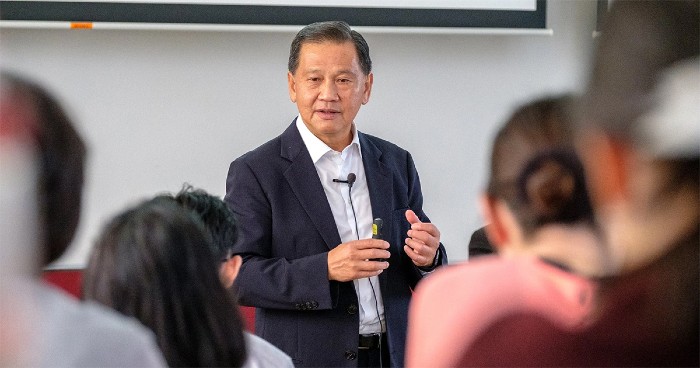

Changi Chairman Liew Mun Leong learned some new lessons this past week

A modern rendition of Shakespeare in Singapore reached a new stage this week when a prince of the Temasek realm finally relinquished his titles as an investigation progresses into possible false theft complaints against a domestic servant, with both Changi Airport Group and consulting firm Surbana Jurong thanking their former boss for being a great guy after he refrained from filing any police reports about them.

Also in the news, e-commerce giant Amazon may have found a partner in India, and is willing to pay $20 billion to seal the deal, and Tiktok owner Bytedance is ready to build a data centre in Singapore as it expands in Southeast Asia.

Changi Airport Picks New Boss as Chairman Steps Down in Maid Abuse Scandal

The Changi Airport Group (CAG) has appointed veteran public servant Tan Gee Paw as its acting chairman following the resignation of Mr Liew Mun Leong, the Ministry of Finance (MOF) said on Thursday (Sept 10).

Mr Tan, who was chairman of national water agency PUB from April 2001 to March 2017, has been a director on CAG’s board since May 2017. His previous appointments include principal of Ngee Ann Polytechnic, permanent secretary for environment and special advisor to the Land Transport Authority. Read more>>

Amazon May Take $20B Stake in India’s Reliance Retail

With India becoming the linchpin for global growth for retailers and tech companies, Indian conglomerate Reliance Industries is reportedly ready to sell to Amazon (NASDAQ: AMZN) a 40% stake in its Reliance Retail Ventures that would be worth as much as $20 billion.

The two have been in negotiations since this summer, when it was reported Amazon was interested in a 10% piece of the business. Read more>>

TikTok Owner to Spend Billions in Singapore after US Ban

ByteDance, the Chinese owner of video-sharing app TikTok, is planning to make Singapore its beachhead for the rest of Asia as part of its global expansion, according to people familiar with the matter.

The Beijing-based company is looking to spend several billion dollars and add hundreds of jobs over the next three years in the city-state, where it has applied for a licence to operate a digital bank, said the people, who asked not to be identified because of confidentiality. Read more>>

Ascendas Reit Prices S$300M Green Perpetual Securities

Ascendas Real Estate Investment Trust (Ascendas Reit) has priced its S$300 million (US$219.17 million) green subordinated perpetual securities, the first such issuance in Asia.

The green perpetual securities, issued under Ascendas Reit’s S$7 billion euro medium-term securities programme, will have an initial rate of distribution of 3% per annum. The first distribution rate reset will fall on September 17 2025 with subsequent resets occurring every five years thereafter. The distribution will be payable semi-annually in arrears on a discretionary basis. The order book was in excess of S$725 million, considered good at final price guidance, across 57 accounts. Read more>>

Mysterious Foreign Buyers Boost Singapore Housing Market

Singapore’s property market is enjoying a sudden lift in an economy mired in recession. A category of buyers labelled as “foreigners, unspecified”, possibly including mainland Chinese, are behind the resurgence.

Sales of new non-landed homes, typically referring to flats and condominiums, rose for a fourth straight month to 1,233 units in August, according to data compiled by OrangeTee & Tie, based on statistics released by the Urban Redevelopment Authority. The volume is the highest since July 2018. Read more>>

Lendlease Eyes Tech Talent for $40M Product Development Centre

A $40 million product development centre will be set up in Singapore next month and will hire 50 tech employees for a start, announced international property group Lendlease yesterday.

The centre will employ 50 technology software application development employees over the next 12 months and will continue to expand the team in the following years. Read more>>

SHK Banks on Reversal of Covid Measures to Revive Retail, Hotel Businesses

Sun Hung Kai Properties, Hong Kong’s biggest developer by market value, is banking on easier Covid-19 containment measures to help revive its stricken retail and hotel businesses and pull the city’s economy out of recession.

The group has suffered this year because of restrictions in movements, and its earnings outlook remain uncertain in the medium term, chairman and managing director Raymond Kwok Ping-luen said. Its recovery will depend on the state of pandemic and measures to reopen cross-border travels, he added. Read more>>

US Proptech Startup to Launch in Singapore Despite Uncertainty

Despite COVID-19 looming over the world, disrupting businesses and delaying launches, San Francisco-based startup OneRent is set to launch its property management platform in Singapore.

However, this is not the first time the company made an entry to Asia, the startup already has a fully remote team working from the Philippines. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on Twitter, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply