Fraser Residence River Promenade was completed in September

Frasers Property has confirmed its sale of a riverfront apartment complex near Singapore’s Robertson Quay with the developer informing the Singapore exchange on Tuesday that it is selling the rental residential and commercial space for S$140.9 million ($104 million).

The developer on Tuesday agreed to sell Fraser Residence River Promenade, an eight-month-old complex which combines 72 serviced apartments with a trio of conserved warehouses, to fellow SGX-listed builder Tuan Sing Holdings, per the statement.

Tuan Sing, which has two hospitality properties in Australia and a third on the way in Indonesia, in its own statement, positioned the deal for the property on Jiak Kim Street in Robertson Quay, which had been reported earlier, as a way to expand its footprint in the lodging sector.

“This strategic acquisition allows the group to enlarge its hospitality portfolio’s product offering and geographical presence, contributing to its overall growth strategy,” William Liem, group chief executive officer of Tuan Sing said.

Riverfront Lifestyle

The set of conservation warehouses once was home to the Zouk nightclub and now house Jiak Kim House, an upscale neo-Singaporean restaurant. The low-rise properties are said to be valued at around S$50.7 million, which would put the compensation for the 72 apartments at around S$90 million, or approximately S$1.25 million each.

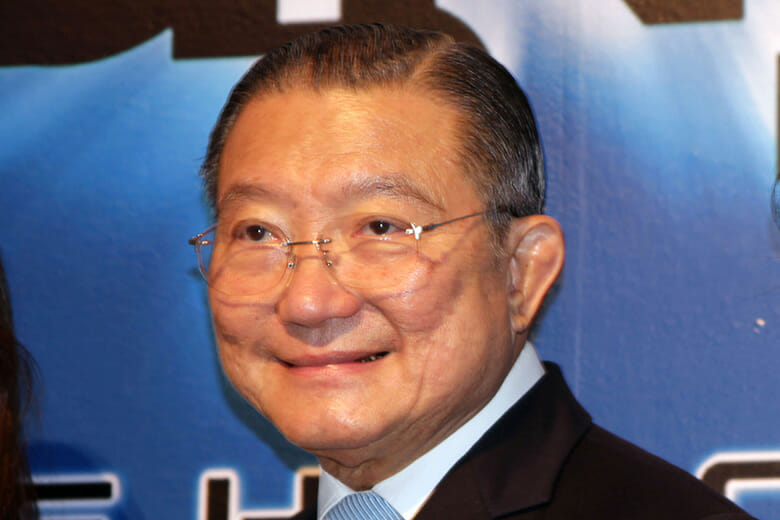

Frasers Property chairman Charoen Sirivadhanabhakdi (Getty Images)

Frasers said that the asset sale “is in line with the strategy of the Group to recycle capital as part of its ongoing active portfolio management initiatives, which enables the Group to unlock value from its assets and optimise capital productivity.”

The complex, which is adjacent to Frasers’ 455-unit Rivière condo project and next to the Grand Copthorne Waterfront Hotel, will continue to be managed by Frasers Hospitality under its Fraser Residence brand following completion of the transaction. The sales process for the transaction was managed by Savills, with representatives of the property consultancy declining to comment when contacted by Mingtiandi.

Referring to hospitality as one of its core business segments, Tuan Sing pointed to both a rebound in the industry and the geographic advantages of the riverfront complex as central to its investment rationale.

“The main attraction of this property is its location along the Singapore River, which is surrounded by an affluent River Valley enclave as well as being within a stone’s throw from the vibrant night life at the Clarke Quay and Robertson Quay precincts,” Tuan Sing said in the statement.

The company’s current hospitality portfolio includes the Grand Hyatt Melbourne and Hyatt Regency Perth hotels, as well as Opus Bay, a development on Indonesia’s Batam island, off the coast of Singapore, which will include hospitality and luxury hotel elements.

Hospitality Assets Continue to Trade

Tuan Sing is picking up the serviced apartment complex as hospitality assets continue to be in demand across Asia Pacific.

Trades of hotel properties jumped 36 percent in the fourth quarter of last year, compared to the same period a year earlier, according to MSCI Real Estate, with funds managed by CapitaLand’s Ascott division having acquired the Hotel G in Singapore from Gaw Capital for $180 million in January, with plans to reposition the property as a co-living space.

In February Weave Living and BlackRock teamed up to buy a Citadines serviced apartment complex around a block away from the Hotel G for $111 million.

Frasers, which last week announced that its profit for the half-year ending 30 March fell 82 percent from a year earlier to S$35.8 million ($26.4 million), already agreed to sell one hospitality property in March this year, inking a deal with a joint venture led by TPG Angelo Gordon to sell a serviced residence near Changi airport for $127 million.

Leave a Reply