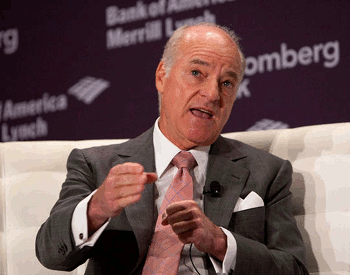

Henry Kravis, also known as the second “K” in KKR, was in Hong Kong yesterday to talk about opportunities for successful M&A in the region, and he made it clear that the company sees opportunities for profitable deals, especially as long as more traditional financing is withheld from the market.

Following soon after the closing of a record $6 billion Asia fund by the firm which was formerly known as Kohlberg, Kravis and Roberts, Kravis was in Hong Kong with Asia Managing Partner Joseph Bae and the pair explained the company’s investment goals and strategies with the local media.

KKR Not Concerned with China Real Estate Risks

Speaking with Hong Kong’s South China Morning Post about the risks in China’s real estate market, Bae did not seem overly concerned about what many observers perceive to be a bubble in asset values.

“Obviously, the real estate market has been a lot stronger than people expected in terms of volume growth and even price. But you can’t generalise about China’s property business,” Bae noted.

Some of KKR’s largest competitors, including Blackstone, Carlyle and Sam Zell’s Equity International have been buying up China real estate in recent months.

In the interview with the Post, Bae contended that superior local knowledge is critical to executing successful deals in the country.

“Real estate in China is by nature a very local business, so I think you really need to have very targeted bets: in which city, what [type] of real estate – residential, commercial or retail.”

Private Equity Stepping in Where Banks Fear to Tread

Since the 2008 financial crisis many Western banks have shied away from investing in real estate deals, and with Chinese banks restricted in their ability to lend to the sector because of government cooling measures, Bae and Kravis see an opportunity for KKR to partner with local firms in need of financing, without necessarily buying them out.

Kravis made it clear that he sees KKR as a “solution provider,” and not the corporate raider that it was often portrayed as during years past.

“Today we can almost accomplish everything that a company needs and that’s the way we want to be positioned,” he said.

The path for KKR to enter execute deals in China should be firmly established, as they have already successfully acquired stakes in and sold off assets in China, including Modern Dairy. The private equity firm sold its 34.5 percent stake in the milk processor to China’s Mengniu Group earlier this year as part of a $410 million transaction.

A Latecomer to China’s Real Estate Scene

However, KKR has been slow to get involved in China’s real estate market, where its competitors have recently done an increasing number of deals.

The Carlyle Group announced just a few weeks ago that it was joining with property manager Townsend Group and local real estate developer Yupei to invest US$400 million in China’s warehouse sector.

And just days prior to that, Equity International unveiled a partnership with Asia-based private equity firm The Redwood Group, also in the logistics real estate sector.

Earlier this year, Carlyle had purchased an office tower in Shanghai for $266 million, and the group bought a minority stake in two shopping malls from local developer SZITIC during May.

US-based Blackstone acquired a Hong Kong real estate developer for $322 million during August, and also bought an office tower in Shanghai last year.

Leave a Reply