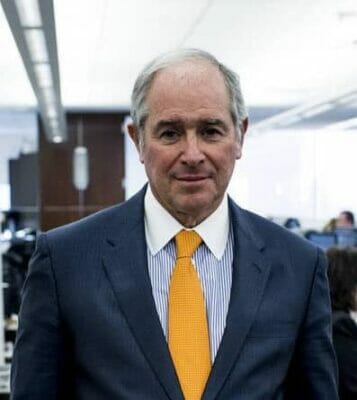

Blackstone’s Stephen Schwarzman is closing in on a set of Japanese retail properties

Leading the news today, Blackstone has moved another step closer to winning its quest for a Singapore-listed trust holding Japanese retail assets, while Angelo Gordon has made what could be Singapore’s biggest bulk buy of condos since the city slapped a stamp duty on overseas purchases. Keppel’s data centre REIT is also in the headlines with its second Dublin server shed, and there’s much more if you just read on.

Croesus Retail Trust Investors Approve Blackstone Offer

A majority of unitholders of Croesus Retail Trust on Wednesday morning (Sept 13) voted in favour of US private equity giant Blackstone’s S$1.17 per unit cash offer to privatise the trust.

In a statement to the Singapore Exchange, its trustee-manager Croesus Retail Asset Management said the trust deed amendment got the approval of unitholders holding in the aggregate not less than 75 per cent of the voting rights of all unitholders present at the scheme meeting. Read more>>

Angelo Gordon Buys 22 Singapore Condos From Alpha

In what is believed to be the first bulk transaction of residential units in a development following a tightening of stamp duty rules in March, American alternative investment manager Angelo Gordon has bought a stack of 22 units in the Draycott Eight condo for over S$100 million.

The units were sold by a fund managed by Alpha Investment Partners, a wholly owned subsidiary of Keppel Capital, the asset management arm of listed Keppel Corporation. Read more>>

Keppel DC REIT Buys Second Dublin Data Centre for S$101M

Keppel DC Reit said on Wednesday (Sept 13) it has acquired its second data centre in Dublin, Ireland, for Euros 66 million (S$101.3 million).

The B10 Data Centre has a long weighted average lease expiry (WALE) of approximately 11.0 years and is 87.3 per cent leased to a global internet enterprise, IT services and telecommunications clients. Read more>>

Shanghai’s Greenland Group Plans 3 Towers for Toronto Site

Greenland Group has filed for site plan approval for the first three towers at its FedEx Lands site at Lake Shore Boulevard East and Lower Sherbourne Street in Toronto’s growing East Bayfront area.

The development at 215 Lake Shore was first announced in May at the third anniversary party for the huge China-based developer’s Canadian arm. With the submission for site plan approval, we are learning more about the plans for the primarily residential buildings designed by Hariri Pontarini Architects. Read more>>

China’s Development Giants Snatch Up Smaller Players

Mainland China’s real estate market is consolidating fast, as bigger developers acquire smaller rivals in at effort to build up their land banks and grow market share, as it continues to get tougher to acquire prime government plots, amid tighter policy controls, according to a new report from PwC.

In the first half of 2017, domestic real estate merger and acquisition (M&A) activity in the sector remained vibrant, as successful bidding prices soared to US$44.6 billion, up 78.5 per cent year on year, said the accounting major. By volume, there were 207 deals recorded, a 24.7-per cent rise. Read more>>

Mainland Tech Startups Tackle Parking Headaches

Commuting by car can test the patience of anyone living in China’s major cities. “It’s such a headache to find a parking space downtown, and it’s been this way for a while,” said Zhang Jun, a 27-year-old finance executive who drives across the river that divides Shanghai for work.

With China’s 300 million-and-counting vehicles crowding streets and exacerbating the problem, a handful of technological tools have emerged to help people like Zhang quickly find a place to park. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply