Golden Wheel Plaza opened at the height of the pandemic in 2020 (Source: Colliers)

A Hong Kong retail tower seized from distressed mainland developer Golden Wheel Tiandi Holdings has been put up for tender in the latest case of a sale by receivers in the Asian financial capital.

Colliers was appointed by the property’s receivers as sole agent for the sale of Hongkong Golden Wheel Plaza, a 25-storey “Ginza-style” vertical retail building at 68 Electric Road in eastern Hong Kong island’s Tin Hau area. While no indicative price has been released, Golden Wheel had reportedly put the newly built tower on the market in December last year at a HK$900 million ($115 million) asking price with that attempt failing to produce a sale.

The public tender, which closes on 31 October, comes after Golden Wheel said in July that it had received notice from executives employed by FTI Consulting that they had been appointed by creditors to take control of a Golden Wheel subsidiary holding the building, after the Nanjing-based developer had last year failed to repay a combined $87 million in loans backed by the property.

Golden Wheel has now joined a wave of mainland developers having suffered Hong Kong asset seizures including China Evergrande Group which saw its former Wanchai headquarters put on the market last year, Goldin Financial which watched as its Goldin Financial Global Centre was sold by receivers in January, and Cheung Kei Holdings, which had its office tower in Hung Hom put on the market by receivers in May..

Bread Now Cheaper Than 2018 Flour

After Golden Wheel had failed to sell the 51,971 square foot (4,830 square metre) tower at HK$900 million last year, the receiver sale could see the property at the junction of Electric Road and Lau Li Street sold for less than the HK$843.8 million the developer paid to acquire the site from HKEX-listed CSI Properties in 2018.

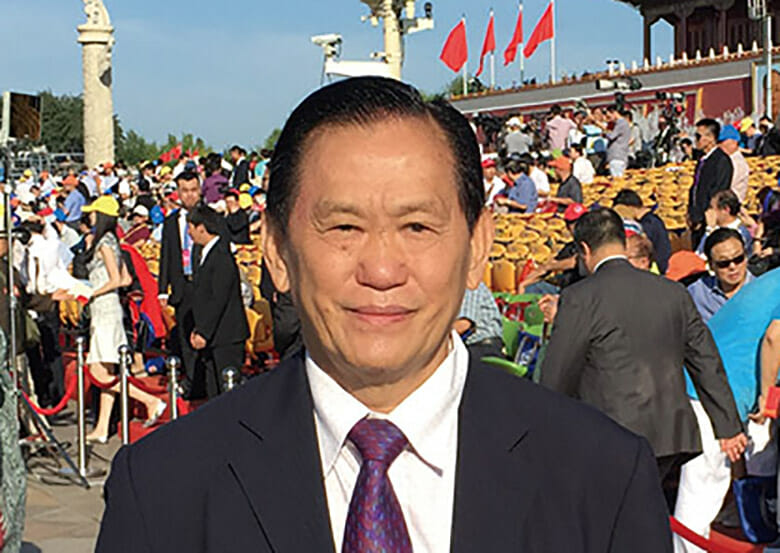

Golden Wheel Tiandi chairman and executive director Wong Yam Yin

Golden Wheel completed construction of Golden Wheel Plaza in July 2020 with the retail tower located about two minutes’ walk from the Tin Hau MTR station, which is four stops east of Central.

Golden Wheel’s December 2022 asking price for its eastern Hong Kong property was already 31 percent below a May 2021 valuation which appraised the asset at HK$1.3 billion, according to a presentation by the firm to investors.

As of the end of 2022, Golden Wheel Plaza was 75 percent leased, primarily to restaurants and other retailers, including a Mannings health and beauty store on the ground floor. Golden Wheel also uses the 27th and 28th floors as its Hong Kong offices.

“It is rare to find a Ginza-style commercial building for sale in the market. Investors may seize this opportunity to purchase the property while the global market is still in the recovery phase,” said Thomas Chak, co-head of capital markets and investment services at the property agency. “When the global economy fully rebounds, stable rental income and property appreciation can be expected.”

With the tower, which is 10 minutes’ walk from the Causeway Bay shopping district, divided into full-floor units and the whole building featuring floor-to-ceiling windows, Chak said target occupiers include high-end restaurants, shops and private clubs, as well as beauty and medical clinics.

Tough Business Environment

In a preliminary release of its financials for the six months ending 30 June, Golden Wheel reported a loss of RMB 519 million ($71 million), after notching a RMB 360 million deficit in the same period a year ago. The company, which primarily operates as a residential developer in China’s Jiangsu and Hunan provinces, noted that its contracted sales for the period fell by 33.5 percent to RMB 562.7 million ($77.2 million).

With revenue down by 56.2 percent to RMB 639 million in the first half, Golden Wheel Tiandi pointed to a “tough business environment in the real estate industry.”

In 2019 Golden Wheel had sold the Silka West Kowloon Hotel in Mong Kok to rental housing operator Weave for HK$515 million, after buying that property from Hong Kong’s Far East Consortium in 2017 for HK$450 million.

The firm owns RMB 4.12 billion worth of ongoing and completed projects as of end-June. Of those developments, some RMB 738 million worth were pledged against outstanding debts, including debts of $40 million and HK$375 million which it defaulted on in October of last year.

Leave a Reply