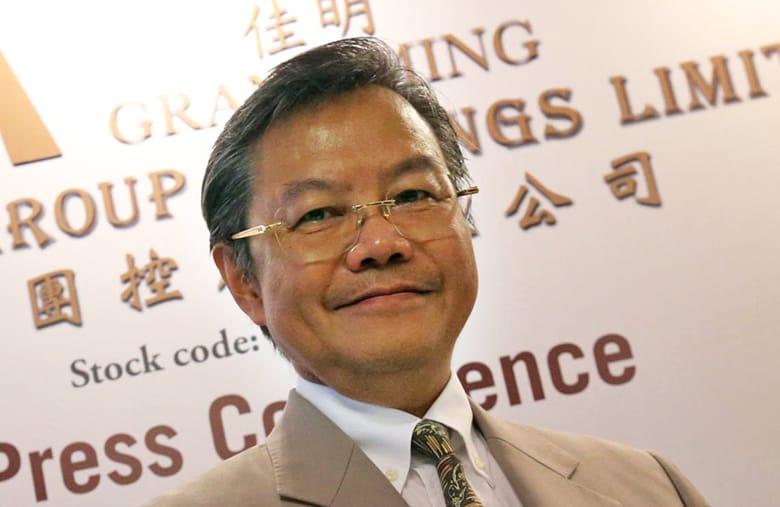

Grand Ming Group chairman Chan Hung Ming is seeking relief from his lenders (Getty Images)

The company’s board said that the loss was mainly attributable to recognition of impairment losses on development projects and own-use assets as well as unrealised fair value losses on investment properties.

The company is already taking action to bolster its balance sheet liquidity including entering into advanced discussions to sell a pair of data centre projects in Hong Kong’s New Territories, with a Mingtiandi report last month identifying Bain Capital as the potential buyer. The US fund manager is in exclusive talks to acquire iTech Tower 3.1 and iTech Tower 3.2 for up to HK$2.15 billion ($274 million), according to market sources.

In a 19 June notice to the HKEX, Grand Ming said it had entered exclusivity for the potential sale of the projects for a period of 90 days, with the potential purchaser due to complete financial due diligence on the deal as well ensure that the land and technical elements of the project are to the potential purchaser’s satisfaction.

The deal also hinges on Grand Ming having secured necessary government approvals and utility connections, among other milestones. In its statement, Grand Ming positioned the sale as a way to bolster its balance sheet.

“Having taken into account the group’s current financial position and strategic objectives, the board considers that, should the potential transaction materialise, the net proceeds will enable the group to reduce its overall indebtedness and thereby improving the financial position of the group,” the company said.

Debt Scramble

The update from the troubled builder follows last week’s eleventh-hour deal by fellow Hong Kong property group New World Development to secure a successful refinancing of HK$88.2 billion ($11.2 billion) in offshore debt.

New World, controlled by the billionaire Cheng family, said it had arranged facilities with its banks that allow for more flexibility in payment, including tranches of loans with different maturities, with the earliest maturity date being 30 June 2028.

Another local developer, Emperor International, revealed in its annual results that it was carrying overdue loans in the amount HK$16.6 billion ($2.1 billion), with the group also reporting a wider attributable loss of more than HK$4.7 billion.

Leave a Reply