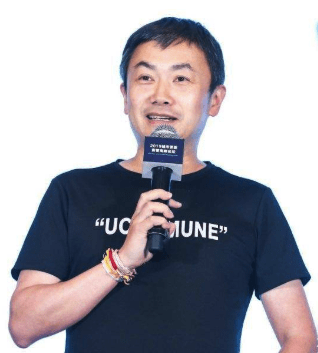

Mao Daqing, founder of Ucommune

Ucommune, WeWork’s biggest rival in mainland China, is reportedly planning to raise as much as $200 million in a US IPO next year, as the loss-making mainland co-working player continues to raise new capital.

The US listing plan by the company headed by former China Vanke executive Mao Daqing was reported in a Bloomberg news account, which cited sources familiar with the company’s plans.

In November of last year the Beijing-based firm had raised $200 million in a series D round of funding which valued the startup at $3 billion, with the mainland real estate unicorn having raised another $200 million at an undisclosed valuation in April of this year.

IPO Plans Still in Early Stages

Ucommune’s plan for a US stock market debut are said to still be in the early stages, however, the company was described as aiming to raise at least $100 million.

In public comments in May of last year, Mao Daqing had predicted that the company, which had gone by the name of UrWork until coming out on the wrong end of a legal tussle with WeWork, would head into a Hong Kong IPO within two to three years.

Ucommune is planning for a New York listing in 2020

In the Bloomberg account the reporters sources indicated that Ucommune had targetted a Hong Kong IPO during the third quarter of last year, but had shelved those plans due to market uncertainty.

Apart from its April funding round, Ucommune has been quiet so far this year after a series of acquisitions of competing players in 2017 and 2018.

With its most recent acquisition of Shanghai-based rival Fountown last October, Ucommune increased its total number of workstations to 100,000 across 200 co-working centers in 37 cities including Singapore, New York, Beijing, Taipei, Hong Kong and Shanghai.

Earlier the company had acquired a number of smaller competitors, including Wedo, Woo Space, New Space and Workingdom, while also diversifying into providing integrated service solutions to its tenants.

Mainland Co-Working Cools Off

A slowdown in venture capital financing and pricing competition, however, saw forty companies in China’s shared-office sector vanish in the 10 months from January to October 2018, according to a study the China Real Estate Chamber of Commerce. That same report indicated that about 40 percent of co-working projects were more than half empty at the time it was published in February of this year.

In April, Ucommune’s Beijing-based competitor Kr Space surrendered its lease in Hong Kong’s One Hennessy after the three-year-old company was reported recently to have closed several locations on the mainland after failing to close an expected funding round last year.

Leave a Reply