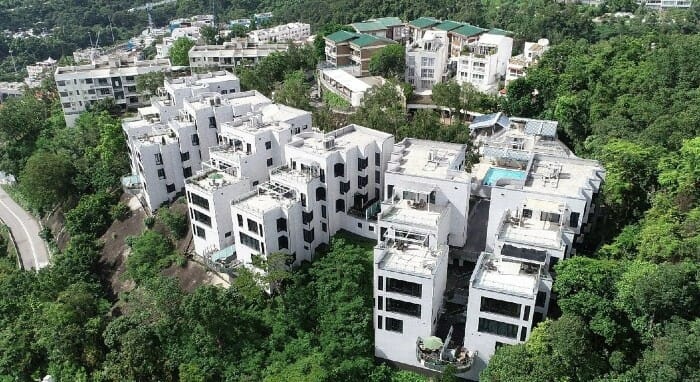

The US may be holding onto its Shouson Hill site for a bit longer

In Mingtiandi’s latest roundup of regional news headlines, Hong Kong approves the sale of a US consular property on Shouson Hill after resolving a diplomatic impasse, while Blackstone bigwig Stephen Schwarzman deals with a backlash over his political leanings.

Sale of US Property on Shouson Hill Moves Ahead

Hong Kong has approved the sale of one of the US government’s most valuable assets in the city to local developer Hang Lung Properties, after the US State Department obtained permission from Beijing.

The transaction, a multimillion-dollar thorn in the side of US-China relations, was confirmed on Thursday by Hang Lung, which said the seller had fulfilled diplomatic protocols and “now with the consent from the Central People’s Government of China, the transaction will proceed”. A US Consulate General spokesperson said on Thursday that the State Department was not at liberty to comment on the specific terms of ongoing contractual transactions. Read more>>

Schwarzman Scholars Push Blackstone Boss Over Insurrection

The private equity billionaire Stephen Schwarzman has spent many years financing educational programmes, from his old high school to the Ivy League.

But the Blackstone chief executive’s largess hasn’t always bought good will: there was swift opposition to his proposal to put his name on Abington Senior High School in Pennsylvania, and his close ties to former president Donald Trump contributed to opposition to having his name on a campus centre he funded at Yale. Read more>>

Roxy-Pacific Consortium Buys River Valley Road Site for S$33.6M

Mequity Hills, a new associate of property developer Roxy-Pacific Holdings, has entered an agreement to acquire a 999-year leasehold residential site at 10A and 10B Institution Hill for S$33.6 million ($25.4 million).

The site has an estimated total land area of 8,761 square feet (814 square metres) and a plot ratio of 2.8 under the 2019 Master Plan for residential development, Roxy-Pacific said in a Thursday bourse filing after the market close. Read more>>

DLF Rental Arm Acquires Hines Building in Gurugram for $107M

Realty major DLF’s rental arm DCCDL has completed the acquisition of the entire 52 percent stake of US-based Hines in a premium commercial project in Gurugram for INR 780 crore ($107 million).

In December, DLF announced that its joint venture firm DCCDL had entered into a securities purchase agreement with funds managed by Hines for acquisition of their stake in Fairleaf Real Estate, which owns and operates One Horizon Center. Read more>>

Keppel REIT Prices Private Placement at S$1.13

Keppel REIT’s private placement has been priced at S$1.13 ($0.85) per new unit, about midway of its indicative range, its manager announced in a bourse filing late on Thursday night.

That’s a 4.1 percent discount to the real estate investment trust’s volume-weighted average price of S$1.1783 for all trades done on Wednesday. Read more>>

Lodha Developers Files to Raise $344M Via IPO

Lodha Developers or Macrotech Developers is all set to raise INR 2,500 crore ($344 million) via an initial public offering in the coming months. The company filed the draft red herring prospectus or IPO documents with the market regulator on Tuesday.

The objective of the IPO is to use the proceeds for debt reduction, land acquisition and new projects. However, this will be the third attempt by the Mumbai-based real estate player to raise money through an IPO. Read more>>

Wheelock Boosts Kai Tak Project Prices by 5%

Wheelock Properties released 68 units in the first price list of Grande Monaco in Kai Tak, at an average price of HK$23,795 ($3,069) per square foot after discounts, about 5 percent higher than the first price list of the phase 1 of Monaco development.

The units measure between 351 square feet and 961 square feet (33-89 square metres). The cheapest unit, measuring 351 square feet, is offered at HK$7.66 million. Read more>>

Shapoorji Pallonji Sells Over 600 Pune Flats Worth $55M

Realty firm Shapoorji Pallonji Real Estate has sold over 600 units, worth about INR 400 crore ($55 million), in its new housing project in Pune as housing demand begins to recover. The real estate unit of Shapoorji Pallonji Group did not formally disclose the value of sales bookings, but sources vouched for the INR 400 crore figure.

In a statement, the company said it has “sold over 600 units in its newly launched housing project in Pune due to accelerated demand”. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply