US private equity firm Blackstone has reportedly agreed to buy the 50,000 sqm Huamin Imperial building in Shanghai’s Jing An District, according to a source familiar with the transaction.

On Friday, Blackstone CEO Stephen Schwarzman, had told reporters that the firm had committed to buy a Shanghai office building, however, the property was not named at the time. Later, a confidential source revealed that the asset to be acquired is the Huamin Imperial.

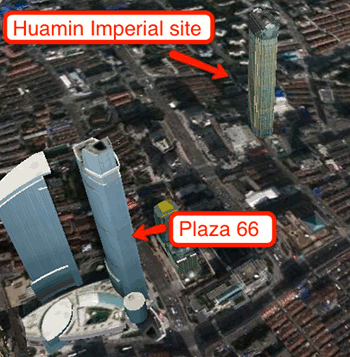

The Huamin is a grade A office and 5-star hotel project, which is currently 95 percent complete. Blackstone plans to complete the project and begin leasing it out. The building is located on West Beijing Road in Shanghai, near the intersection with Jiangning Road and close to the city’s well-known West Nanjing Road commercial district.

Media reports put the value of the Huamin Imperial project at RMB 7 billion. At one point the project was intended to include a Sofitel Hotel, however, no mention of the hotel brand was included in media reports of the sale transaction.

Commenting on the purchase from Blackstone’s Hong Kong office, Schwarzman said, “It’s a situation that became available as a result of some of the pressure among real estate developers that’s occurring in China,”

Schwarzman also indicated that Blackstone, which manages $205 billion in assets to become more active in Asian markets.

In a Reuters report on the deal, Antony Leung, Blackstone’s Greater China chairman and former Hong Kong financial secretary, was quoted as saying, “We are going to be a bit more aggressive, particularly on real estate.”

Blackstone’s latest real estate fund is worth more than US$13 billion, making it larger than most of its rivals.

[…] Group L.P. (BX.N) bought the 50,000-square-meter Huamin Imperial office tower and 5-star hotel complex in Shanghai during October last year. The Blackstone purchase has been […]