WeWork’s latest financials may show the limits of hustle

Adding to the pain of the We Company’s IPO fail in September, the parent firm of shared workspace provider WeWork revealed in an investor presentation this week that its losses reached $1.25 billion in the third quarter of this year.

The financial shortfall, which more than doubled WeWork’s $497 million loss during the same period in 2018 came as then CEO Adam Neumann bet the company’s future on the potential for an initial public offering that he hoped would raise at least $3 billion from share sales and unlock a separate $6 billion package of debt financing.

With the New York-based firm having failed to convince investors to purchase its shares, WeWork was left with just $1.3 billion in unencumbered cash at the end of September, according to a New York Times account citing company documents, and Neumann was on his way out as the company went into bailout mode.

Revenues Rise 94%, Losses Jump 151%

The 151 percent increase in WeWork’s losses during the third quarter came as WeWork rushed to open new centres worldwide, throwing open the doors to nearly 100 new locations during July, August, and September, despite declining occupancy.

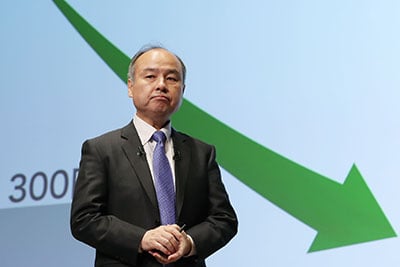

Softbank’s Masa Son needs to see if he can change WeWork’s trajectory

By the end of September WeWork listed 625 locations worldwide – up 87 percent from the same period in 2018. After entering Asia in 2016 with a single location in Shanghai, the company’s website now lists 40 locations in the mainland commercial hub. The co-working pioneer’s portfolio covered 127 cities at the end of the quarter – up from 83 on 30 September last year.

That attempt to push serviced offices into making the leap to hyperspace allowed WeWork to boost its revenue to $934 million in the third quarter although that 94 percent boost in the top line failed to keep pace with the company’s expenditures. On an annualised basis, WeWork said in the presentation, which was distributed to buyers of the company’s bonds but obtained by the New York Times and the Financial Times, that it projected sales of $4.2 billion for the full year of 2019.

WeWork’s harvest from its fresh crop of hip office locations remains unclear, with the company’s deck indicating that, after adding 115,000 new desks during the third quarter, to bring its global total to 719,000, it counted 609,000 members.

That ratio of desks to members puts WeWork’s average occupancy worldwide at 79 percent at the end of September – down from 82 percent at the end of June, according to figures cited in the Financial Times account. In Shanghai, where WeWork has its Asia headquarters, a report last month by the FT indicated that the company’s centres averaged 35 percent vacancy, while its locations in Xi’an and other second-tier mainland cities were seen as 60 percent vacant or more.

Reversing Flow in an Office Pipeline

The collision of accelerated expansion, sliding take-up and an aborted IPO resulted in Softbank’s combination buyout/bailout of WeWork, after Masayoshi Son’s investment firm had sunk more than $10 billion into the company.

The Japanese venture capital firm agreed to take control of WeWork last month as part of a $9.5 billion bailout plan, according to a Wall Street Journal account, and this week’s investor presentation clarified the need for that rescue effort.

Neumann left WeWork with just $2 billion in cash as of 30 September, with $692 million of that already restricted. That number was down from $3 billion at the end of June, according to the New York Times account.

With the bailout plan still a work in progress, WeWork is scrambling to find ways to reverse the flow of new centres pushed into its pipeline under Neumann’s all-or-nothing expansion plan. In Hong Kong, the co-working provider is surrendering two of four floors of a still-unopened centre in Wanchai’s Hopewell Centre, and is said to be looking for replacement tenants to take over at least five more centres around the city, according to sources who spoke to Mingtiandi earlier this month.

WeWork Says It’s Here to Stay

Despite the financial pressures, WeWork’s Asia operation released a statement yesterday reinforcing its commitment to the region. Pointing out that it had received an additional commitment of $9.5 billion in funding from Softbank the company said, “WeWork looks forward to embarking on its next chapter with local members, landlords, partners, investors and governments in the region.”

The company underlined that it had recently signed an agreement with Sun Hung Kai Properties to open a new facility in the Hong Kong development giant’s Nanjing IFC project in the capital of Jiangsu province.

Leave a Reply