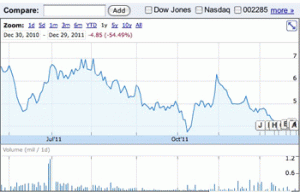

CRIC which sells data on China’s residential real estate market (and to a lesser extent on the commercial market) to subscribers, has suffered shortfalls in revenues and a continual slide in its share price as institutional investors and market speculators have lost their taste for China’s residential property market. Now E-House, which already owns 54.1 percent of CRIC, is preparing to buy back the outstanding shares after it recently increased the cash component of its buy-back offer. According to a press release circulated via NASDAQ.com this week,

China’s real estate services firm E-House (China) Holdings Ltd. (EJ) Wednesday announced that it has agreed to acquire all the outstanding shares of its unit China Real Estate Information Corp. or CRIC (CRIC) for a sweetened fixed consideration of $1.75 cash and 0.6 E-House shares / American depositary shares for each CRIC share.E-House, which currently holds 54.1 percent stake in CRIC, has initially proposed a cash portion of $1.60 on October 28. The boosted offer values around 5.7 percent premium to CRICs’ closing on Nasdaq on Tuesday.Following the deal, Merger Sub, a newly formed limited liability company and a direct wholly owned unit of E-House will be merged with CRIC and CRIC will become a a privately held and wholly owned subsidiary of E-House. The deal is currently expected to close around the middle of 2012.

While there is a need for more reliable data on China’s real estate markets, CRIC never successfully moved beyond its roots in the residential market, and when the demand for this sector collapsed, it seems they were not able to make the adjustment.

Leave a Reply