Shanghai’s Jinmao Tower

Hong Kong-listed developer China Jinmao announced to the stock exchange on 27 July that it has agreed to sell a combined stake of nearly 25 percent of the company to Ping An Life and New China Life Insurance for a total of HK$8.67 billion ($1.1 billion).

The share sale, which is being accomplished through a pair of separate transactions for new and existing shares, would make Ping An the second-largest shareholder in the commercial property subsidiary of state-owned Sinochem Corporation at a time when tightening credit conditions and a slowing economy are putting a strain on many mainland developers.

For Ping An Group, which by some measures is China’s largest insurer, the investment comes five months after the Shenzhen-based financial conglomerate became the second-largest shareholder in Beijing-based China Fortune Land Development.

Ping An and Sinochem Trade Stakes

Under the terms of the share sale agreement, Sinochem Group, which is Jinmao’s largest shareholder, will sell 1.787 billion newly issued shares to Ping An at just over HK$4.81 per share for a total consideration of just less than HK$8.6 billion. The share price represents a discount of approximately 0.61 percent to Jinmao’s closing price of HK$4.84 per share before trading was halted before the share sale announcement and a discount of approximately 0.79 percent to the average closing price of approximately HK$4.849 on the last 10 trading days.

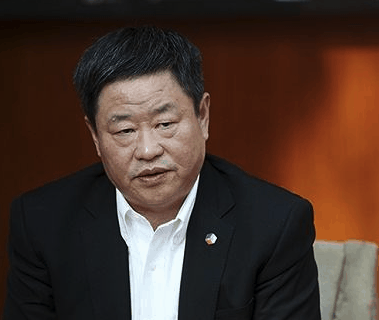

Ning Gaoning, chairman of China Jinmao

The transfer of the 1.787 billion shares, representing 15.42 percent of the existing issued share capital and 15.20 percent of the issued share capital of the company as enlarged by the subscription, would make Ping An China Jinmao’s second largest shareholder after Sinochem.

At the same time that Ping An purchased the shares in Jinmao, the developer, through Sinochem, conditioanlly agreed to purchase 153 million newly issued Ping An shares at the parallel price of just over HK$4.81 per share.

In the same announcement which revealed the Ping An investment, China Jinmao, Sinochem and New China Life Insurance indicated that the three parties had entered into a separate agreement for Sinochem to sell 15.56 million of its existing shares in the developer to New China at the same price of HK$4.81 per share, for a total consideration of HK$74.85 million.

Upon completion of the deals, Sinochem’s total holding in China Jinmao will be reduced to 35.1 percent from the previous 49.71 percent, with Ping An holding a 15.2 percent interest and New China Life Insurance 9.18 percent.

Jinmao Seeks New Capital Sources

China Jinmao, which is best known for Shanghai’s Jinmao Tower skyscraper, explained in the statement that the share sales are being undertaken to supplement the group’s funding of its expansion. The developer, which ranked the China’s 18th largest builder by sales in the first half of 2019, added in its filing that it intends to use the estimated net proceeds from the subscription of approximately HK$814.6 million as general working capital for the group.

According to the company’s 2018 financial report, as at 31 December 2018, China Jinmao had cash and cash equivalents on hand of RMB 21.32 billion. At the same time, the group had total interest-bearing bank and other borrowings of RMB 87.97 billion, with approximately RMB 21.976 billion repayable within one year.

Between May and June this year, China Jinmao sold eight project companies, according to the local media, with more disposals on apparently on the way.

On 12 June, a notice from the Beijing Equity Exchange showed that China Jinmao planned to transfer a 28.56 percent stake in a Beijing subsidiary for RMB 530 million after the project in China’s capital racked up overdue interest payments of RMB 19.14 million.

Last week, China Jinmao announced the completed issue of $500 million in senior notes due in 2029, and on 18 July the company disclosed in another filing to the Hong Kong Stock Exchange that the China Securities Regulatory Commission had approved its issuance of domestic corporate bonds of RMB 2 billion. Jinmao said in the statement that it intended to use the proceeds from the issue of the new notes for repayment of loans.

Ping An Expands Real Estate Investments

Ping An, China’s most valuable insurer, was the first of the country’s insurance giants to respond to the China Banking Regulatory Commission’s call on 28 January this year for insurance funds to “increase holding of top public listed companies.”

In February, Ping An increased its stake in top ten mainland builder China Fortune Land Development (CFLD) to 25.25 percent in a deal worth just over RMB 4.2 billion. That investment came less than seven months after it acquired nearly one fifth of the group to become its second largest shareholder.

Leave a Reply