FEC and Chow Tai Fook each own a 25% stake in the Queen’s Wharf Brisbane casino development

An A$3.6 billion ($2.3 billion) Brisbane casino resort backed by a pair of Hong Kong heavyweights has secured financing that allows the controversial development to press ahead despite opposition from preservationists and design groups.

Australian gambling and entertainment company Star Entertainment Group, which has teamed up with David Chiu’s Far East Consortium and New World Development chairman Henry Cheng’s Chow Tai Fook Enterprises to develop the 27.5 hectare (68 acre) riverfront project, said in an announcement on Friday that it had secured A$1.6 billion in debt to fund the project.

While not disclosing details of the financing, the ASX-listed company noted that the facilities had been agreed prior to the COVID-19 pandemic and that the funding reflects the more favourable terms available on the market at that time.

Star, which owns a 50 percent interest in the Queen’s Wharf Brisbane development while Chow Tai Fook and Far East Consortium share the remaining 50 percent equally, said that it will make its first drawdown on the credit facility in June before withdrawing a larger amount early next year to fund construction.

“Construction at Queen’s Wharf Brisbane is continuing, with the project remaining on time and on budget,” Star said in a statement.

Courting Controversy from Global Design Bodies

The project’s masterplan, led by US-based architectural firm Jerde Partnership, is set to be the biggest private sector development ever in Queensland, covering an area equivalent to almost a quarter of the city centre with a casino, five hotels, 50 F&B outlets, 2,000 apartments, and 40,000 square metres (430,556 square feet) of retail space.

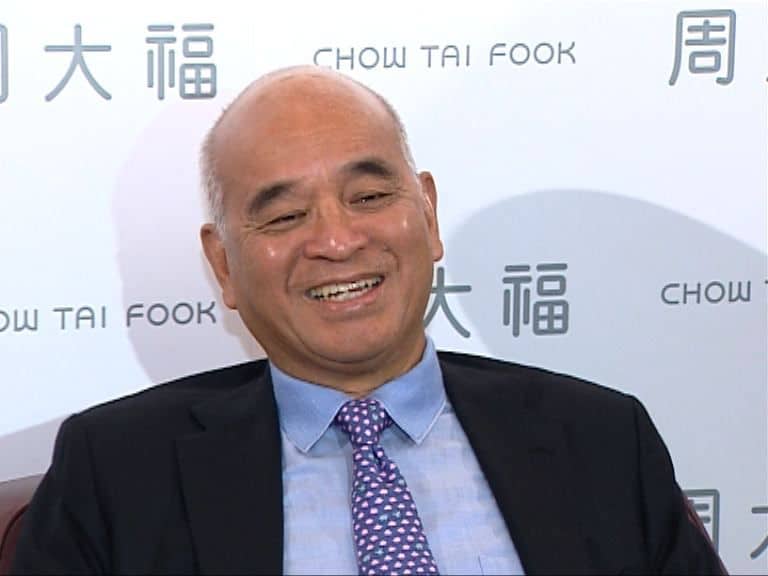

Chow Tai Fook’s Henry Cheng has a good feeling about his Brisbane mega-casino

With the scale of the project set to transform a historical part of the city riverfront – with roughly half of the development’s 386,660 square metres of gross floor area on land and the remaining portion projecting over water – the casino resort has been widely condemned by architectural and design groups.

The development in the Queensland capital encompasses the adaptive reuse of a number of heritage-listed government buildings including the former Treasury Building, the former Land Administration building, and the former state library.

When the masterplan was unveiled, Australia-based designer Richard Kirk, who serves as the national president of the Australian Institute of Architects, called its location in the city’s “oldest and most symbolic precinct” among Brisbane’s parliamentary buildings unsuitable.

At the same time that Kirk took his stance, the Australian Institute of Architects, together with the Australian Institute of Landscape Architects and the Urban Design Alliance jointly wrote to the government saying that the development would erase important parts of the city’s history.

Deepening Ties to Asian High Rollers

Star, Chow Tai Fook and FEC kicked off construction of the basement levels of Queen’s Wharf Brisbane in June last year, and have continued to press forward despite the pandemic.

The consortium – known as Destination Brisbane Consortium – was awarded the project in 2015 after shouldering off a competing bid from a joint venture between Shanghai’s Greenland Group and James Packer’s Crown Resorts when Star was still known as the Echo Entertainment Group.

The Brisbane financing milestone provides fresh fuel for the joint Brisbane efforts by the Aussie gambling operator and its Hong Kong partners after the group was stymied late last year in its efforts to launch a similar mega-casino in Sydney.

In November 2019, the three partners saw their joint bid to develop a A$530 million casino complex rejected by the Independent Planning Commission in the New South Wales capital after the planning body termed the 237-metre-tall tower, which was designed to feature a 220-room Ritz-Carlton hotel and 204 residential apartments, as “overtly obtrusive”.

Chow Tai Fook and Far East Consortium combined to invest A$490 million in Star in 2018, with each of the Hong Kong heavyweights buying just under a five percent interest each in the casino operator.

Leave a Reply