Chinese billionaire Wang Jianlin late last week was reportedly ready to sweeten a $4 billion offer to take private his Hong Kong-listed developer, Dalian Wanda Commercial Properties.

If a recent survey of Mingtiandi readers is a reliable indicator, however, the tycoon often reckoned as China’s richest man may be wasting his time with his plan to re-list his mainland mall building colossus on a mainland stock exchange.

Mingtiandi Survey Measures Mood of Real Estate Equity Analysts

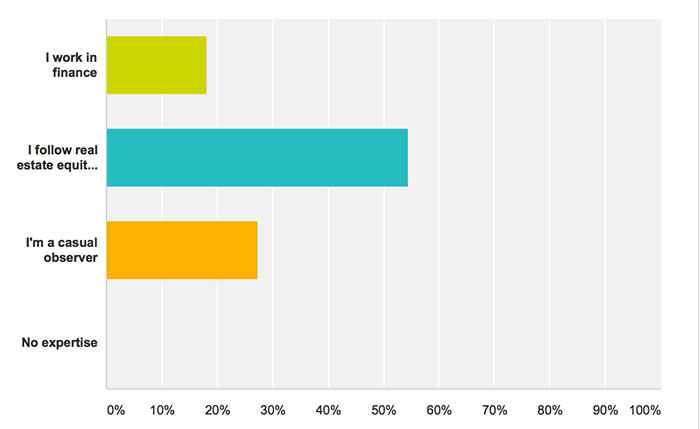

In an open survey distributed to Mingtiandi readers via its email newsletter and website starting on April 24th, we asked readers to explain their own understanding of the market in general, and re-listing plans by Wanda as well as a rumoured re-listing scheme by competing developer Evergrande Real Estate. The poll gathered more than 20 responses from finance professionals in the region.

Real Estate Equity Analysts Respond to Survey

Of the survey respondents, over 54 percent said they follow real estate equities as an investor or analyst, and altogether more than 72 percent reported that they are finance professionals.

Do you have professional expertise regarding Asian-listed property developers?

Why Wanda Wants to Re-list

Wang Jianlin has said that his company would like to re-list because it is not being appropriately valued on the Hong Kong exchange, where Wanda Commercial Properties shares slid from its December 2014 IPO price of HK$48 per share to just HK$31.55 per share before news of the company’s privatisation plan hit the markets in March.

Industry analysts, however, have suggested that Wanda’s management may be attracted by the lower level of regulatory scrutiny on the mainland, or by political pressure from the Chinese government to have mainland giants listed on local exchanges.

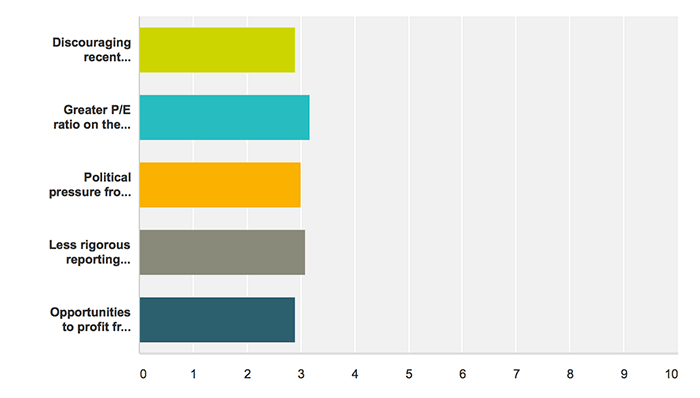

Why is Wanda de-listing in HK in favor of the mainland?

Respondents were asked to rank the most likely reasons on a scale from 1-5 with 1 being most likely. Values shown are averages across respondents.

Mingtiandi’s readers were fairly evenly split in their estimations of Wanda’s potential motives for bringing its listing to the mainland.

Interestingly, respondents believed that political pressure from mainland authorities and less rigorous accounting standards were more important as a motivation than Wanda’ professed interest in improving its P/E ratio.

Gaining Better Access to Capital on the Mainland

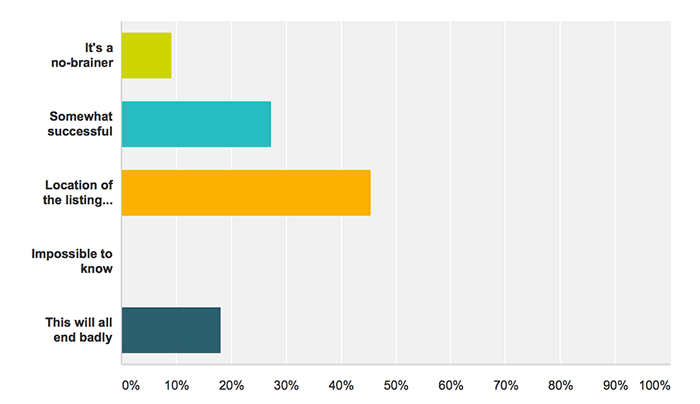

Regardless of the motives for re-listing, Mingtiandi’s readers were skeptical of Wanda’s chances to achieve its stated valuation goals by relisting on a mainland exchange.

Wang has predicted that Wanda could achieve a price to earnings ratio of 20 times if listed on a mainland exchange, compared to the 9.3 times that it was achieving in Hong Kong, according to the company’s investment proposal.

However, more than 45 percent of Mingtiandi’s readers expected Wanda to achieve little long term boost in its access to capital via a mainland listing and another 27 percent said that the company is likely only to be somewhat successful in reaching its valuation goals.

How successful is Dalian Wanda likely to be in gaining improved access to capital through a mainland listing?

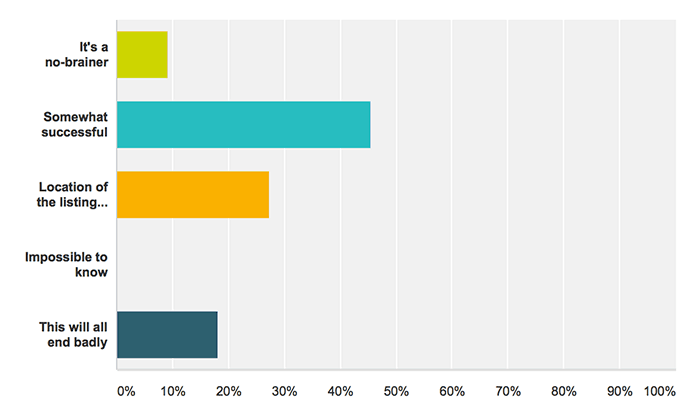

Evergrande Given Better Chances

Evergrande, which is currently China’s most indebted developer with total debts estimated at RMB 297 billion ($45.8 billion) as of the end of last year, is generally seen as a shakier bet than Wanda among investors. However, survey respondents saw the developer controlled by Xu Jiayin as having more to gain from moving its Hong Kong-listed entity to a local Chinese exchange.

How successful is Evergrande likely to be in gaining improved access to capital through a mainland listing?

Over 45 percent of survey respondents indicated that Evergrande would be at least somewhat successful in achieving a higher valuation if it moved its listing to either Shanghai or Shenzhen, while only 27 percent said that the listing location would not make a difference.

Wang and Xu May Run Out of Time

Regardless of the reasons for re-listing, or the potential benefits of moving Chinese property developers to mainland stock exchanges, companies like Wanda and Evergrande may be running out of time in their bids to benefit from the higher valuations given to Chinese companies on the Shanghai and Shenzhen bourses.

China Securities Regulatory Commission spokesman Zhang Xiaojun said at a press conference last week that the agency, which regulates the country’s public equities, said in regard to overseas listed Chinese companies hoping to move their listings to the mainland that it “will launch an in-depth analysis and research on similar companies,’ according to an account in the Wall Street Journal.

While the exact nature of this new level of regulatory attention has not yet been specified any added level of regulatory risk or chance of bureaucratic delays could add to the already daunting challenges involved in shifting companies with thousands of shareholders across national boundaries.

Leave a Reply