-

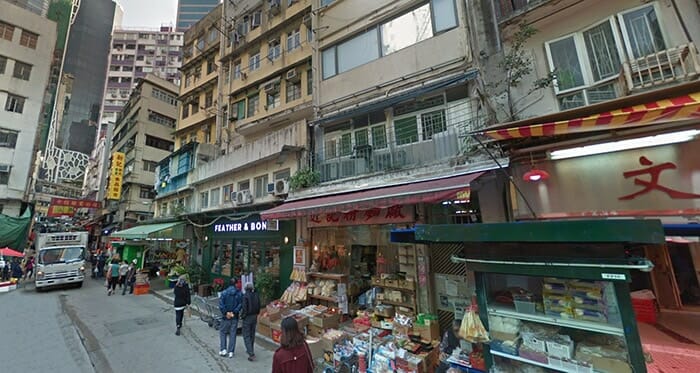

Chuang’s Consortium is now ready to redevelop this set of Gage Street properties

Halfway through a year of public health crisis and political controversy in Hong Kong, the city’s real estate developers continue to take extraordinary measures to acquire prime sites, with Chuang’s Consortium having snapped up a redevelopment site in Central district through a compulsory sale.

After acquiring full ownership of 20 Gage Street in 2018 and buying up nearly 90 percent of the space available in two adjoining buildings on the narrow market street just uphill from some of the city’s most expensive office towers, Hong Kong-listed developer Chuang’s Consortium successfully acquired the remaining units in 16 and 18 Gage Street through a public auction which valued the pair of properties at HK$332 million ($43 million).

Having now secured a 3,600 square foot (334 square metre) site, Chuang’s Consortium will likely start development soon on a long planned 36,000 square foot commercial and residential building, according to a statement by the company.

Chuang’s Consortium moved forward with acquiring the remaining space that it did not already own in 16 and 18 Gage Street (11.1 percent and 12.5 percent respectively) through a compulsory sale on 14 July, despite average sales per quarter of luxury apartments in Hong Kong falling by more than 20 percent in the first half of 2020 compared to last year’s average.

According to property consultancy JLL, during the first half of 2020, total investment in Hong Kong commercial properties dropped to HK$20.6 billion — a 63 percent decline in volume compared to the same period last year.

Buying Up Aging Buildings in Central

“This building has a great deal of potential and is in a prime location,” said Cynthia Li, senior director of capital markets at JLL in Hong Kong, which managed the compulsory sale on behalf of the buyer. “Developers are keen on this area, especially because of its proximity to the Urban Renewal Authority’s Central Redevelopment Project.”

-

JLL’s Cynthia Li says the property’s location is key to its value

The site is in the midst of the Peel Street/Graham Street Redevelopment Scheme, a 67,528 square metre project which includes rebuilding the Graham Market just opposite the properties purchased by Chuang’s Consortium.

The site is only 300 metres from The Centre, a grade A office building which CK Asset sold to a group of local speculators in 2017 for a record $51.5 billion.

The deal for the 51-year old properties was made possible under a Hong Kong law which allows developers to apply for a compulsory sale of units in a building of 50 years old or more, once they have acquired at least 80 percent of the asset.

Compulsory Sales Coming Back

The acquisition by Chuang’s Consortium comes as the number of compulsory sales in the city seems to have rebounded after the initial COVID-19 shock, with some of the city’s biggest developers buying up pieces of aging buildings in the second quarter.

Earlier this month, New World Development Company Ltd. (HKG 0017) applied for compulsory sales of two old buildings in the Sai Ying Pun area just west of Central, after securing over 80 percent of the ownership of the properties. Should the developer’s application succeed it will add to its development pipeline a site valued at a combined HK$333 million, which could yield an 88,000 square foot project.

New World’s move came after Edwin Leong Siu-hung’s Tai Hung Fai Enterprise in May snapped up the remaining 8.6 percent of the On Hing building in Sai Ying Pun at a public auction, paving the way for the billionaire investor to develop a new building of up to a 53,718 square feet on the site just 3 kilometres from Central’s IFC complex.

“Court hearings (for compulsory sales) were suspended during the COVID period, said JLL’s Li, “Now, it is catching up with the pent up cases and that’s why you see the number of cases increasing.”

Compulsory sales have become popular among developers in recent years as they have become more aggressive about replenishing their land banks across the city due to a lack of sites in core urban areas under the government land sales programme, according to JLL’s Li.

Last year, CSI Properties completed the purchase of a building in Hong Kong’s Sheung Wan area through compulsory sale and then acquired the remaining four floors in a building on Wellington Street in Hong Kong’s Central district for HK$185 million ($23.59 million).

In June of 2019, Henderson Land Development also acquired four aging buildings in Hong Kong’s Mid-levels through a forced sale which valued the properties at HK$963 million.

Developer Demand for Sites Stays Strong

2020 has been a challenging year for Hong Kong’s residential property market, with only an average of 561 residential properties valued over HK$20 million changing hands per quarter in the first half, compared to an average of 710 per quarter in 2019, according to JLL.

“The residential price movement for the next three years is unpredictable at this point because the economic uncertainties remain,” JLL’s Li said. “But we found that developers remain interested in acquiring residential sites as the housing demand remains strong and the land supply is limited.”

The company’s research showed retailers suffering from the disruption bred by COVID-19, precipitating an average 26.5 percent decrease in rents for high street shops in the city’s four major shopping districts in the first half of 2020.

Leave a Reply