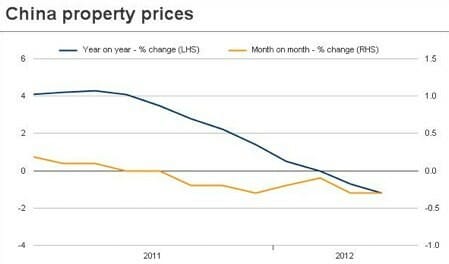

China’s residential real estate prices fell for the second month in a row in April compared to rates in 2011. The average transaction price for home sales fell 1.2 percent according to data released on Friday by the National Bureau of Statistics.

April’s fall in prices followed a 0.7 percent drop in March, which was the first month that prices had fallen since the Chinese government began restricting home sales in an effort to cool down the residential real estate market.

The statistics which reported April home sales in 70 major cities in China also showed that sales had fallen 0.3 percent on a month to month basis, the seventh straight month of such decreases.

The information for the Bureau of Statistics showed that price drop offs were widespread with 46 of 70 cities surveyed reporting year on year decreases. The biggest fall came in the entrepreneurial eastern China city of Wenzhou where prices went down 12.3 percent annually during April. Beijing reported a 1.0 percent decrease with a 1.3 percent fall in Shanghai.

Despite the hardships that the reversal in the residential real estate market may be causing for local governments who derive much of their revenue from land sales, many developers and analysts foresee the central government maintiaining its strict control over the market for the time being.

Speaking to Reuters on Thursday, the day before the data was released, Freddy Lee, CEO of real estate developer Shui On Land said,

“Although the macro environment is not good, property policies will not be relaxed immediately. The government can speed up investment in many other sectors, or relax lending. But the money will not necessarily flow into the real estate sector.”

Complete details of the house pricing statistics can be found on the Bureau of Statistics website.

Leave a Reply