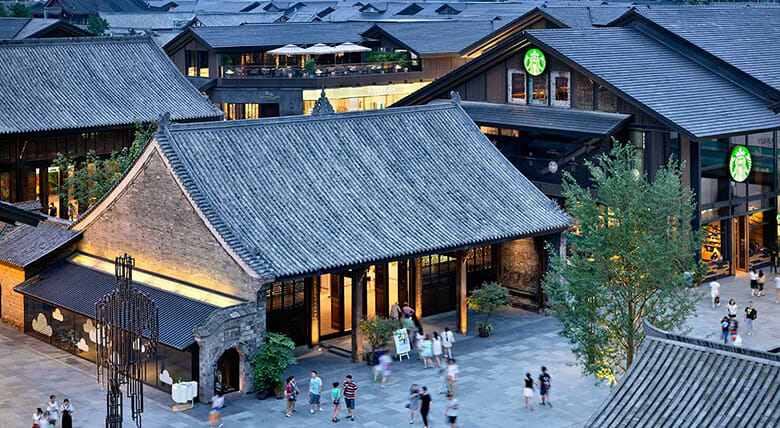

Sino-Ocean had sold its half-stake in a Chengdu shopping centre in December

Sino-Ocean Group is appealing to creditors for more time to meet payments coming due by 5 August on $1.8 billion in offshore bonds, according to a statement to the Hong Kong exchange late on Wednesday, as the mainland developer faces a continuing slide in its core housing business.

Ranked as China’s 25th-largest developer by sales, Sino-Ocean asked creditors to approve resolutions which would help it to avoid default by providing two additional months to make $50 million in interest payments due on separate sets of bonds maturing in 2024, 2027 and 2029.

“If the extraordinary resolution proposed by the 2024 Notes Issuer is not approved by holders of the 2024 Notes, an event of default under the 2024 Notes is likely to occur after 13 August 2023 (being the last day of the 14-day grace period for payment of interest accrued on the 2024 Notes from 30 January 2023 to 30 July 2023), cross-default provisions under the Guarantor’s other indebtedness (including the 2027 Notes and the 2029 Notes) may be triggered,” Sino-Ocean said in a statement.

On Tuesday, Sino-Ocean had said that it was requesting holders of a RMB 2 billion ($280 million) domestic bond due on 2 August to accept installment payments over the next year to stave off default. Having suffered a loss of $2.3 billion in 2022, Sino-Ocean’s attempts to avoid formal default comes after it had won a similar extension from investors for a separate set of bonds in May and despite discounted sales of trophy properties in Beijing and Chengdu over the past several months.

Deadlines and Commitments

With a two-week grace period still in place, Sino-Ocean bondholders have until 11 August to vote on the extraordinary resolution, the developer said. Should Sino-Ocean, which is 29.7 percent owned by state-owned insurer China Life, fail to win approval, it would likely suffer defaults and face restructuring, the company added.

Sino-Ocean chairman Li Ming

The statements by the Beijing-based builder included a consent solicitation sent to bondholders requesting delay of an interest payment due on Sunday for a $700 million bond maturing next year in addition to a separate appeal to extend the 4 August deadline for repaying interest on $500 million bond due 2027, as well as the 5 August target date for paying interest on a $600 million bond due 2029.

Under the resolutions, Sino-Ocean would have until 30 September to pay interest due on its 2024 notes, and until 4 October to pay interest on its 2027 notes, while the interest deadline on its 2029 notes would be pushed back to 5 October.

In early May the developer had won permission to delay payment of interest on a set of bonds which had been due 25 April until their maturity date in October. A report by Bloomberg on Thursday said that holders of another bond had been told to expect payment this week of previously delayed interest on two separate sets of bonds. Bloomberg pegged the company’s interest obligations due this quarter at $380 million.

In the developer’s annual report published in April, Sino-Ocean’s auditor noted that, “material uncertainty exists that may cast significant doubt on the Group’s ability to continue as a going concern and therefore, the Group may not be able to realise its assets and discharge its liabilities in the normal course of its businesses.”

Sino-Ocean faces $1.64 billion in bond obligations due by the end of this year and had cash on hand of just $811 million as of 31 December, according to its annual report.

Home Sales Slide, Assets Sold Off

In its statements, Sino-Ocean pointed to challenges in China’s housing market and tougher borrowing conditions as crimping its finances and restricting its ability to meet its bond commitments.

Sino-Ocean had disposed of the Ocean We-Life Plaza Beijing in May (Image: Sino-Ocean Group)

“Since early 2022, the Group experienced liquidity pressure due to adverse market conditions, which resulted in reduced operating cash inflow and limited access to external capital to refinance its existing indebtedness,” the company said.

Earlier this month Sino-Ocean announced that its contracted sales for the first half of the year totalled approximately RMB 35.66 billion and that it had achieved an average price of RMB 12,900 per square metre on those homes. That contracted sales volume represented a 17 percent drop from its performance in the same period of 2022 and was down nearly 32 percent from January through June of 2021.

During the first half of this year Sino-Ocean achieved an average price per square metre which was down 23 percent from last year and off 30 percent from its 2021 results.

Faced with a slumping housing market, Sino-Ocean in May agreed to sell the Ocean We-Life Plaza Beijing mall to Shenzhen-based retailer Easyhome for RMB 359.2 million. That deal was announced less than a half year after the company agreed to sell its half-stake in the Sino-Ocean Taikoo Li Chengdu shopping centre to its joint venture partner, Swire Properties, for RMB 5.5 billion.

In October of last year Sino-Ocean agreed to sell its 10 percent stake in the China Life Financial Centre office tower in Beijing to a pair of China Life subsidiaries for RMB 230 million.

In its Tuesday statement announcing the restructuring of its domestic bond, Sino-Ocean indicated that these asset sales have not been enough to meet its financial commitments.

“Since the first half of 2023, the Group has all along comprehensively arranged the repayment of public debts that are due during the year with the sales and operating plan, the feasibility of debts rolling financing and the asset disposal plan. However, the liquidity has not improved as expected.”

Leave a Reply