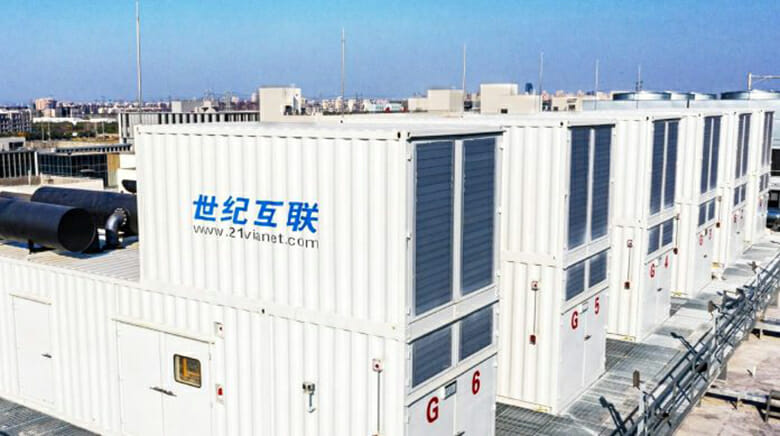

VNET operates more than 50 data centres across China

China’s VNET Group has received an unsolicited offer from two mainland companies to acquire all of the outstanding ordinary shares of the Blackstone-backed data centre developer, whose beaten-down stock exemplifies the recent woes of US-listed Chinese tech firms.

Investment manager Hina Group and the Shanghai branch of Industrial Bank proposed to pay $8 in cash for each of NYSE-listed VNET’s American depositary shares, equivalent to $1.3333 per ordinary share, Beijing-based VNET said Monday in a release.

That offer represents a 48 percent premium to the stock’s $5.40 closing price on Friday and a discount to the $11 per ADS implied by private equity giant Blackstone’s investment in $250 million worth of convertible notes earlier this year. VNET cautioned on Monday that its board had not made any decisions with respect to the proposal.

“There can be no assurance that any definitive offer will be made, that any agreement will be executed or that the proposed transaction or any other transaction will be approved or consummated,” VNET said.

Earnings Upside

The offer for the company and its over 50 data centres across more than 30 Chinese cities comes after VNET’s stock slid more than 77 percent over the past 12 months.

VNET founder Josh Chen

After peaking at $42.60 in February 2021, VNET’s ADSs have paralleled the descent of its US-listed competitors, Shanghai-based GDS and Beijing-based Chindata, as mainland authorities have pushed Chinese technology firms to abandon overseas stock exchanges, citing national security concerns over vital information infrastructure.

GDS ADRs have declined over 51 percent on the NASDAQ in the last year while Chindata’s equity has slid in value by more than 58 percent on the same exchange.

Blackstone’s latest bet on VNET followed the Manhattan-based firm’s acquisition of a stake in what was then known as 21Vianet Group, through a $150 million private placement announced in June 2020, with the investment convertible to ADSs at the price of $17 per share. The Chinese firm’s shares ended that month trading at close to $25 each.

Josh Chen, founder and executive chairman of VNET, said in January that the firm had accelerated the growth of its data centre footprint in high-demand locations across China’s Tier 1 cities during the past two years.

“Blackstone’s investment provides us with the capital to take advantage of a robust pipeline of attractive development projects that support our hyperscale and enterprise customers,” Chen said at the time of the 2020 investment.

That heavy-duty backing appeared to pay off last month when VNET announced a 28.2 percent jump in revenue to RMB 6.19 billion ($971.3 million) in 2021, with adjusted EBITDA surging 32.4 percent to RMB 1.75 billion ($275.2 million).

“For the full year of 2021, we met our annual guidance for cabinet delivery despite macro uncertainties and external challenges,” said chief financial officer Tim Chen. “Looking ahead, we will continue to explore various financing solutions to enhance the health of our balance sheet, capitalise on rapid growth in IDC demand, and generate increasing value for our shareholders.”

Unshaken Conviction

Blackstone is currently the second-largest institutional shareholder in VNET, behind London-based TT International Asset Management, according to public statements by the company.

VNET operates in more than 30 cities throughout China, serving over 6,000 hosting and related enterprise customers such as internet companies, government entities, blue-chip firms and small to mid-sized enterprises.

Although Beijing’s ongoing scrutiny of US-listed digital infrastructure firms has spooked investors, Jasvinder Khaira, a senior managing director with Blackstone’s Tactical Opportunities division, struck an optimistic note in January.

“Under the leadership of Josh and the management team, VNET has become one of the top data centre operators in China with a strong operating track record,” Khaira said then. “Data centres and the ongoing migration to the cloud are two of Blackstone’s highest conviction themes globally and we believe VNET plays an important role in the buildout of China’s digital new infrastructure.”

Leave a Reply