China Evergrande’s name has lost some value in recent weeks

Moody’s Investors Service has downgraded the credit-worthiness of China Evergrande Group and three of its subsidiaries, dealing a fresh blow to the mainland’s most indebted developer.

The agency slashed the corporate family ratings for Evergrande and its principal domestic unit, Hengda Real Estate Group Co Ltd, by two notches to Caa1 from B2, according to a report issued Monday, as the financial information provider added to a cascade of bad news regarding the company.

“The downgrades reflect Evergrande’s heightened refinancing risk over the coming 12-18 months given its weakened funding access and liquidity position,“ said Cedric Lai, a Moody’s vice president and senior analyst. “We also expect its profit margins to decline as the company lowers the selling prices of its properties to preserve liquidity.”

The action by Moody’s comes as more of Evergrande’s creditors have taken to China’s courts to pursue repayment of past-due bills and the developer scrambles to raise cash through asset sales.

Trouble On-Shore and Off

In addition to the downgrade for Evergrande Group and its mainland entity, Moody’s marked down to Caa2 from B3 the corporate family rating of Tianji Holding Ltd, which serves as Hengda’s overseas financing platform.

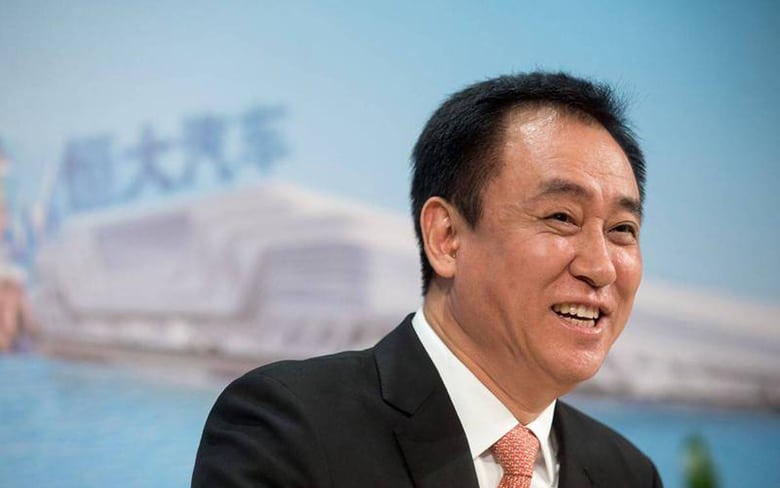

Evergrande’s Xu Jiayin is battling creditors in court

Evergrande’s senior unsecured ratings were cut to Caa2 from B3, while another offshore financing vehicle, Scenery Journey Ltd, saw its backed senior unsecured ratings fall to Caa2 from B3.

Moody’s changed the outlook for Evergrande’s corporate universe from ratings under review to negative, reflecting the agency’s expectation that the developer’s liquidity profile will remain weak over the next 12-18 months.

The latest demotions by Moody’s were the second in as many months for the Shenzhen-based company led by billionaire Xu Jiayin, and they came as reports surfaced that two more suppliers were taking action against the company over unpaid bills.

Creditors Revolt

Reuters on Tuesday said ad agency Leo Group was applying to a Chinese court to freeze RMB 356 million ($55 million) in assets of Evergrande for overdue payments. Meanwhile, Langfang Development said a court had ordered Evergrande’s shares in the company to be frozen for three years after a ruling on a lawsuit between Evergrande and an investment company.

Lets Holding, a construction R&D company, said in a weekend securities filing that it had not ruled out taking legal means to resolve Evergrande’s overdue commercial paper of RMB 33 million, according to Reuters.

Bloomberg had reported last Friday on a lawsuit filed against Evergrande in Anhui province by Huaibei Mining Holdings, which alleged that a subsidiary of the group had missed payments.

Huaibei Mining is demanding RMB 401 million for fees and breach of contract, while another company, Peace Tree Wood, said Evergrande has missed payments on RMB 2 million in commercial bills.

Future Imperfect

Moody’s said Monday that Evergrande would need to focus on generating internal cash to repay its maturing debts and fund its operations in 2021.

In the first half of 2021, the group’s contracted sales grew by 3 percent year-on-year to RMB 356.8 billion, the agency noted, but the average selling price fell to RMB 8,295 per square metre, compared with RMB 8,945 per square metre in 2020 and RMB 10,281 per square metre in 2019.

Moody’s expects Evergrande’s debt leverage to improve over the next 12-18 months as the developer reduces spending on land and controls debt growth.

According to an annual financial statement released at the end of March, Evergrande reduced its total debt by 14 percent in the second half of last year to RMB 717 billion as of 31 December. By the end of March, those obligations had been shrunk still further to RMB 674 billion.

The company has said it will further tame its balance sheet in the years to come, with a goal of bringing total debt down to RMB 350 billion by mid-2023.

Leave a Reply