China’s developers are waiting for projects to get going again

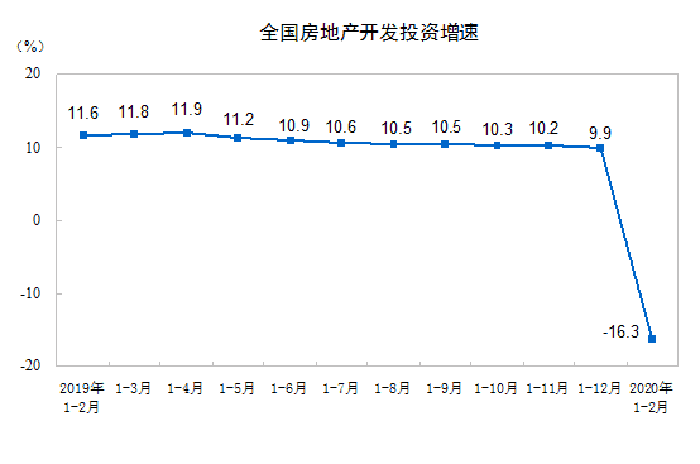

Real estate investment in mainland China collapsed over the first two months of 2020, recording its largest contraction since records began, according to statistics published today by the country’s National Bureau of Statistics.

The government agency said that overall property investment in China contracted by 16.3 percent in January and February, compared with growth of 7.3 percent in December.

The latest figures, which according to Reuters are the worst on record, reveal the impact of the coronavirus outbreak on the property market, with investment in real estate development nationwide falling to RMB 1 trillion ($140 billion) over the first two months of the year, compared with RMB 1.2 trillion for the same period in 2019.

Property Sales Plunge 39%

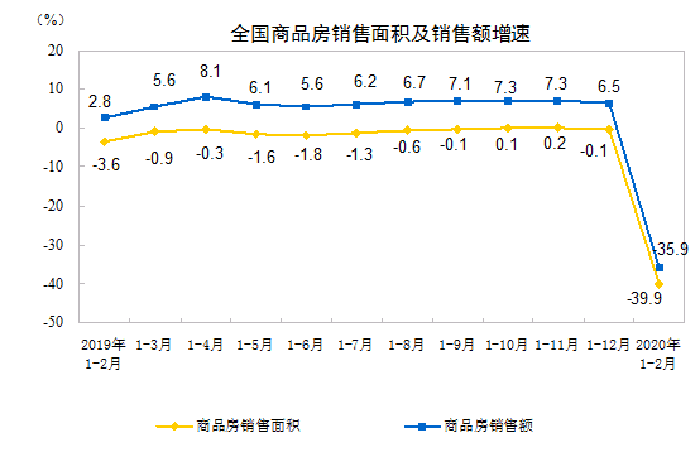

The NBS data, which groups the first two months of each year together to compensate for distortions due to the lunar new year holiday period, also revealed that real estate sales in China tumbled 36 percent in January and February, with developers selling only RMB 820 billion in new property during the period.

As measured by area, sales plunged 39 percent to 58 million square metres (624 million square feet) over the first two months of the year, compared with the same period last year.

China’s home sales growth took an abrupt turn this year

The latest data from the government agency comes as restrictions on movement to contain the coronavirus outbreak in mainland China this year, as well as regulations placed on businesses, have kept buyers at home and forced developers to close sales offices.

Developers Chase Sales with Huge Discounts

With homebuyers reluctant or unable to venture to sales offices, China Evergrande Group, the country’s third largest developer by sales, offered discounts of up to 25 percent on new homes while ramping up its Internet sales drive.

The company said in a stock exchange filing just under two weeks ago that, as a result of this push, its contracted sales for February reached RMB 44.7 billion – a jump of 108 percent from the same period last year.

New property investment saw its biggest drop ever

On the other hand, Country Garden Holdings – the country’s largest developer by sales – announced that the company’s contracted sales for February had halved compare to the same month a year earlier, due to the impact of the coronavirus outbreak to reach a total of just RMB 21 billion .

With the health scare squeezing business, developers shied away from borrowing new cash with real estate financing falling 17.5 percent in January and February compared with the same period last year, to reach just RMB 2 trillion in new loans and other borrowing, according to the NBS’ latest statistics.

New project starts, measured by area, fell 45 percent, while land acquisition volumes were also down, dropping 29 percent to 11 million square metres, with developers spending 36 percent less acquiring new sites than they had during the same period last year.

Returning to Work After a Collapse

Despite the scale of COVID-19’s impact on the property market, some market analysts have signalled that the worst may be over for the sector now that China’s National Health Commission has officially declared that the virus has passed its peak in the country.

“Broadly speaking, the peak of the epidemic has passed for China,” said Mi Feng, a spokesman for the National Health Commission, told Reuters last week.

Hong Kong-based analytics firm Real Estate Foresight said in a research note today following the release of the latest NBS figures that should “relative normality” return to China’s property market by the end of March, the expectation would be a major but non-structural short-term hit to the housing market.

Leave a Reply