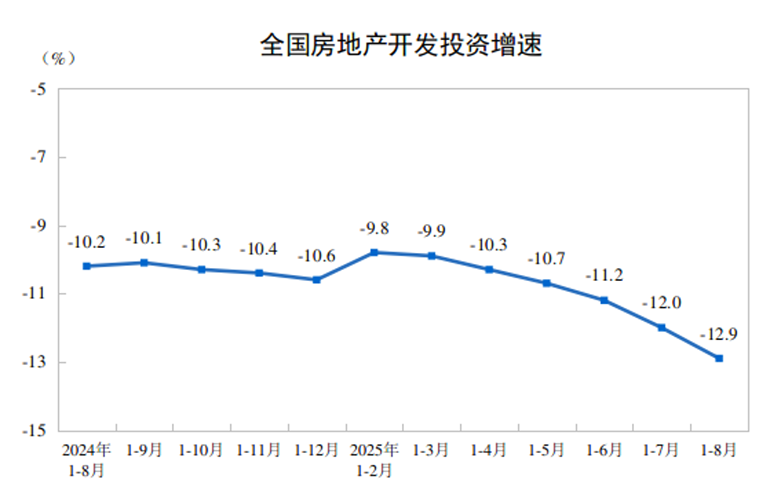

Investment in Chinese real estate fell 12.9% in the Jan through Aug period from a year earlier (Image: NBS)

Home prices in China continued to fall in August while property investment in the first eight months of 2025 saw the largest year-on-year decline since the breakout of the pandemic, with analysts predicting that the housing market’s drag on the country’s economy could trigger fresh stimulus measures.

An index of new home prices in 70 major Chinese cities dropped 0.3 percent in August from a month earlier while second-hand home prices fell 0.58 percent over the same interval, both declining at around the same pace as July, according to an analysis by European bank ING.

New home prices rose or held steady in just 13 of the 70 cities surveyed in August, while only Changchun, the capital of Jilin province, saw second-hand home prices increase, data released on Monday by the National Bureau of Statistics showed.

“This suggests pressure on homeowners continues,” said Lynn Song, chief economist for Greater China at ING. “Sentiment remains soft despite a slew of measures over the past year. One major concern is the continued slump in the property market.”

Property Downturn Persists

Separate data from the statistics bureau showed that total investment in the industry fell 12.9 percent year-on-year in the first eight months of 2025, dragging growth in overall fixed asset investment down to just 0.5 percent over the period, the lowest level since 2020. Excluding real estate, the NBS noted that fixed asset investment grew at a comparatively robust 4.2 percent year-on-year.

Chinese Premier Li Qiang is not taking the housing crisis sitting down

Sales of new private homes also continued to struggle. NBS data showed that the value of sales of new homes by developers in the first eight months of the year fell 7.3 percent compared to the same period in 2024, with that decline accelerating from the 6.5 percent rate witnessed over the January through July period.

Measured by floor area, developer sales fell 4.7 percent in the January-August period, widening from a 4 percent decline in the first seven months of the year.

Case for More Stimulus

With the prolonged property slump seen undermining confidence and discouraging investment in the broader economy, China’s economy slowed across the board in August with retail sales growing at the slowest pace since November and year-on-year expansion in industrial production falling to a 12-month low.

“This deceleration can no longer be simply explained away as a temporary weather-related blip. Growth has been slowing for several months now, with data generally falling short of market forecasts each month,” said ING’s Song.

China’s summer slowdown strengthens the case for additional short-term stimulus efforts, said the ING analyst, who sees “a high possibility” of another 10 basis-point rate cut and 50 basis-point reserve-requirement-ratio cut in the coming weeks.

“A strong start to 2025 still keeps this year’s growth targets within reach. But, similar to where we were at this time last year, further stimulus support could be needed to ensure a strong finish to the year,” he added.

Multiple rounds of stimulus measures have so far failed to rekindle China’s housing market.

China’s central bank in May cut the benchmark five-year loan prime rate (LPR) by 10 basis points while also trimming the interest rate on loans from an individual’s housing provident fund by 25 basis points. Analysts, however, saw these measures as inadequate to the challenge.

In the past few weeks, Beijing, Shanghai and Shenzhen have further eased homebuying curbs, scrapping the cooling measures in suburban areas and lifting some home purchase restrictions for singles.

The central government has in recent months stayed with its messaging of needing to stabilise the property market. Premier Li Qiang said in a cabinet meeting last month that China should “adopt forceful measures to consolidate the stabilising trend” in the real estate market and stimulate demand for housing upgrades.

Leave a Reply