All credit goes to Wall Street Journal columnist Jacky Wong

The last working day in November sees one of Asia’s biggest homegrown private equity firms falling short in its bid to takeover a Hong Kong-listed REIT, while project owners in Singapore may be showing more confidence in the market as condo-owners in a mixed-use project in the city’s Bukit Timah region move forward with an attempt at a S$165 million collective sale and of course, there’s a lively debate of the risks involved with Chinese developer debt as bond yields soar. Keep reading for all these stories and more.

PAG Falls Short in Spring REIT Buyout Bid

Hong Kong-based PAG’s bid to buy Spring Real Estate Investment Trust fell through on Wednesday after it failed to secure the required acceptances from the realty firm’s unitholders.

Spring REIT’s shares opened 12.7 percent lower on Thursday morning, at HK$3.36, following the announcement after market close on Wednesday. Read more>>

India’s Lodha to Sell Pair of London Projects, Exit UK

India’s realty business giant, Lodha Developers will move out of the UK property market and is on its way to sell two of its residential projects in the central London for about Rs 42 billion (£465.80 million), according to a company official on Wednesday (28).

The decision to exit from UK’s real estate market is a part of the company’s strategy to cut debt and further strengthen its business. Read more>>

Godrej to Develop $215M New Delhi-Area Commercial Project

The Godrej group is stepping into the commercial real estate space in the National Capital Region in a joint venture with Hero Cycles Ltd, starting with a one-million sq.ft office and retail project. Located at Gurugram’s Golf Course Road, the project will come up at a four-acre plot owned by Pankaj Munjal-promoted Hero Cycles. It is expected to be completed in the next three years.

According to two people aware of the matter, who spoke under condition of anonymity, the development is likely to entail a total investment of around Rs 1,500 crore. Spokespersons of both the companies declined to comment on investment. Read more>>

Bukit Timah Mixed-Use Site on Market for S$165M

The owners of Beauty World Plaza are putting up the retail and residential development for tender with a reserve price of $165 million, marketing agent Knight Frank Singapore said yesterday.

The 2,305.6 sq m site in Upper Bukit Timah comprises a single block with 61 retail and 30 residential units. Read more>>

Freehold Project on SG’s Orchard Road to Launch This Weekend

Malaysia-based property developer YTL Land & development (YTL Land) is set to launch a 77-unit freehold condominium along Orchard Boulevard, with 53 apartments released for sale this Saturday, Dec 1.

Located at 3 Orchard Boulevard, 3 Orchard By-The-Park is a short walk to the Singapore Botanic Gardens and within the enclave of the Orchard Road shopping belt and amenities such as the Camden Medical Centre. The condominium is also situated next to the upcoming Orchard Boulevard MRT station. Read more>>

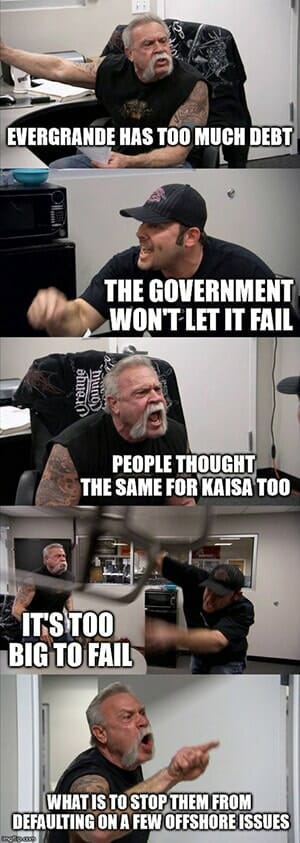

Evergrande Bond Sales Heighten Debt Concerns

A “frigid winter” is coming to China’s property market, and investors are wondering if the country’s largest developer will be caught out in the cold.

China Evergrande, which posted $45bn in sales in the year to the end of June but also carries the industry’s largest debt pile, raised eyebrows this month with a $1.8bn bond deal. To some, the 13.75 per cent coupon on the five-year tranche carried a whiff of desperation. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply