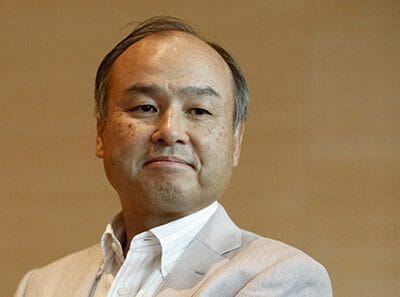

SoftBank CEO Masayoshi Son could become a player in the real estate market following the Fortress deal

Asia’s impact on the rest of the world is being underlined again today as one of Japan’s most aggressive investors announces that it is buying one of America’s best known private equity firms on the same day that a leading consulting firm warns that China’s capital controls could bring down the Aussie housing market. Also in the news – Chinese investors vote to remain in London’s property market following Brexit, and CSCEC discovers that building new capitals in the middle east might be a dodgy business. Read on for all these stories and more.

Softbank to Buy Fortress Investment for $3.3 Bil

SoftBank Group agreed to buy asset manager Fortress Investment Group LLC for $3.3 billion, in a surprising move that is part of an effort by the Japanese technology giant to transform itself into one of the world’s largest investment firms.

Fortress Class A stockholders are to get $8.08 a share, the companies announced late Tuesday after The Wall Street Journal reported on the deal. That is 39% above the closing price Monday, excluding dividends. The shares surged by about 6% Tuesday before word of the acquisition surfaced. Read more>>

KPMG Warns on Impact of China Capital Controls on Aussie Housing

China’s crackdown on capital outflows could hit the Australian property market, with private Chinese investors having potential problems settling on deals, KPMG’s China experts warned yesterday.

“There might be some problems in the residential real estate property markets in Australia and other centres where Chinese have been buying property,” KPMG’s head of financial services in China, Simon Gleave, told The Australian. Read more>>

Chinese Investors Bought Over $3.75B in London Property in 2016

While commercial real-estate deals in London have declined since Britain voted to leave the European Union, one group of investors has become increasingly active: the Chinese.

Investors from China and Hong Kong bought more than £3 billion ($3.75 billion) of central London real estate in 2016, less than U.K. investors but more than those from the U.S. or Europe, according to real-estate broker JLL. Read more>>

China’s CSCEC Pulls Out of Project to Build New Egyptian Capital

A disagreement over construction costs has caused Chinese state-owned firm CSCEC to pull out of a $3bn agreement to fund and build government offices in Egypt’s planned new capital city east of Cairo.

The ambitious scheme will instead be “built by Egyptian hands”, Egypt’s Housing Ministry said in a statement on 8 February, Reuters and local media reported. Read more>>

Fosun Seeks Funding for Overseas Tourism M&A

China’s Fosun is in talks with investors to raise funds for its tourism unit’s planned overseas acquisitions, looking to build up the business even as regulators closely scrutinize outbound transactions, the unit’s president said.

Fosun Tourism & Culture Group, a key profit growth business for China’s largest private conglomerate, is in discussions with domestic and international investors for its first round of capital raising to boost overseas investments ahead of a public listing, said Qian Jiannong. Read more>>

China’s Top Developers Look for More Land in 2017: Poll

Chinese real estate developers surveyed by Reuters mostly plan to increase their land investments in 2017 as they shrug off record prices and government tightening measures while seeking to expand their market share.

The 10 companies contacted by phone and messaging represent half of the top 20 Chinese developers and together have close to $300 billion in annual sales, mainly of apartments. Read more>>

Are Home Prices Now a State Secret? China Clamps Down on Real Estate Data

A private-sector data provider has quietly stopped publishing a widely watched barometer of China’s property market that was one of the few alternatives to an official gauge, leaving a hole in a government-dominated flow of information on the Chinese economy.

Beijing-based Fang Holdings, China’s largest online real-estate portal, has since at least 2010 published its compilation of home prices in 100 Chinese cities into a monthly index. The index usually shows sharper increases in China’s runaway property prices than the official index, despite several interventions by Beijing to control property prices in recent years. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter for headlines as they happen.

Leave a Reply