The enthusiasm of international private equity investors for China real estate deals made another appearance last week when RRJ Capital of Hong Kong announced a US$50 million investment purchase of shares in Hong Kong-listed real estate developer CIFI Holdings (Group) Co.

RRJ agreed to buy 257 million newly issued CIFI shares at HK$1.52 per share – a premium of about 4.1 percent over the closing price as of October 16th. The new shares will comprise 4.3 percent of CIFI when the transaction is complete. RRJ already holds $100 million of CIFI bonds.

According to a statement by CIFI, the company will use the new capital to acquire additional projects and purchase land.

Joining the Private Equity China Real Estate Rush

The investment by RRJ occurs as international private equity firms have become increasingly active in purchasing China real estate assets, as well as acquiring shares in developers active in the market.

During September, Henry Kravis, one of the co-founders of private equity giant KKR visited Hong Kong to make known his firm’s intention to spend part of their record $6 billion Asia fund on acquiring China real estate assets. The KKR announcement followed soon after US-based Carlyle Group announced a $400 million investment in China’s warehouse market.

In August US-based financier Sam Zell’s Equity International spent an undisclosed amount to buy into the Redwood Group – which also focuses on China’s warehouse sectors. During the same month, in a move that in many ways parallels last week’s action by RRJ, Blackstone acquired a Hong Kong real estate developer for $322 million – primarily to increase their access to the China market.

Buying into a China Top 50 Developer

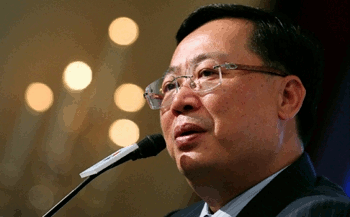

Headquartered in Shanghai, CIFI is known for developing small to medium scale residential projects, as well as commercial properties which are generally sold on a strata title basis. The company ranks among China’s top 50 real estate developers by revenue and is headed by chairman and executive director Lin Zhong. Earlier this year, CIFI estimated that it would achieve 31 percent growth in revenues compared to 2012.

RRJ Capital has only been around since 2011, but it succeeded in raising US$3.5 billion for its second fund earlier this year, thanks to the prominence of the Malaysian-born brothers, Richard and Charles Ong who founded and operate the firm. RRJ’s two funds combined give it a total funds under management of US$5.9 billion.

Before setting up RRJ, Richard Ong had a long career with HOPU and Goldman Sachs, and Charles spent 10 years managing investment projects for government-linked Singapore investment firm Temasek Holdings.

Leave a Reply