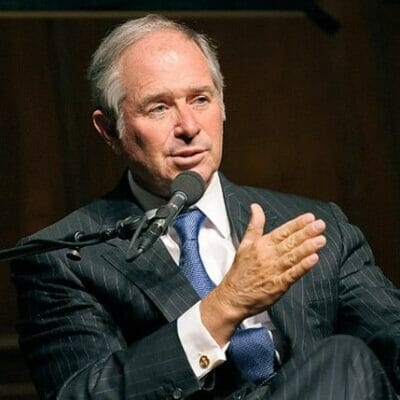

Blackstone Chairman & CEO Stephen A. Schwarzman is looking to up his firm’s investments in Asia

US private equity giant Blackstone is reportedly planning to ramp up its presence in Asia by raising up to $3 billion for its first buyout fund focused on the region. According to sources cited by Reuters, Blackstone Group LP has informed its limited partners about the planned vehicle and is aiming to receive the first tranche of investment by the end of this year.

The new fund will primarily target opportunities in China, India, Southeast Asia, Australia, and Korea and may also invest in Japan, according to a source. The vehicle will aim to buy controlling or significant minority stakes in a range of sectors including healthcare, high-end manufacturing and services, and consumer goods and services.

Takeover Fund Follows News of $5B Real Estate Vehicle

The size of the takeover fund has not yet been finalised and could top $3 billion, according to the report. About 40 percent of the Asia-focused fund’s investments will come from Blackstone’s global private equity fund, which has previously focused on investments in the US and Europe.

The news of the new buyout fund follows soon after sources revealed in January that the world’s largest alternative asset manager is preparing to launch an Asia-focused fund of at least $5 billion targeted at retail and warehouse assets in China, India, Southeast Asia and Australia. At the time, the fund was said to be on the way within 12 to 16 months.

Asian Fundraising Rally to Give Blackstone a Boost

Blackstone’s new fund is poised to ride a regional wave of private equity fundraising this year. According to data provider Preqin, Asia-focused private equity funds have gathered a total of $32.5 billion so far in 2017, nearly 80 percent of the $42.5 billion raised in all of 2016.

Among other private equity players, New York-based KKR closed its third Asia-focused buyout fund last month after amassing $9.3 billion, a record for the region. San Francisco’s TPG Capital Management was reported last September to be seeking more than $4 billion for a new Asia fund, which has not yet closed. Private equity heavyweights Carlyle Group and Savills Investment Management are also preparing billion-dollar Asia-focused vehicles.

Gaw Capital’s Goodwin Gaw is among the region’s private equity heavyweights

In the property sector, Hong Kong’s Gaw Capital closed its largest fund to date, Gateway Real Estate Fund V, this past April at $1.3 billion with a sidecar co-investment of up to US$500 million. The private equity real estate firm’s new vehicle will target property assets mainly in gateway and secondary cities in Greater China, with selected investments in Japan, South Korea, Southeast Asia and Australia.

US PE Giant Deepens Its Asia Presence

Blackstone’s planned Asia fund would mark another milestone in the region for the world’s largest real estate manager. The firm’s private equity investments in Asia previously came from its global funds, including Blackstone Capital Partners VII, an $18 billion global buyout fund closed in 2015.

Blackstone funds have invested in companies in India, New Zealand and Australia over the past three years, including commitments of more than $1.5 billion in India since 2015. The private equity behemoth led a consortium to buy Chinese outsourcing firm Pactera Technology International in 2014, which it sold to a unit of Hainan-based HNA Group for around $675 million.

The firm headed by Stephen A. Schwarzman is also reportedly in talks to acquire a $525 million, 11-portfolio India real estate fund, adding to Blackstone’s $3 billion of property investments in the country. Further east, Blackstone last month made a S$900.6 million ($651 million) acquisition offer for Croesus Retail Trust, a Singapore-listed business trust comprising a portfolio of 11 Japanese shopping malls.

Strong gains in real estate, which accounts for 28 percent of Blackstone’s total business, gave the company an earnings lift in the second quarter. Blackstone announced an economic net income of $705 million for the quarter, or 59 cents a share, up 36 percent from the previous year. Earnings were buoyed by major transactions including the sale of European logistics portfolio Logicor to sovereign wealth fund China Investment Corporation for €12.25 billion ($13.82 billion), which was confirmed in June.

Blackstone currently has a total of $371 billion worth of assets under management as of June 30, including $100 billion of private equity assets and $104 billion of real estate.

Leave a Reply