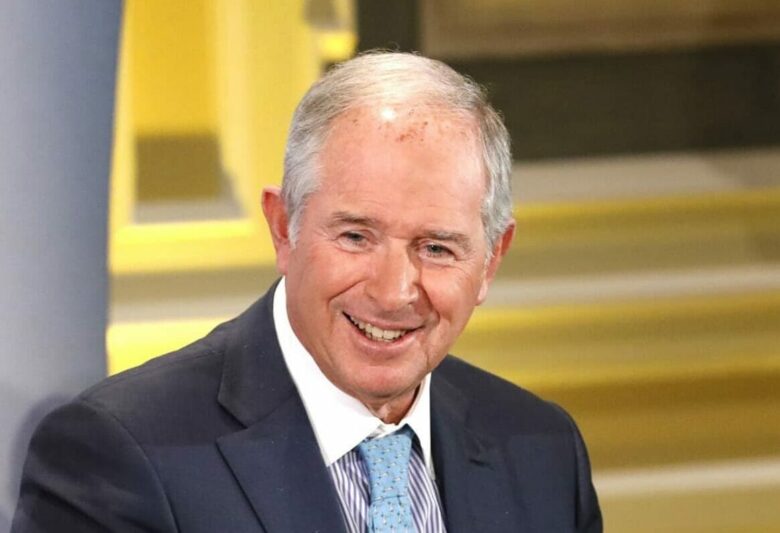

Blackstone boss Stephen Schwarzman may have some lightly used India assets to sell you (Getty Images)

Sovereign funds lead today’s roundup of real estate headlines from around the region as Blackstone is said to be in talks with potential buyers for some of the firm’s India holdings. Also making the news, Asia’s richest man sells his NYC condo and Singapore’s PM vows to keep the city’s public housing affordable.

GIC, ADIA Said Talking $4.5B India Deal with Blackstone

Sovereign wealth funds including Singapore’s GIC and Abu Dhabi Investment Authority (ADIA) along with two Canada-based pension funds are in talks to acquire Blackstone Group’s 50 percent stake in two separate commercial portfolios of Panchshil Realty and Salarpuria Sattva Group, said persons with direct knowledge of the development.

The deal is estimated to be concluded at an enterprise valuation of over $4.5-$5.0 billion. The Canada Pension Plan Investment Board (CPP Investments) and The Ontario Municipal Employees Retirement System (OMERS) are the pension funds that have evinced interest in picking up the stake in this commercial real estate portfolio spread across a total 26 million sq ft in India. Read more>>

India’s Ambani Said to Have Sold Manhattan Condo for $9M

Mukesh Ambani, the eminent Indian tycoon renowned as the wealthiest individual in Asia and a key strategic ally to India’s Prime Minister, Narendra Modi, has recently made a notable property transaction in Manhattan’s West Village.

Reports unveil that an entity associated with Ambani has successfully sold a luxurious residence at 400 W. 12th St., popularly recognized as Superior Ink, for $9 million. Read more>>

Singapore PM Vows to Keep Public Housing Accessible in National Day Speech

Singapore’s Prime Minister Lee Hsien Loong said he’s confident the city-state will stand strong as he seeks to move past a series of political scandals and persistent inflation.

Lee also signaled adjustments will be made to public housing, where the bulk of residents live, to keep them accessible and affordable for “all income groups.” The cost of living and property affordability has ranked in polls as major issues rankling the public. Read more>>

Japan’s Mori Unveils Tokyo’s Tallest Office Tower

Japan’s Mori Building unveiled Tokyo’s tallest office tower on Tuesday (8Aug), part of a sprawling business and residential complex that aims to capitalise on an investment boom in the world’s third-biggest economy.

At 330 metres, the Mori JP Tower anchoring the Azabudai Hills project is just slightly shorter than the iconic orange and white Tokyo Tower nearby. Due to open in November, the Mori JP Tower will have offices for about 20,000 workers and accommodations for 3,500 residents. Read more>>

Korea’s NPS Says Outsourced Deals Outstripped Direct Investments in 2022

South Korea’s National Pension Service (NPS), the country’s largest institutional investor, has seen its domestic equity holdings managed through outsourcing surpass those managed directly for the first time.

According to a disclosure by the NPS Investment Management on Monday, its investment in local stocks totaled KRW 125.37 trillion ($96 billion) at the end of December last year. Read more>>

Investors Bet on China’s State-Backed Developers Amid Market Turmoil

Investors betting on recovery in China’s battered property sector are favouring the stocks and bonds of state-backed firms that are more likely to benefit from government support, market participants said.

The hugely leveraged sector has been gutted by three years of measures aimed at curbing speculative price rises and reducing developer debt, and has seen a string of major names defaulting on bonds or otherwise in dire financial straits. Read more>>

Broker-Free Apps Take Aim at Singapore Residential Market

A handful of web-based property dealing platforms are sprouting up, touting themselves as one-stop shops connecting buyers and sellers without an agent as go-between. Armed with data tools, they aim to facilitate transactions directly, in a crowded marketplace where traffic is still largely controlled by real-estate agents.

The latest to jump into the fray is Kucing – Malay for “cat” – a peer-to-peer platform for residential property sales that cuts out real-estate agents completely. Read more>>

Hong Kong’s Fortune REIT Predicts Slower Growth

Fortune Real Estate Investment Trust is expecting slower growth in the second half of 2023 after its income available for distribution for the first half fell by 2 percent yearly to HK$447.7 million ($57.2 million), with distribution per unit falling 3 percent to 22.36 HK cents.

Revenue for the first six months of the year rose 4.7 percent yearly to HK$908.7 million, partly due to the absence of rental rebates during the period. The property trust had offered rental concessions to tenants during the fifth wave of Covid-19 a year ago. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply