The mansion owned by the family of the late Cheong Eak Chong is now up for sale

A Singapore mansion located just five minutes walk from the former residence of late Prime Minister Lee Kuan Yew has been put up for sale in a rare chance to grab a freehold residential site in the city’s posh Orchard area, according to CBRE, which is marketing the property.

Currently owned by the family of the late real estate tycoon Cheong Eak Chong, who founded listed developer Hong Fok Corporation and Tian Teck Group, the colonial era estate on Oxley Rise in upscale District 9 is expected to attract offers exceeding S$300 million ($220 million) said Michael Tay, CBRE’s head of capital markets in Singapore.

“5 Oxley Rise is strategically located on the hilltop of prime District 9 and is within one of Singapore’s most exclusive and highly coveted residential enclaves,” Tay said. “Plum landed sites in Singapore which are larger than 100,000 sq ft are typically tightly held and are rarely put up for sale and as such, these esteemed asset classes have been proven to be resilient through various market cycles.

The proposed sale of the property, which could be developed into a single home, multiple bungalows or a mixed-use project comes as top-end home values have stayed resilient this year despite cooling measures introduced in December, with landed home prices rising by 4 percent in the first quarter at the same time that condo prices declined.

Pieces of Singapore History

Located on a hilltop overlooking the home of Singapore’s founding father, 5 Oxley Rise occupies two freehold land plots spanning a combined 151,205 square feet (14,047 square metres) which is home to a single two-storey bungalow and four out-buildings.

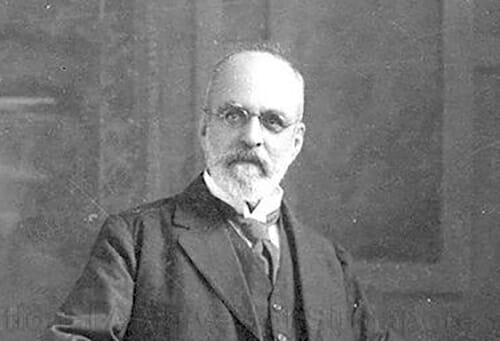

The mansion currently on the site was first developed by Manasseh Meyer

The site was first developed in 1847 by colonial era leader Dr Thomas Oxley who established a home known as the Pavilion on what was then his nutmeg plantation. From 1859 to 1861 the property served temporarily as Government House, while a new governor’s mansion was being constructed. From 1874 to 1892, the mansion was home to Straits Times founder Catchick Moses.

The current home on the site is believed to have been developed in the 1920s by businessman Manasseh Meyer, who owned the property until it later became home to the family of Cheong Eak Chong, until the death of Cheong’s widow, Lim Ghee, in 2020.

A Business Times account in October 2020 said that the property is currently owned by seven sons of the late tycoon, whose companies were responsible for development of International Plaza on Anson Road and The Concourse on Beach Road, among other projects.

“For owner-occupiers, it is a once-in-a lifetime opportunity to acquire sprawling land to build multiple GCBs to house multiple generations. Not forgetting, this esteemed asset class has also proven to be resilient through various market cycles due to its tight ownership,” CBRE’s Tay said.

The public tender for the property is set to close on 8 June, and should the site change hands at S$300 million, that price would indicate an accommodation value of S$1,984 per square foot based on independent calculations.

That rate would make the historic site a bargain compared to a good class bungalow at 2 Cluny Hill which sold for S$63.7 million or S$4,291 per square foot of built space in April of last year. In March of 2021 the family of the founder of Nanofilm Technologies International paid S$128.8 million for a bungalow on Nassim Road which was equivalent to S$4,005 per square foot of accommodation.

Buy the Whole Set

The sale of 5 Oxley Rise may also be inspiring other sale attempts with representatives of the owners of the Oxley Garden condo complex adjoining the hilltop estate announcing a collective sale today.

5 Oxley Rise has Lee Kuan Yew’s residence to the west and Oxley Garden covering its east flank

The owners of the low-rise block are asking S$200 million for the property, according to marketing materials from JLL Singapore, which is promoting the potential for a joint purchase of the two adjacent properties.

“A developer who buys both sites may reconfigure and explore a comprehensive redevelopment for better site efficiency in design and layout, as well as better visibility in access,” said JLL with executive director Tan Hong Boon. “This is certainly a mutually beneficial and value enhancing proposition for both the sites.”

The freehold Oxley Garden property spans a 58,207 square foot site and the four-storey complex can be redeveloped into a new condominium of up to five floors in height with a maximum 92,065 square feet in gross floor area, if bonus GFA of 8 percent available for developing the property to meet government targets is included.

Luxury Buyers Unbothered

Tricia Song, CBRE’s research head for Southeast Asia, is expecting strong demand for the 5 Oxley Rise site amid expectations that Singapore’s luxury residential market will continue to thrive despite the December cooling measures.

“The luxury landed or GCB market on Singapore mainland is unlikely to be affected by the cooling measures as buyers are Singapore citizens and the properties are usually their first homes,” Song said.

The market for these landed properties is distinct from the high-end condo market, according to Song, where potential buyers may be more likely to re-evaluate home purchase plans due to the higher stamp duty for second property purchases.

“Nonetheless, demand should remain resilient on rising rents and Singapore’s safe haven status amid geopolitical uncertainties,” she added.

Leave a Reply