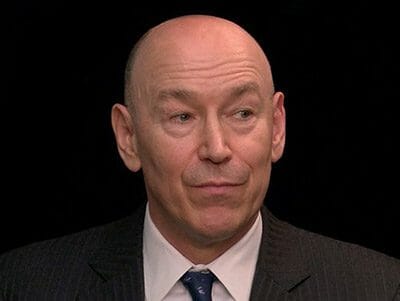

Tom Delatour’s Century Bridge completed its second China exit in six months

Century Bridge Capital has exited from its second joint venture with partner Jingrui Holdings, selling a stake in a $122 million residential project in mainland China it purchased just over a year ago, according to an announcement this week by the company.

The Texas-based private equity investment firm bought into the project in the port city of Ningbo in Zhejiang province in March 2016, investing $11.5 million from its second China real estate fund, according to a report by real estate industry publication PERE.

Betting on Housing for China’s Rising Middle Class

Still under construction, the 840-unit, 90,139 (970,256 square foot) development is located close to a hub of new commercial development in Yinzhou district, part of Ningbo’s urban core. The area is “a mature submarket with significant growing, unfulfilled demand for middle-class housing,” Century Bridge CEO Tom Delatour stated at the time of the acquisition last year. In a conversation with Mingtiandi, Delatour indicated that nearly all of the units in the project have already been sold.

Century Bridge, which has offices in Beijing and Dallas, Texas, partners with mainland builders to invest in middle-income housing in China’s second-tier cities. Active in China since 2008, the company has ongoing projects in Hangzhou, Wuhan, Zhongshan and Dalian.

The investment firm is betting that the seismic trends of urbanization and middle-class growth in China will sustain demand for reasonably priced housing in the country’s second-tier cities. The central government wants 60 percent of the population to be living in cities by 2020, rising from the 56.1 percent urbanization rate reported last year.

Century Bridge Eyes Further Projects in China

Century Bridge previously teamed up with Hong-Kong listed Jingrui on a residential project in the eastern Chinese city of Wuxi. Last December, the private equity shop sold its 43.24 percent stake in that 1,694 unit development to Jingrui for $41.8 million.

Rendering of Jingrui’s under-construction housing complex in Ningbo

“A critical and differentiating component of our strategy is to have our team of locally based real estate professionals work together with experienced Chinese joint venture partners,” Century Bridge CEO Tom Delatour said in a statement following this most recent transaction.

Shanghai-based Jingrui is a developer of residential and commercial properties in the mainland. In addition to its deals with Century Bridge, the company has also received backing from investor Richard Ong’s RRJ Capital.

For its first project with Jingrui in Wuxi, Century Bridge deployed capital from its debut real estate fund, which it closed in 2012 with over $170 million committed by large global investors. The follow-up Century Bridge China Real Estate Fund II, targetting total investment of $400 million, held a first close of $59.7 million in September 2015, according to filings with the US SEC.

Leave a Reply